It's amazing how much things have changed in the Bay Area's startup and venture capital world in just the last eight years.

While working on stories this month about all the records set by that industry in 2021, I was struck by just how much funding rounds have grown since 2013 when the Business Journal launched its TechFlash newsletter.

Then, $20 million was a significant figure for a new funding round. It was roughly the average size of a Series C or later round for Bay Area startups, according to PitchBook Data.

We used that amount to determine which investments to cover. If a company's round met or exceeded $20 million, readers usually considered that achievement remarkable enough to click on a story about it.

These days, a funding round of $20 million is pretty much run-of-the-mill in Silicon Valley and San Francisco. The average Series C or later deal for area startups now tops $75 million. To get readers' attention, a funding round has to be worth at least $100 million or result in the creation of another unicorn — a company worth $1 billion or more.

It's not just these later rounds that have gotten jumbo-sized. Early-stage, angel and seed deals have seen similar jumps.

In 2013, the average angel or seed round for Bay Area startups was a little more than $1 million. Today the average for such rounds is $3.7 million. And the average for Series A and Series B rounds has gone from $6.5 million in 2013 to about $18 million this year.

Meanwhile, the overall average size of funding rounds — across all stages — has gone from about $20.6 million in 2013 to $142.7 million this year, according to PitchBook.

Why have rounds grown so much and gotten so big?

One simple and partial answer is that investments in the industry have paid off in a big way over the last eight years. In 2013, venture-backed companies returned $24.7 billion to their investors by going public or by being acquired. This year such exits will offer a windfall to venture investors of more than $300 billion.

The promise of such returns has lured in new investors and convinced returning ones to put increasing amount of money to work in the industry. The result is more investors are investing in increasing numbers of startups' venture rounds. The total number of funding rounds raised by Bay Area companies has grown from 2,871 in 2013 to around 4,300 this year.

As long as the industry continues to deliver standout returns, expect more of the same.

Top Bay Area First Half Venture Fundings

10. SoFi, $370 million: Led by Anthony Noto, the San Francisco online refinancing business went public in June via a merger with Social Capital Hedosophia Holdings Corp. V., a Palo Alto-based blank check company. On the same day in January the company announced that deal, it also closed this Series G round, which included investments from T. Rowe Price and Aeon Family of Funds. On its first day of trading after it completed its SPAC merger, SoFi, officially known as Social Finance Inc., was valued at $19.5 billion. It's market capitalization is now $13.5 billion.

SoFi

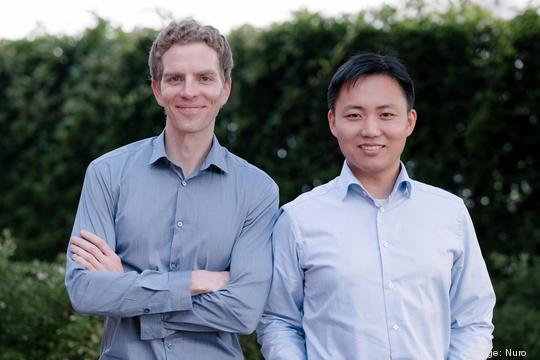

9. Nuro, $500 million: The Mountain View startup raised this Series C round on March 25 in a deal led by T. Rowe Price. Founders Dave Ferguson, left, and Jiajun Zhu have now raised a total of $1.5 billion for their autonomous delivery company. Investors valued their company at $4.5 billion in the latest deal. Nuro has lined up test delivery programs with customers including Walmart, CVS, Kroger and Domino's.

Nuro

8. Roblox, $520 million: Before going public in a direct listing in March, the San Mateo gaming company raised this Series H round. The deal came at a valuation of about $28.5 billion. Headed by CEO David Baszucki, Roblox's market capitalization is now $50 billion.

Roblox

7. Lacework, $525 million: The San Jose company, led by Dave Hatfield, scored this Series D round on Jan. 7. The deal was led by Sutter Hill Ventures and Altimeter Capital Management. It gave the automated cloud security company a valuation of about $1 billion, according to PitchBook Data.

Mason Foster

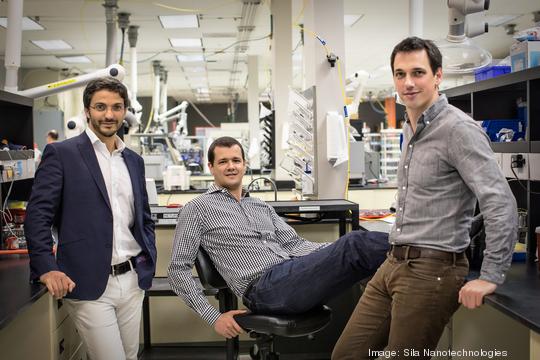

6. Sila Nanotechnologies, $590 million: The Alameda company saw its valuation more than triple in this January Series F round, which was led by Coatue Management. Co-founded by Gleb Yushin, left, Gene Berdichevsky and Alex Jacobs, the 10-year-old company makes supercharged car batteries.

Sila Nanotechnologies

5. Stripe, $600 million: The San Francisco startup hit a valuation of about $94 billion when it raised this Series H round on March 14. Allianz X, Sequoia Capital and AXA led the investment for the online payments processing business, which was co-founded by brothers Patrick and John Collison.

4. SambaNova Systems, $678 million: Investors valued this Palo Alto company at more than $5 billion after it raised this Series D round, which was led by SoftBank Investment Advisers in April. Intel Capital, GV and BlackRock also invested. Kunle Olukotun, left, Rodrigo Liang and Christopher Ré co-founded the developer of artificial intelligence chips.

Tomas Ovalle | SVBJ photo illustration

3. Databricks, $1 billion: As part of this huge Series G round in February, investors valued this San Francisco startup, led by CEO Ali Ghodsi, at about $28 billion. Franklin Templeton Investments led the round, and was joined by a host of other investors, including Andreessen Horowitz and New Enterprise Associates. Databricks' software is designed to make it easier for companies to analyze big data sets.

Todd Johnson | San Francisco Business Times

2. Waymo, $2.25 billion: This deal in June marked only the second time that this Google LLC spinoff had taken outside funding. Magna International, AutoNation and Silver Lake led the round, valued the Mountain View company at about $30 billion, according to PitchBook. The developer of self-driving vehicle technology raised its first funding — a $3 billion round — last year.

Brett Carlsen/The New York Times

1. Robinhood Markets, $3.4 billion: The Menlo Park startup secured the quarter's largest funding round. But the online brokerage, led by co-founders Baiju Bhatt, left, and Vladimir Tenev, didn't raise the funds for the usual reasons. Instead, it had to scramble to shore up its reserves after an unprecedented run of trading by anti-shortselling crusaders who bought up shares of downtrodden companies, including GameStop and AMC. Valued at about $12 billion, the company filed for an IPO just before the July 4 holiday weekend.

Aaron Wojack/The New York Times