When Ben Huh decided to get into investing in cryptocurrency startups, he decided to do so by creating an organization built on Web3 technologies.

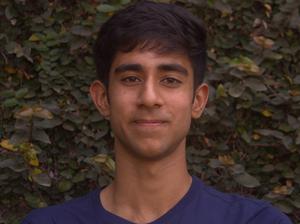

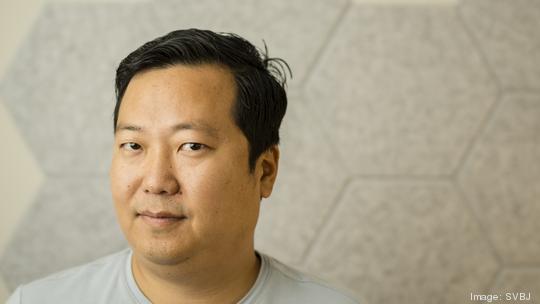

Huh, a serial entrepreneur who ran comedy site The Cheezburger Network, is the founding member of Orange DAO, a decentralized autonomous organization. An alternative to a traditional corporation, a DAO is comprised of a group of people whose stakes in the entity give them say in how it's run. Their ownership and the DAO's operating rules in the form of smart contracts are recorded on a blockchain.

In Orange DAO's case, its members are either former Y Combinator-backed founders like Huh or staff of the Mountain View accelerator. Huh set up the organization to encourage YC graduates to work on Web3-related technologies and projects. Huh also created a related venture vehicle, dubbed the Orange Fund, to invest in Web3 startups and generate revenues for the DAO.

Huh, who lives in El Cerrito, spoke with the Business Journal recently about his thinking behind Orange DAO, his focus on YC-backed startups and whether his entities might expand beyond Web3. This interview has been edited for length and clarity.

Why did you set up a DAO? What's the advantage of that structure for investing?

There's a need for a type of organization that is software first. DAOs are a form of that. (It) uses the blockchain to make transactions and accounting and voting and conversations.

The way Orange DAO works is it can go into any kind of business at once. It's not an investment vehicle. It is like an operating company, and it can create a partnership with an outside fund or a company or some other foundation that allows the DAO to generate revenue for its treasury, and the members who hold those tokens govern the use of that treasury.

How do Orange DAO's members participate in its activities?

There are three committees in which people are elected. Two members are elected on a seasonal basis. In that way, it's like a representative democracy. Those committees are like the infrastructure of the DAO, and they support all these other teams that want to do work and want to create value and things like that.

For example, we have a team whose job is to help source deal flow for our partner fund and to support the portfolio companies that the fund has invested in. That team is funded by the DAO on a seasonal basis. They're given tokens and stablecoins and things like that to go run their program.

Any member can run for those elected seats, or they can join a team or create one themselves.

How does Orange DAO relate to the Orange Fund?

The fund actually came first. The fund is helping finance the treasury and the operations of Orange DAO.

How does the fund resemble and differ from a traditional venture firm?

Imagine you are starting a brand new early stage venture firm for the first time. The difficulty is you need a network to source deals to make sure you're getting in front of the right startups. You need a way of filtering them and you need a way of supporting them.

If you started a company and you were midway through raising (a round), and I come and say, "Hey, you should take our money" — if you have plenty of choices, which a lot of (startups) do these days, you'll say, "What are you going to do for me?"

Our differentiator is we have 1,300 founders (in) the DAO. These founders have gone through everything between them. We have this amazing library of expertise and connections that our portfolio companies can draw from.

What kind of experiences do your members have with blockchain technology and cryptocurrencies?

We are people who (range from the) crypto-curious to people who have shipped multiple products and built multiple companies on the blockchain.

What's awesome is the enthusiasm our members have (for) building on a blockchain is incredible. People work with each other to ship things. And that's a great way for anyone to learn.

It's like a little founder dating platform for Web3.

How much is the Orange Fund investing in its portfolio companies?

(We have) flexibility on the check size. But almost all of our investments have been $100,000 checks.

Orange Fund is (pursuing) a "super angel" strategy, which is to write the same-size checks at a very early stage across a lot of startups.

Why did you decide to focus on Y Combinator founders and staff?

I belong to a WhatsApp group of a bunch of YC alumni that were talking about crypto. That for me was a natural place to talk to other members and come up with ideas and bounce them off each other.

Do you ever see Orange DAO investing in non-cryptocurrency startups?

The Orange Fund's mandate and its promise to its investors is to focus on seed- and pre-seed-stage Web3 companies. The fund is going to continue to focus on that part.

The mission of the DAO is to support entrepreneurs who transition to Web3. So it's unlikely we'll fund anything outside of those two mandates.

How will the Orange Fund distribute its investment returns? Will they go to DAO members?

Right now there are no plans and no mechanisms for the distribution of the treasury to the members. All of the funds go to a foundation based in the Cayman Islands that has an independent board of directors. Their job is to make sure that we are pursuing the mission that we set out to do, which is to bring more entrepreneurs into YC.

The challenge here is that the law is not clear on (distributions to DAO members). So we're staying very well clear of the gray area and saying there's no mechanism for distributions. If the law changes, we'll figure that out.

But right now, if we can continue to fund entrepreneurs and keep that money in the founder ecosystem, that is a win for all of us.