Miami is the world's 31st-best startup ecosystem and ranks No. 15 in the United States, according to a new report by Startup Genome.

The report highlighted the region's universities, low taxes and access to venture capital as reasons to move a startup to Miami. It noted the South Florida area is home to a strong life sciences and blockchain sector, with standout funding deals such as Heru's $30 million series A round last May and Recur's $50 million series A round last September.

South Florida companies attracted more than $5 billion in venture funding in 2021, up from $940 million in 2013. The region's weather and low taxes made it an attractive option when tech workers and investors went remote during the Covid-19 pandemic, which fueled that growth.

“Miami’s startup ecosystem has grown by leaps and bounds, jumping up nine spots in the GSER ranking," said Startup Genome founder and CEO J.F. Gauthier.

Globally, Miami tied with Atlanta, Copenhangen, Dallas and Helsinki at No. 31.

The news comes as the U.S. confronts another economic downturn, making it more difficult for startups to fundraise. But these market corrections come after years of astounding growth in the number of startups in the area, the quality of newly emerging companies and the largest influx of venture capital dollars the area has ever seen.

The new Startup Genome report largely reflects the massive growth seen between 2020 and 2021, and not necessarily the undulating markets experienced in the U.S. over the past couple of months. It notes that inflated valuations have boosted overall numbers, but that they can carry risks for startups.

"It often spells lower returns for investors for the affected vintage investments. For startups (and for investors) this raises the specter of down rounds as the market goes back to near-historical valuations before their next round," the report states.

While limited on these recent changes, the report paints a vivid picture of how startups largely succeeded, landing record funding dollars and skyrocketing valuations, over the course of the Covid-19 pandemic.

"Since the pandemic, tech companies grew 2.3 times more than their non-tech counterparts," the report said. "While about 90% of startups completely fail, Startup Genome research demonstrates that only 1.5% of startups — or about 15% of those that survive — produce a successful exit of $50 million or more across the top eight U.S. startup ecosystems."

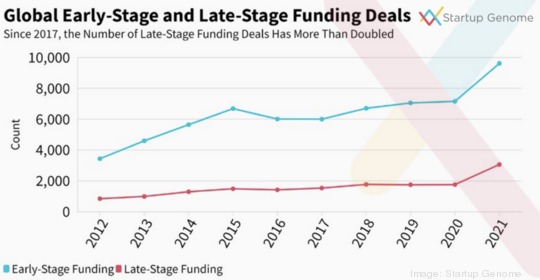

The growth over the past year has benefited companies at all stages. The average series A deal, for example, climbed to more than $18 million, a 239% increase from a decade ago. Since 2019, post-money valuations have climbed 125% for series B rounds.

Startup fundraising has been accelerating almost everywhere, with VC funding growing to $87.4 billion in Asia, $219.6 billion in North America and $12.9 billion in Latin America.

In the U.S., several metro areas have bolstered their startup ecosystems. Detroit ranked No. 1 among emerging startup hubs, with Minneapolis and Houston also cracking the top five.

Among big cities, Silicon Valley led the pack, which is not all that surprising, despite some companies leaving the Bay Area in search of lower costs of living or going fully remote following two years of pandemic-related office disruptions. But the trend is that more cities are attracting and retaining larger shares of tech talent.

Gauthier said the number of unicorns emerging over the past year is one of the most surprising trends in the report. At least 540 companies secured valuations of $1 billion or more in 2021. In Miami, that included MoonPay, Pipe and Papa.

Phoenix, for example, has led the way among emerging startup ecosystems producing new billion-dollar companies. Four unicorn startups emerged there in the past decade, the report showed. While somewhat arbitrary in nature, having a startup with a billion-dollar valuation can be a game changer for a metro area, Gauthier said.

"Once you have a unicorn in your city, suddenly the ceiling is lifted and the definition of success changes," he said. "People say 'We can do it here. We can build a $5 billion company.' And that changes a lot."

Hyper-growth companies tend to churn out new founders and additional talent with experience in scaling a tech company at a rapid pace. They know how to reach international markets, raise bigger rounds of capital, expand operations and so on, he said.

"At one point they leave, there's an exit and it releases that great talent," he said. "This is a big deal when you have a first unicorn and it allows you to create several more a few years later."

For decades, Silicon Valley had an outsized share of talent, investment and attention in the tech world. That, Gauthier said, is changing quickly.

"Silicon Valley has no monopoly, no dominance on that," he said.

Gauthier expects growth to continue, even though it will be impacted by inflation and other factors: "I think this is a very long-term trend, and we're not in the middle of it. I think maybe at the end of the beginning, with tech becoming one of the main economic drivers all over the world."

Every time there's a crash, we think maybe it's an end of an era, he said.

"But the fact is we are transitioning to a digital economy, and there's a lot of industries that are yet to convert," Gauthier said. "And that's what's ongoing right now with deep tech where new technical skills, new technical innovation is finally changing those older industries. It's going to continue for a few decades."

Top 15 startup markets in the U.S.

- Silicon Valley

- New York City

- Boston

- Los Angeles

- Seattle

- Washington, D.C.

- San Diego

- Chicago

- Denver-Boulder

- Austin

- Philadelphia

- Salt Lake-Provo

- Atlanta

- Dallas

- Miami

Source: 2022 Startup Genome report

For more stories like this one, sign up for Miami Inno newsletters from the South Florida Business Journal and the American Inno network.