The record flood of capital pouring into venture firms came to an abrupt halt at the end of last year in a shift that could impact the startups they back.

The Wall Street Journal reported on Monday that venture firms raised $20.6 billion in new funds in the final quarter of 2022, a 65% drop from the same period last year and the lowest amount since the fourth quarter of 2013. It was the first time since 2009 that the amount raised dropped between the third quarter and fourth quarter, according to Preqin Ltd., which tracks venture-fund data.

The managers of family offices, pension funds and university endowments that venture outfits typically tap for capital backed just 226 new venture funds in the fourth quarter, Prequin reported, down from 620 funds at the end of 2021.

A major factor in the drop may be the lack of venture-backed companies that went public or were acquired in 2022, which was attributed to plunging valuations of public companies, rising interest rates and inflation. The limited partners who back new funds typically use returns they get from such exits as the principal source of the money they invest in ventures.

"Managers have slowed down the pace and aren’t coming back to market," Miguel Luiña, a managing director at investment firm Hamilton Lane, told the Wall Street Journal.

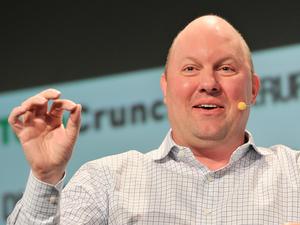

This is having an impact on Silicon Valley venture firms, the Journal reported. Andreessen Horowitz has reportedly told its limited partners that it is slowing the pace of investment from a $4.5 billion cryptocurrency fund. Sequoia Capital has reportedly invested only 10% of a cryptocurrency fund it announced in February 2022. It typically invested an entire fund in about two years.

The drop in value of other investments that limited partners are holding has also left them over-allocated percentage-wise in venture, the Journal reported.

"It is a moment of indigestion," Sunil Dhaliwal, a general partner at venture firm Amplify Partners, told the Journal.