Andreessen Horowitz has made another move to sure up its massive bet on Web3 and crypto companies.

On Tuesday, the firm announced it was relaunching its "crypto startup school," which will provide founders with a 12-week program and a $500,000 equity investment.

The Menlo Park venture firm launched the Web3 accelerator program three years ago and its first cohort met in 2020. This batch will take place in person in Los Angeles.

The firm has been betting on crypto for close to a decade and has raised $7.6 billion for its Web3 and crypto investments, including a $4.5 billion fund announced in May and a $2.2 billion fund a year earlier.

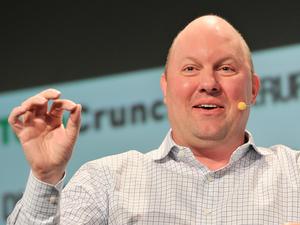

General Partner Chris Dixon oversees the firm's crypto investments and encouraged founders to apply for its crypto accelerator during the first day of TechCrunch Disrupt in San Francisco.

Dixon also commented on a variety of other topics, including the future of Web3, the firm's investment in Adam Neumann's latest startup, Meta's role in building out the metaverse and how to think about the market downturn.

Here are the highlights from Dixon's conversation with TechCrunch Senior Editor Lucas Matney:

On crypto and regulations

“Our focus is on what products are being built… and the entrepreneurs that are in the space. We try to really kind of focus on that. And I think, in that regard, we've made a lot of progress in the space. … We are proponents of smart regulation.”

How to get through a market downturn

“I've been through five downturns. … In crypto, there's been three downturns and before that there was 2008, obviously, the financial crisis. And before that … I started a company in 2004. A web2 company. And it was a downturn then. People forget this but Amazon was, I think, a 500th of the share price today. Dot-bomb was the headline of all the newspapers. … It was a very negative time. And so, I guess my broader view, what I learned through all of that is a couple things. One, if you want to do something substantive as an entrepreneur or investor, I think you have to be prepared to build through ups and downs. If you just run around to the new hot thing, I don't think you're gonna do things that are that interesting.”

Is crypto and web3 actually solving any real world problems?

“People think of a major new computing/internet movement and … they need it to solve a problem. … Even when the first computer came out, the first PC … I don't think it really solved problems. If we go into the ads in the early ’80s … they were really kind of fun to look at. Like the early Apple II ads… They didn't know how to explain it but then the developers come along and we get the word processor, desktop publishing, Photoshop, all of these things. And those solve problems. So, this is how computing works.

“Mobile phones — did it solve a problem? Sort of. But then like, really what happened is all these apps came along that solved problems and created new use cases.”

Meta's role in the metaverse?

“They're making significant investments in VR and the metaverse. … It takes a lot of money. There's certain things I think that are better done by startups. Like, I think a lot of the crypto stuff. I think a lot of the metaverse stuff I would like to see kind of develop on a decentralized point, the way the early internet was. I think it would be a very bad outcome for the world if there was this metaverse where people spent five hours a day. I think a much better outcome would be something like the way the web was this sort of network and anyone can put up a website, or a metaverse space, and people could build businesses and developers can build. I think that's a much more exciting and optimistic vision of the future. And that's what we're trying to invest in.”

Why is A16z investing so much money into Adam Neumann?

“He's one of the few founders, the only one, who built a real estate company. And I think in a lot of ways, doing a residential version of that makes a lot more sense. … We do our own research. We don't rely on books and movies for due diligence.”

Are founding partners Marc Andreessen and Ben Horowitz still deeply involved in the firm?

“They are 100% working on a daily basis.”

Does he take the chatter on Twitter personally? And has he stopped using Twitter?

“Twitter has just become very hostile. I've slowed down a lot but it's just … bots and spam… then people talk about politics. I care about community. Obviously I use it for my professional life. … I like that, I like building stuff, I like being around people who build stuff and I want to talk about that stuff on Twitter.”