It's a great time to build climate technology companies despite the tough venture funding environment, especially in the earlier stages, a panel of venture capital investors said this week at TechCrunch Disrupt.

Climate tech has gone through its own cycles in past decades. The so-called cleantech 1.0 era of the 2000s largely focused on solar energy and batteries, and many investments from that time failed.

Now in what some call the climate tech 2.0 era, the segment is seeing renewed interest, largely due to an increase in global awareness around the need for reducing carbon emissions. Also, last year President Joe Biden signed the Inflation Reduction Act, which earmarked an estimated $369 billion for climate change mitigation efforts.

The result has spurred investors to view climate tech companies as a viable asset again.

"The question is really what happened in the last few years that made climate so exciting," Libby Wayman, a partner at Breakthrough Energy Ventures, said during the Disrupt panel Tuesday.

Climate tech is often what VCs consider "hard tech," which involves challenging science and expensive research and development. That makes it a difficult and capital-intensive space to work in, but low interest rates in recent years presented an "amazing window" for climate investments, Wayman said.

Another major trend, she added, was "that the world has begun to wake up again to the eventuality of climate change."

Despite the broad downturn that has roiled both public and private tech companies since early 2022, climate tech activity is "still actually quite elevated from where it was almost five years ago," Wayman said. "We're off of the all-time highs, but it's still trending up into the right."

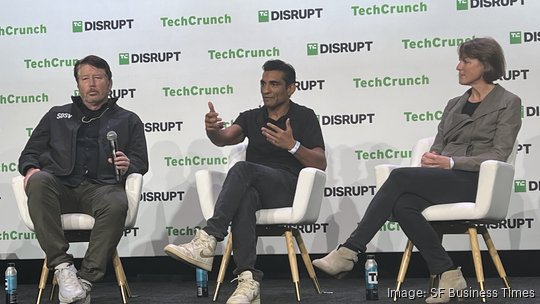

Wayman was joined on the panel by Po Bronson, the managing director of SOSV's IndieBio program, and Mayfield partner Arvind Gupta.

Here are the highlights from their conversation.

Early stage climate tech startups are in a good position. "The earlier the stage, more capital is clearly flowing," Gupta said. "I think getting up to Series A, there's a lot more discernment … Series B and C, I think it comes with a lot of metrics that are harder and harder to achieve."

If you can differentiate yourself, you can stand out even in a saturated market. "What we see startups kind of underestimate is underestimating how many other startups are doing almost exactly the same thing," Bronson said. "It's a lot of sharpening that has to happen and clear, slight differentiating in crowded markets, because climate tech is hot and there are a hundred hydrogen companies and a hundred carbon companies. And so that differentiation can make it stand out."

Investors are looking for new ideas. "We feel really good about the portfolio that we've built … covering what we think is the landscape of things that are really important for climate, and then also identifying a few themes that were really important for us to invest in at the time," Wayman said. "Now, I think we're just in a really interesting, fun, generative stage of being really open to new ideas."