Seattle-based cryptocurrency exchange Bittrex has filed for Chapter 11 bankruptcy.

Bittrex announced the decision on Monday, roughly a week after shuttering its U.S. operations at the end of April. According to the company, the decision doesn't affect Bittrex Global, which serves customers outside the U.S. and is regulated in Bermuda and Liechtenstein.

The company said in a news release that customer funds that were not withdrawn prior to the end of April "remain safe and secure."

"Our main priority is to ensure that our customers are made whole," the company said. "While the bankruptcy court will ultimately decide the method by which those funds can be claimed by and distributed to our customers, we intend to ask the court to activate those accounts as soon as possible so that customers meeting the necessary regulatory requirements will be able to withdraw them."

Chapter 11 bankruptcy allows a debtor to restructure its obligations to make good with creditors. Companies are often able to stay in business while going through Chapter 11 bankruptcy.

Bittrex also faces charges from the Securities and Exchange Commission, which alleges Bittrex was operating an unregistered securities exchange. The SEC, which announced the charges in April, says Bittrex facilitated the buying and selling of crypto assets that were sold as securities, and Bittrex generated at least $1.3 billion in revenue between 2017 and 2022 without registering with the SEC. According to the federal regulator, Bittrex and co-founder and former CEO Bill Shihara tried to eliminate public statements that could lead a regulator to investigate Bittrex's crypto assets as securities.

Bittrex said it had asked the SEC what assets it viewed as securities, and the SEC did not tell the company. A spokesperson in April said the SEC charges were part of "Chairman (Gary) Gensler’s larger crusade to drive cryptocurrency out of the United States," adding that the SEC's enforcement would have a chilling effect on crypto, blockchain and innovation.

In February, Bittrex disclosed it was laying off 83 employees.

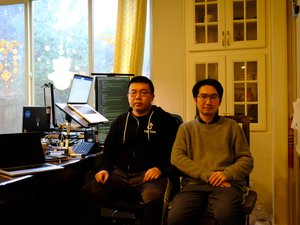

Shihara co-founded Bittrex in 2014 along with fellow Amazon cybersecurity engineers Rami Kawach and Richie Lai, the company's current CEO. Consumers can use Bittrex to buy and sell cryptocurrencies like Bitcoin and Ethereum, and it allows consumers to trade on a mobile device. The company didn't comment on how many employees remain at Bittrex, but it has over 270 employees listed on LinkedIn.

The crypto industry has fallen on tough times. Most notably, crypto exchange FTX, once valued at $32 billion, filed for bankruptcy in November. In January, crypto exchange Crypto.com said it was laying off about 20% of its staff, adding to layoffs in July.

"Crypto markets suffer from a lack of regulatory compliance, not a lack of regulatory clarity," Gensler said in a release announcing the charges against Bittrex. "As alleged in our complaint, Bittrex and issuers that it worked with knew the rules that applied to them but went to great lengths to evade them by directing issuer-applicants to ‘scrub‘ offering materials of information indicating that certain crypto assets were securities."