When St. Louis supercomputing startup SimpleRose meets with potential investors, its pitch turns to an unexpected topic: poker.

SimpleRose executives explain that there are nearly 2.6 million different hands that can be played in the card game, with 7,462 distinct ranks.

Potential investors are then handed 25 cards and asked to arrange them into the five best possible hands in the next two minutes. The investors do a decent job with the task, says SimpleRose co-founder and CEO Carl Ledbetter, but they can’t match the technology the startup is there to pitch.

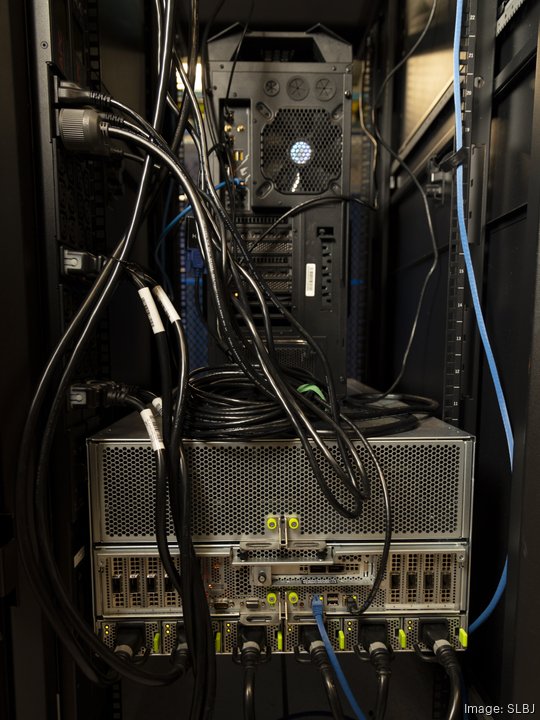

It’s developed a supercomputer — 7 feet high, 5 feet long and 2.5 feet wide — it says can complete the same task in just two seconds.

That supercomputer, named Rosette and housed in a downtown St. Louis data center nearby SimpleRose’s headquarters at 1017 Olive St., includes thousands of small computer chips designed to work simultaneously to make calculations. SimpleRose has stealthily built and fine-tuned the device since its launch in 2018, aided by $47 million it has raised that has helped grow its team to 28 employees. The startup's ambitions are much bigger than its device: to help customers "solve large, complex business optimization problems" like with financial portfolios, scheduling and logistics.

Ledbetter points to Southwest Airlines’ widespread flight cancellations in December as an example of how its technology could be implemented. The airline says its technology struggled to keep up with rescheduling as cancellations piled up, causing what has been called a “meltdown.” That’s the type of problem Ledbetter SimpleRose is poised to fix.

“The idea behind SimpleRose is can we solve their problem for them in 15 minutes instead of four days,” Ledbetter said.

That’s an attractive offering for companies, said Roger Chamberlain, professor of computer science and engineering at Washington University.

“I think the sky really is the limit for this kind of stuff,” Chamberlain said. “These are important enough problems that really do impact the profitability of huge, large corporations. The potential impact really is high.”

For the time being, SimpleRose is acting as its own customer, using the supercomputer to optimize its own financial portfolio. It believes that will help demonstrate the potential of its technology as it seeks to become St. Louis’ next unicorn startup.

Decades in the making

SimpleRose counts Silicon Valley-based venture capital giant NEA as one of its investors. Its portfolio includes several unicorns — companies with valuations north of $1 billion — including financial technology firm Robinhood, software company Databricks and financial services firm Plaid.

SimpleRose hopes to one day join that club of unicorns, Ledbetter said.

But it's not a financial return that necessarily drives Ledbetter’s pursuit of SimpleRose. The 73-year-old says the startup isn’t something he needs to take on financially, thanks to a successful career, with roles ranging from professor to venture capitalist. Ledbetter’s career includes stints at several technology companies, including IBM, AT&T and Sun Microsystems. He’s currently a board member of San Francisco-based technology company CloudFlare (NYSE: NET).

The creation of SimpleRose fits with a passion that has overlapped with Ledbetter’s entire career: mathematics. He developed a love of the subject as a child when he began calculating the batting averages of Major League Baseball players on an index card. He says that helped spawn a career.

“The other reason, of course, is when I got to Pony League and saw my first real curveball, I said. ‘That’s not right,’ and decided it would be easier to be a mathematician,” he said.

The creation of SimpleRose dates to Ledbetter’s tenure at IBM in the 1980s. He said his former professor, E.D. Nering, posed a question that sparked the technology that underpins the startup. That led to five U.S. patents filed by Ledbetter and Nering, who’s 101 years old and is a shareholder in SimpleRose.

Ledbetter initially built a prototype of SimpleRose’s supercomputer in his basement while living in Denver during his tenure as managing partner of Salt Lake City-based Pelion Venture Partners. He turned his attention to SimpleRose full time after leaving the venture firm in 2020.

One of SimpleRose’s first tasks as a full-fledged company involved finding a home. Denver, where Ledbetter was living at the time, was an option, as well as technology hubs like Austin, Texas; Raleigh, North Carolina; and California’s Bay Area.

“St. Louis was originally not even on the list,” Ledbetter said.

