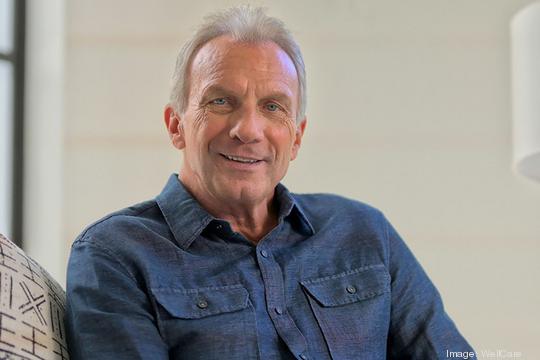

As a private equity investor, former 49ers quarterback Steve Young is interested in sports-related technology and services but there's one thing he's not looking for: an NFL franchise stake.

Young has been in the private equity game for 17 years through his Palo Alto-based firm Huntsman Gay Global Capital, commonly known as HGGC, which he founded in 2007.

HGGC has made hundreds of investments across a variety of sectors, including financial services which makes up a little over half of the firm's investments, according to PitchBook, followed by B2B products and services, information technology, consumer, health care, materials and energy.

Young didn't start looking at sports investments until recently, though. He explained the shift in strategy during an appearance at Axios' BFD conference in San Francisco on Tuesday.

"It took me 15 years to start using my relationships from my previous life in my investing world," Young said. "We get into meetings with business owners in sports, they're like, 'Where've you been?' ... I just took some time to figure out that it was okay to bring the two worlds together."

He's most interested in sports technology and services, but he isn't considering taking a stake in any NFL franchise.

"I think that there's a lot of businesses around sports, especially in the kids and young adult clubs and what they're doing in services and the technology. There's a lot of cool stuff happening. So that's the kind of things we're looking for," Young said.

The NFL is reportedly considering allowing private equity firms to acquire up to 10% of a team, according to a recent report from Bloomberg News.

"It's been successful in the NBA, it's been successful in Major League Baseball, and the NFL thinks of themselves as the kings," Young said.

So, why isn't Young interested in taking a piece of a professional sports franchise?

"I've been around the NFL so long, and equity values are so high ... I'm not going to join that parade now," Young said, but "even though I have my own, you know, idiosyncrasies about it, it's definitely investable today ... I think you'll see a rush to it."

Young also credited former Dallas Cowboys quarterback Roger Staubach for encouraging him to get into private equity as a new career after retiring from the NFL.

"I go, Roger, what do I do now that I'm finished playing? He goes, 'Run' ... just get away from this, start something new and have the humility to start over," Young said. "And I went into private equity with that humility."

These Bay Area athletes have money in the (startup) game

Many professional athletes are in the investing game now, including several Warriors players such as Stephen Curry, Andre Iguodala, Klay Thompson and Draymond Green.

Former Niners quarterback Joe Montana has a venture firm, Liquid 2 Ventures, based in San Francisco.

Tennis champion Serena Williams also set up her venture firm, Serena Ventures, in San Francisco.