The venture capital world is dominated by men.

Female founders still get a fraction of the deals made, and dollars spent, despite making steady strides over the past decade. And it's no coincidence that women still only make up about 15% of all general partners at VC firms around the country.

There's room for optimism though, according to a new report from Pitchbook.

While the pandemic hit startups with female founders harder than all-male teams, women began outpacing national trends at the end of 2020 and are already shattering records this year, according to Pitchbook's third annual report on female founders.

There are also signs that things are changing in the investment community, particularly in the Bay Area where women now make up more than 17% of general partners — nearly two points higher than the national average. Chicago and New York saw the greatest increases, bringing them within striking distance of Silicon Valley. In Chicago, women VCs have nearly doubled to 16.5% of general partners. And in New York, they increased almost half to 16.8%.

Despite some modest increases, the gender split is still nowhere close to being 50-50 but the incremental changes in VC firms bode well for female founders who tend to make more deals when women are signing checks.

"The challenges that remain for diverse founders and investors have not changed: they need access to network, community, expertise and mentorship. Now that more women are writing the checks, and getting into the boardroom, we need to make sure their presence counts – and it’s not just about optics,” Pamela Aldsworth, J.P. Morgan Commercial Banking's head of venture capital, said in a statement.

Nonetheless, startups with female founders are shattering deal records this year.

Funding for startups with at least one female founder rebounded at the end of 2020. Their deal volume grew 54%, compared to only 24% for all-male startups, and the average deal values grew by nearly 20%, even as the overall market declined more than 7%.

Some of that momentum has carried over to 2021, as well.

In the first three quarters of the year, startups with a female founder have already raised $40 billion nationally — a 70% increase over the previous record set in 2019. However, this still represents less than 18% of the nearly $240 billion-worth of funding received overall during the first nine months of the year, according to Pitchbook.

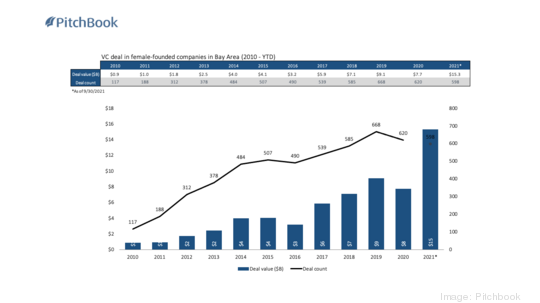

In the Bay Area, female-led startups have raised $15 billion during the same period. However, the amount of funding dramatically drops when there's no male co-founder. Bay Area startups led entirely by female founders have raised $1.6 billion this year through mid-October — only 1.7% of the $93.6 billion raised locally overall, according to additional data provided by Pitchbook.

Shelly Kapoor Collins, a partner at the San Francisco-based firm Sway Ventures, attributes this to the challenges that women predominantly faced last year during the pandemic. When Collins started the Shatter Fund, a firm dedicated to funding female entrepreneurs, in 2017, all-female teams were landing slightly more funding — around 2%.

"During Covid, women became the number one caretakers in their families," Collins told the Business Times, which pushed fundraising down on the list of priorities for a lot of women. "That would validate why we've gone in the opposite direction."

But women are also more capital conscious, tend to exit faster and also get higher returns, Collins said. Pitchbook's report reflects this reality.

Valuations and Exits

Disparities in valuations also persisted during the pandemic, too, particularly for early- and late-stage startups. The Pitchbook report shows that teams with female founders saw their median valuations rise about 4% for early-stage startups, compared to around 15% overall. For late-stage startups, median valuations increased 7% compared to nearly 13% overall.

And yet, women-led startups are outpacing the overall growth for exits — both in terms of value and the amount of time it takes to exit.

In 2020, startups with a female founder exited more than a year faster than the overall market with the value of the deals growing 32% to $24 billion versus 8% growth overall — a trend that has continued into this year.

Through the end of September, the value of exits for startups with female founders has skyrocketed nearly 144% to $59 billion — more than 40 points higher than the overall market — and they're still exiting a full year faster.