It's a truism in Silicon Valley that funding rounds keep getting bigger.

Just how big have they gotten? So big that some of the more recent early-stage rounds raised by local companies would have been sizeable late-stage rounds in the not-too-distant past.

Indeed, just since the beginning of last year, 11 Bay Area startups have closed funding rounds that tallied at least $100 million. Two of those were recorded in the first two months of this year.

Those rounds happened despite the recent stock market downturn that seems to be weighing on valuations and funding rounds for later stage companies.

"We're seeing no slowdown in funding or decline in valuations for startups raising Series A rounds, or Series B for that matter," said Kyle Stanford, a senior analyst at PitchBook Data. Because such companies are years away from going public, he added, "startups at that level are pretty well insulated from public-market volatility."

You can see the 11 companies that raised Series A rounds of $100 million or more in the gallery below:

Series A megarounds

8. (tie) Eluvio, $100 million: Led by CEO Michelle Munson, this startup's big round was led by Fox Corp in August. Based in Berkeley, Eluvio has developed a blockchain network designed for owner-controlled storage, distribution and monetization of digital content.

Businesswire

8. (tie) Septerna, $100 million: Third Rock Ventures led last month's round for this South San Francisco biotechnology company, which is led by CEO Jeff Finer. Samsara BioCapital, BVF Partners, Invus, Catalio Capital Management, Casdin Capital and Logos Capital also invested in the deal, which gave Septerna a valuation of $145 million.

Spencer Aldworth Brown

8. (tie) Nino Finance Inc. (dba CoinTracker), $100 million: Accel led the round last month for this provider of a cryptocurrency portfolio tracker and tax calculator that was co-founded by Chandan Lodha, left, and Jon Lerner. Other investors in the round, which came at a valuation of $1.3 billion, included General Catalyst, Initialized Capital, Y Combinator Continuity, 776 Ventures, Coinbase Ventures, Intuit Ventures and Kraken Ventures.

CoinTracker

8. (tie) CoinList, $100 million: Led by CEO Graham Jenkin, this San Francisco-based provider of a cryptocurrency trading service was valued at $1.5 billion as part of this October round. Accomplice VC and Agman Partners led the deal, which included 18 other investors.

CoinList

7. Brave Software, $108 million: Led by Brendan Eich, this web browser developer has raised six Series A rounds, including this one in September. All Blue Capital, Quiet Capital and unnamed investors led the latest round for the San Francisco company.

Mozilla

6. Anthropic, $124 million: Led by CEO Dario Amodei, this startup was valued at $674 million after this May round that was led by Skype developer Jaan Tallinn. The San Francisco company is working on ways to increase the safety and reliability of artificial intelligence systems.

Microsoft Corp.

5. Enervenue, $125 million: Headed by CEO Jorg Heinemann, this startup plans to use its funds to build a factory to make the nickel-hydrogen batteries it's developing. Oilfields services giant Schlumberger, which plans to help Enervenue distribute its batteries, led the round for the Fremont startup.

EnerVenue

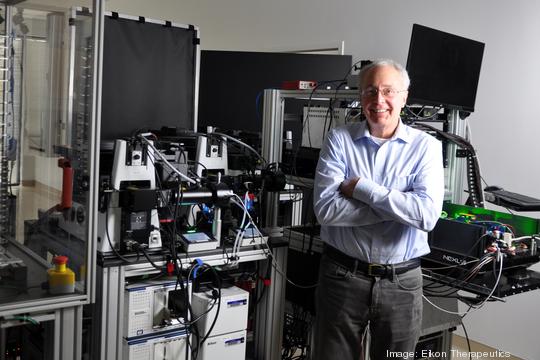

4. Eikon Therapeutics, $148 million: This Hayward-based drug developer, which is led by Roger Perlmutter, was valued at $248 million as part of its May round. Column Group led the investment for the company, which went on to raise a $518 million Series B round in January at a $3 billion valuation.

Courtesy of Eikon Therapeutics

3. Moonshot Brands, $160 million: This startup, headed by CEO and co-founder CJ Isakow, second from left, scored its big round in June. The Oakland company acquires and operates small e-commerce businesses.

2. Forte Labs, $270 million: Led by Josh Williams, this startup raised its round in a May in a deal led by Griffin Gaming Partners. The San Francisco company went on to raise a $725 million Series B round in November and an undisclosed amount of more funds in January. As of its Series A round, the blockchain technology company was worth $1 billion.

Forte Labs

1. Altos Labs, $270 million: Soon to be headed by Hal Barron, who will take the CEO reins in August, this biotechnology startup emerged from stealth with this September round. Amazon Executive Chairman Jeff Bezos and influential Israeli-Russian venture capitalist Yuri Milner invested in the round, which valued the company at $1.1 billion. The Redwood City startup raised another $3 billion in January.

Courtesy of GSK

But well beyond the $100-million rounds, early-stage startups in the Bay Area and beyond have been raising unprecedented amounts of money.

In 2015, more than half of the Series A rounds in the U.S. were for less than $5 million a piece, according to a report from Silicon Valley Bank. Last year, more than half such deals were for more than $10 million each.

All told, Bay Area companies raised a total of $13.3 billion in Series A funds last year across 720 rounds, according to PitchBook. Both of those numbers were records and up from the $11.6 billion companies in the region raised across 554 Series A rounds in 2020.

By comparison, in 2017, Bay Area companies raised a total of $5.7 billion in Series A money across 569 rounds, according to PitchBook.

A flood of capital into the venture industry is helping to boost the amounts early-stage startups are able to raise, Stanford said. Additionally, a growing number of investors have been focusing on such nascent companies, attracted by the promise of big returns, he said.

The average annual return on an investment in Series A investment round from around the globe is now nearly 27%, according to PitchBook. By contrast, global investors are seeing an annualized return of between 15% and 19% on later rounds.

The early-stage venture market has seen both a growing number of non-traditional investors and investors from established firms who have left to form their own shops that are focused on nascent startups, said Sunita Patel, chief business development officer at Silicon Valley Bank.

"Competition to invest in that (Series A) stage is more intense than it's ever been," PitchBook's Stanford said.