But Ledbetter said his wife soon began lobbying for St. Louis, which would locate them close to family locally and in Chicago. Ledbetter soon discovered St. Louis would be ideal for more than just personal reasons. Early on, he explained, SimpleRose needed to stay under the radar while he worked to advance its technology.

“You’re not quite as visible in St. Louis as you would be in the Bay Area or Austin, so it worked out really well for us,” he said.

Other advantages also started to emerge in St. Louis, Ledbetter said. SimpleRose has raised capital from local investors, hired talent from St. Louis-area universities and worked with Maryland Heights-based technology firm World Wide Technology to build its supercomputer. World Wide Technology declined to comment for this report.

Building a business case

As Ledbetter talks about the potential of SimpleRose’s technology, he’s quick to make a distinction: It’s not designed to suggest or predict outcomes.

“We prescribe what the best thing is you can do,” Ledbetter said.

SimpleRose says it hopes its supercomputer gives customers a better overview of their options when it comes to making decisions that can optimize operations by analyzing problems that include trillions, or more, calculations. That could include helping investment firms have the right mix in their portfolio to generate the best return on investment or helping a logistics company best schedule its route for efficiency. Its technology seems to help customers understand “the way you can move resources around to do something that has value financially or that you can minimize the amount of the time."

“When there’s a way to calculate what it is, we will find the ones that’s the best,” Ledbetter said.

While SimpleRose has yet to sign on customers, its technology has attracted the interest of investors, who have invested nearly $50 million. Its investors include local backers, including venture capital firm Cultivation Capital and Lightchain Capital, the family office of Scottrade Financial Service Inc. founder Rodger Riney, as well as NEA and Pelion Venture Partners, the venture firm where Ledbetter used to work.

Greg Papadopoulos, a venture partner with NEA, said that while computers have gotten faster over the decades, he believes there's been little algorithmic innovation to better solve complex business problems. NEA was the lead investor in SimpleRose's $13 million Series A round, which included the first capital it raised from outside investors, and is currently its largest shareholder. Papadopoulos thinks SimpleRose will be able to help companies solve big, challenging economic problems and do it quicker than they have in the past. Papadopoulos said he believes there's a wide base of commercial opportunities for SimpleRose, ranging from airline schedules to supply chain optimization.

“It’s almost an embarrassment of opportunity of all these things,” he said.

SimpleRose is beginning to chase that opportunity, and in Match closed on a $23 million Series C funding round it says will help fund its portfolio management activities using its technology. While Ledbetter said SimpleRose has run other applications on its supercomputer, the first use was for its own financial portfolio, which has involved "calculating what, at any instant, certain financial products are worth." He said that includes finding pricing differentials that are advantageous.

"It's kind of like shopping for a grill by looking at the advertisements for them at ten home and garden stores and other outlets, all with different prices — only really fast, and with a lot more outlets," he said.

With its funding, SimpleRose also plans to add staff who will help commercialize its technology. It plans to begin with a focus on the financial sector, with Ledbetter saying it can best integrate its supercomputing platform into that domain, given the amount of public information available there.

Ledbetter said bringing its technology to customers in other fields will take longer as SimpleRose and potential customers determine how its supercomputing technology can best solve problems within the structure of their operations.

“We have to build an interconnection with them and that takes time,” Ledbetter said.

Chamberlain, the Washington University computer science professor, said he believes SimpleRose offers an attractive option for companies, offering technology they may not currently use that also allows an option to do computation faster.

“When the problem size gets big enough, it really takes a long time to solve them using traditional techniques,” he said.

SimpleRose said revenue generation could come by either charging a fee for its supercomputing services or through a percentage of revenue it helps users generate. Its entrance into the market will include competition from the likes of other business optimization technology and software provided by firms such as IBM, Gurobi and Fico. IBM last month said it investing $100 million over 10 years build a supercomputer in partnership with the University of Chicago and University of Tokyo.

Demand for supercomputers is expected to grow in the coming years, according to market studies. A report published last year put the size of the market for supercomputers at $5.6 billion in 2020, projecting that figure will grow to $14 billion, citing increased use commercially for the machines and uptake in sectors like manufacturing and utilities.

As the use of artificial intelligence technology increase, Saint Louis University's Ted Ahn, an associate professor of computer science, said that also presents a growth opportunity for supercomputers, which can be used to create AI models.

"Everything is connected to a computing power,” Ahn said.

While other firms are in the space, Ledbetter said he believes SimpleRose's strongest competitors will be companies that are currently relying on in-house methods and technologies to do quantitative analysis.

“In a lot of potential customers, the real competition is to do it for them much faster and better than they can do it while they are doing it themselves,” Ledbetter said.

Right now, SimpleRose operates with a single supercomputer. Growth will necessitate building more, Ledbetter said, with the company working on an enhanced version of its machine.

Its goal is to one day house the fastest supercomputer.

“We’re not quite at the level yet, but we’re close,” Ledbetter said.

SimpleRose at a glance

What it does: SimpleRose has created a supercomputer it says uses algorithms to quickly solve business problems

Founders: Carl Ledbetter, chairman and CEO; Marti Martindale, chief operating officer

Headquarters: 1017 Olive St.

Employees: 28

Capital raised: $47.3 million

Investors: Cultivation Capital, Lightchain Capital, Pelion Venture Partners, NEA, Ray Rothrock/FiftySix Investments