With venture investing down dramatically over the last 18 months, it's a tough time for founders looking to raise new cash.

But that didn't stop Pankaj Patel from scoring a megadeal for Nile Global Inc.

On Tuesday, the San Jose-based networking startup announced it had raised a $175 million Series C round from a collection of strategic and traditional venture investors in one of the biggest funding deals the Bay Area has seen this year.

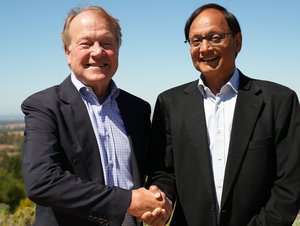

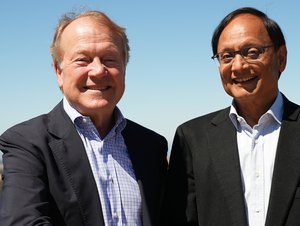

To be sure, Patel, a former Cisco Systems Inc. exec who founded Nile with John Chambers, the networking giant's ex-CEO, ran into some of the same obstacles other founders are facing. But he found a way around them — and he has some advice on how others can do the same.

Patel chatted with the Business Journal on Monday about how Nile landed its jumbo-sized round, the challenges it faced in doing so and how other founders can improve their chances of raising funds. This interview has been edited for clarity and length.

With venture investors reining in their investments, how were you able to raise such a large round?

Raising this large round was an interesting experience, because I wanted to get the strategic investors in the fold, and we didn't do that the last time.

I raised that (last round) out of my living room on Zoom sessions in literally three weeks. So compared to that, this has been a very different experience.

It clearly has taken a bit longer. But we have taken a significant amount of money from marquee players. And the reason why people have really rallied to this round is because of the bold vision that they see for the company.

Also, John Chambers and I have a decent track record. We have been in the industry for a long time — He ran Cisco for 20 years, and I was running engineering for a couple of decades there. People see what we are capable of doing.

What was the biggest challenge you faced in raising this round?

I started (raising) late last year. I was just socially talking to people over holiday parties or whatnot. There was a lot of angst about both valuation as well as about (the size of) checks people wanted to write.

As time progressed, we (saw) that a huge percentage of the Series C rounds were pretty significantly down. And so, in the early days, I would talk to some people, and then they (would) ask me, "Are you OK to take a flat round or slightly down round?" And I'm like, "No, I'm not."

In a market like that, when the market was working against you, to really (have to) set the stage and convince people why we are so special and different. At the end of the day, all it took was a couple of lead investors to really come through. I would have been even happy with 50-60% of what we raised. But when I saw the (strategic investors) coming in to chip in, I couldn't resist (the) larger opportunity.

What's your advice for startups and founders looking to raise capital right now?

Always focus on your vision, make sure that it is a truly bold vision, (that) it's not going to be solving a small incremental problem, No. 1.

No. 2, right from the beginning, it's very important to get some sounding board validation from some customers and to get a feel as to where they're going to fit in in the market. Ideal customer profile is very, very important for the startup founder. A lot of (founders) fall into the trap that they think that they will innovate and the market will come. That's not the way it works, unfortunately. You have to really focus on which problem you are going to solve for the customer.

The other two things which are very important is that investors will pay a lot of attention to you (when you) surround yourself early on with incredible talent. You want to build on that talent and leadership, because at the end of the day your talent is your biggest asset, right?

The last one I would say is think about some strategic investors who can help you connect with (the) right customers who can help you with go-to-market and more.