For millions of Americans, the tragedy of Covid brought a once-in-a-lifetime reprieve from the burden of crushing student loan debt.

Congress suspended federal student loan repayments for six months starting in March 2020, paused collecting loans in default and temporarily slashed interest rates to 0% — a relief policy extended four times until Jan. 31, 2022. Unfortunately, borrowers with private student loans might have gotten little to no relief unless their lenders provided options like hardship forbearance.

Goodly wants to help.

Founded by Greg Poulin in 2018, the San Francisco startup works with employers to offer tax-free student loan repayment assistance as an employee benefit, up to an annual $5,250 contribution. Goodly has raised $1.4 million in seed funding since going through Y Combinator in 2018.

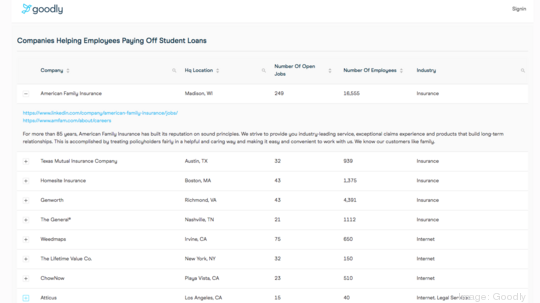

On Tuesday, the company launched a product that allows job seekers to search for companies offering the benefit. It expects to add hundreds of new companies every day this week and build up the database to about 5,000 entries by the end of the year.

Users can search the directory by company name, headquarters, number of job vacancies and the number of employees by company and industry. Goodly’s products can be used by anyone with student loan debt, whether federal or private.

I spoke with Poulin about why offering student loan benefits could give employers a competitive edge as the so-called Great Resignation carries on.

Why did you start Goodly? It came from my own experience with student loans. When I was in school, my father passed away very unexpectedly after having a heart attack. So, to pay for school at Dartmouth I had to borrow $80,000 in student loans. After I graduated, I moved to San Francisco and was the first employee at an HR and payroll company called Rippling. It's really challenging to do things like saving for retirement, let alone saving to purchase a home or starting a family, when you're paying down such huge student loan debt. My monthly payment is now $900.

I also met my co-founder at Rippling. We started kicking around ideas for how we could apply our expertise in building HR and payroll software to the student loan problem. We found there was a lot of interest from employers but there weren't any good tools on the market for companies to administer these types of programs.

Have you paid off your own student loans? Not yet, no. I still have about $50,000 to go. I do have federal student loans, so they are in forbearance right now but come January those payments will be resuming.

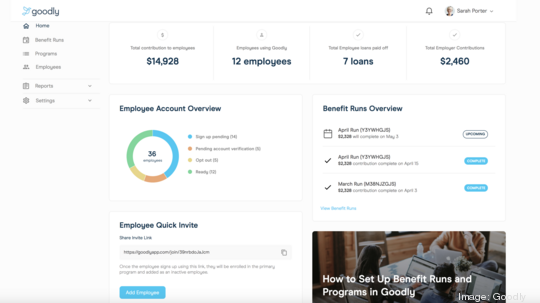

What's the onboarding process like for an employer to get signed up and start offering repayment assistance through Goodly? It takes about five to 10 minutes for companies to get up and running. And it's designed to be really streamlined. All you have to do is enter the basic employer information and then sync a corporate bank account. That serves as the funding source for payments. So, each month it's a simple ACH pull and we'll remit the payment directly to the student loan servicer. The final steps include entering the program design. We usually see about $100 per participant per month being the most common. The other approach that's popular is to tie those employer contributions to tenure at the company. Start with, say, $100 per month in year one and then $200 in year two till you reach a cap. The final steps are just entering the payment schedule and uploading a census file with names and emails of your employees and we use that to verify folks through signing up and making sure they're eligible. We can also send out invites. Our team will manage everything downstream from that.

And employees have their own dashboards? That's right, and it takes employees just a few minutes to create their account. If you have multiple student loans, you can mark one of those as the primary one. And you can track the total payments made from the company. Other features include access to financial wellness tools and calculators.

Thinking about the Great Resignation, this seems like a benefit that could make an employer more competitive. Are you seeing more interest from employers who want to beef up their benefits in order to attract the best candidates? Absolutely. We've seen a huge uptick in interest since the benefits have become tax free but also now that the economy has gotten so competitive for things like recruiting and retention. Throughout the pandemic, we've been seeing companies adding all sorts of wacky perks attempting to improve engagement, like virtual pizza parties, pet adoption subsidies and house plants. And people wonder why we have 10 million open jobs in the U.S. and more than 4 million people quit their jobs in August. Student loan debt can be the No. 1 blocker to achieving financial freedom. By the time they reach the age of 30, people with student loan debt have about half the retirement savings as people without that debt. They also delay things like home ownership, getting married and having children.

There's also been a big push to cancel student loan debt. I don't think anyone's holding their breath, but even if it happens, a lot of people have private student loans and are not eligible for federal relief. Does Goodly work with both private and federal lenders? Yes, we can work with all student loan types. Federal, private, graduate, undergraduate. As long as the loan is in the name of the employee and it was used for their education. It seems unlikely that there will be widespread student loan cancellation. But also, a one-time debt jubilee really doesn't solve the problem. The Department of Education has been very clear that borrowers are going to have to resume their payments in early 2022. A lot of folks are going to need help transitioning back into that. Student loan cancellation also doesn't create a long-term solution for the student loan crisis and we think that employers, as direct beneficiaries of their workers' education, should play a part in repaying those loans, as well.

How does Goodly's new job search tool work and why are you launching it? With federal student loan forbearance ending, we've had a lot of job seekers and employees reaching out to us saying, “We're concerned about managing our payments, can you help connect us with a company or do you have any resources for finding employers offering student loan paydown benefits?” So we created this Goodly jobs board, and it allows job seekers to find companies that help repay their workers' student loans. You can browse the companies and job opening offering repayment benefits. It's free to use. Users can also suggest edits or submit data to be added. Or if you're an employer that's not already added, you can submit your company.