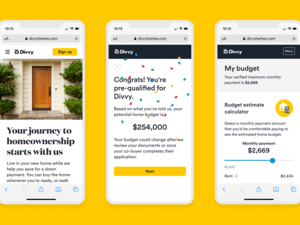

Lofty AI is making it possible for anyone to become a real estate investor – as long as they have $50 to spare.

The Miami property technology startup aims to lower the barrier to entry for real estate investing by enabling users to purchase a fraction of U.S. rental property, even if they don't have the money for a huge down payment.

"We live in a world where, more and more, you need to own assets to accumulate wealth," said co-founder and CEO Jerry Chu. "So people who don't own assets are left out of that growth. That's what we're trying to change."

Chu said his own experience as an aspiring real estate investor inspired the creation of Lofty.

He said he spent months traveling to different cities, setting up inspections and vetting management companies when he tried to buy his first rental property. It was an onerous process: Often, he was outbid. In another instance, he and co-founder Max Ball tried to buy an $80,000 home in Ohio, only to discover a bank wouldn't give them a mortgage because the loan they were requesting was too small.

"I found myself in a position where I didn't have access to this asset class, even though I do quite well for myself," he said. "That made me consider how many other people don't have access."

That's when he turned to the blockchain. Chu said he and Ball realized that putting ownership of real estate assets on the blockchain, a digital ledger of transactions, would make it possible to tokenize and divide ownership of a single property.

The Y Combinator-backed startup has cleared more than $27 million in transactions and brought 120 rental properties to its marketplace over the last year. Lofty makes money by charging listing and convenience fees for each home or apartment. The company also takes an 8% cut when a home sells on the platform.

Each property is vetted before sale to ensure it has been recently renovated and make sure the owner is not offloading a delinquent tenant. That, along with an appraisal report, is publicly available on the Lofty website so potential investors can do their due diligence before putting money down.

Investors can only purchase up to 15% if a property to ensure one person does not have too much control over a single home or apartment. When it's time to make a decision – like raising rents or, potentially, evicting a tenant – owners vote on that decision. To move forward with any action, they must have a supermajority of 60%.

"We've had tenants who are delinquent, but then ownership voted to offer them a payment plan as a last resort before eviction," Chu said, explaining the Lofty investors – often, renters themselves – tend to be more willing to work with struggling tenants than large residential real estate owners.

To ensure tenants aren't dealing with dozens of potential "landlords," the company requires holding entities to hire property managers who are paid from a portion of the rental income earned every month.

A $50 or $100 investment may not seem like much, but Chu argues that's just the beginning for many Lofty users. Over time, they can build up their real estate portfolio and gain rental income from those properties. Then, they can use that income to invest in additional rental properties.

"The next thing you know, after 5, 10 or 20 years, they might be sitting on a nice piece of wealth growing at a stable rate," Chu said.

For more stories like this one, sign up for Miami Inno newsletters from the South Florida Business Journal and the American Inno network.