Menlo Park-based Social Capital is looking to get rid of $312 million in shares across 258 startups, according to a new report.

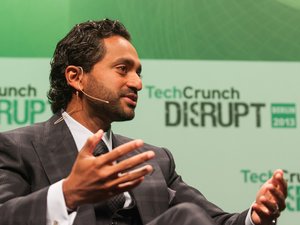

The investment firm led by Chamath Palihapitiya was looking to rid himself of funds he was managing on behalf of limited partners, The Information first reported and learned from sources.

Of the startups Palihapitiya was looking to sell stake 42% pertained to health and biotech, 20% of educational investment, 17% of financial technologies and 10% in data and analytics. The largest being $77 million in MeMed, an Israel-based biotechnology startup, the news outlet reported.

One of the Bay Area companies Social Capital is looking to divest from is Patreon Inc., a San Francisco content creator network startup in which the firm has an $80,000 stake. According to The Information’s reporting, Patreon has struggled with revenue and user growth over the past year.

The Business Journal reached out to Social Capital but did not hear back by publication time.

In 2018 Social Capital moved away from traditional investment and has focused on taking companies to Wall Street by way of merging them with special purpose acquisition companies (SPACs). It also manages Palihapitiya's personal funds; Forbes in 2021 estimated his wealth at $1.2 billion while a June report in DataWallet said his wealth portfolio was more than $4 billion.

According to Social Capital's website, it “has continued to make investments, with a broad focus across energy transition and climate science, life sciences, and deep tech.” However, PitchBook Data reports the firm is not making new investments.

The $312 million sale would represent a fraction of the firm's total holding. According to its 2022 annual shareholders letter, Social Capital reported having $6.6 billion under management.

Social Capital showed early success with SPACs by bringing Virgin Galactic and OpenDoor Holdings public through the process, which gained popularity in 2018 and 2019 before falling out of favor. Palihapitiya, often referred to as the "SPAC King," has said the firm made more than $750 million via SPACs in six deals, which roughly doubled Social Capital’s money.

Last week, Palihapitiya took to X, the social network formerly known as Twitter, after a user accused him of inflicting “massive losses” after the user stuck with the investments after Palihapitiya sold shares.

"I didn’t inflict any losses. Stop being a victim, the world will pass you by," read Palihapitiya response. "I’m in the arena trying stuff. Some will work, some won’t. But always learning. You’re anonymous and afraid of your own shadow. Enjoy the sidelines."