Cryptocurrencies rose to prominence on trading by everyday investors and enthusiasts.

A San Mateo startup is starting to cash in as institutional investors like hedge and venture funds get in on the action.

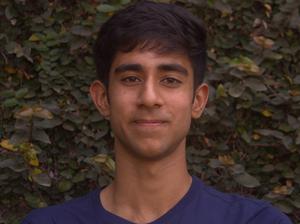

FalconX Ltd. is essentially a cryptocurrency brokerage that focuses solely on such investors, Raghu Yarlagadda, its co-founder and CEO, told the Business Journal. Among its customers are some of the world's largest hedge funds and asset managers, he said.

"As a brokerage, we provide really good pricing to institutions, and we sit on top of all these different (cryptocurrency) exchanges," Yarlagadda said.

Institutional investors such as venture funds and family investment offices can use FalconX's service to buy and sell cryptocurrencies, manage their portfolios and borrow funds for trading. The company also helps new cryptocurrency projects get their tokens listed on the major exchanges.

FalconX charges customers a fee when they purchase cryptocurrencies.

Yarlagadda was an unlikely founder of a cryptocurrency-related company. He spent much of his 15-year career in tech focusing on hardware. From 2014 to 2017, for example, he headed up Google LLC's Chromebook effort. He also didn't initially see much value in cryptocurrencies or blockchain technology.

But he decided to learn more about the technology after finding out that some of his colleagues at Google were enthusiasts.

"Some of the brightest engineers that I know at Google were quite stoked and excited about blockchain," Yarlagadda said.

Yarlagadda's bullish about cryptocurrencies

He ended up becoming an enthusiast himself. Not only did he found FalconX in 2018, but he now believes that the majority of the world's assets will be tokenized — turned into digital assets that can be bought and sold in online marketplaces — in the next four to five years.

Yarlagadda sees a huge opportunity there for his company, especially as institutional investors trade in such assets.

"If a lot of value in the world gets tokenized, I wanted to build a Google for that world," he said.

- Company: FalconX

- Headquarters: San Mateo

- CEO: Raghu Yarlagadda

- Year founded: 2018

- Number of employees: 150

- Website: falconx.io

FalconX has already found some success. Last year, its revenue grew 46 times, according to the company. It also raised $260 million in venture funding in 2021, including a $210 million Series C round in August that boosted its valuation to $3.75 billion. Among its investors are Coinbase Ventures, Lightspeed Venture Partners and Tiger Global Management.

Yaralgadda's company seems to be in the right place at the right time. A growing number of institutional investors have become interested in recent years in cryptocurrencies and related assets, he said. Just this week, Sequoia Capital, the venerable venture firm, announced it is devoting $500 million to $600 million to a fund focused on investing in cryptocurrency tokens and startups.

Institutional investors typically buy cryptocurrencies for one of three reasons: as a hedge against inflation, to reap a higher-yield investment, or to offer such assets to their own customers, Yarlagadda said.

Regulatory scrutiny is increasing

Even as institutional investors have become more interested in them, cryptocurrencies have drawn increasing scrutiny from global regulators. President Biden, for example, is expected to issue an executive order next week directing federal agencies to study digital currencies and figure out how to regulate them.

That's actually a positive thing, Yarlagadda said. More institutional investors will likely participate in the market once the U.S. and other governments clarify the rules of the road, he said.

"Regulatory clarity is something that a lot of institutions in the U.S. and worldwide are waiting for," he said.

At least some of the regulatory scrutiny is due to concerns about fraud and the often volatile nature of cryptocurrency prices to date. Such problems aren't surprising, given how young the technology still is, Yarlagadda said.

"Innovation in the very early stages is always a very messy process," he said.