A San Francisco business software startup wasn't looking for more capital but has raised $100 million in new funding after being approached by some of its existing investors.

Legally known as Greenbax Inc., Zip announced the Series C round on Monday. It was led by Y Combinator and also included CRV and Tiger Global Management.

It brings the startup's total funding to $181 million and raised its valuation slightly to $1.5 billion, up from $1.2 billion when it raised $43 million one year ago in a Series B that was also led by Y Combinator.

The new funding round stands out for a couple of reasons. Funding to procurement management software companies dropped by more than 77% last year compared to 2021, according to Crunchbase. And Zip's valuation increased during a time when many startups are facing — or avoiding — so-called down rounds.

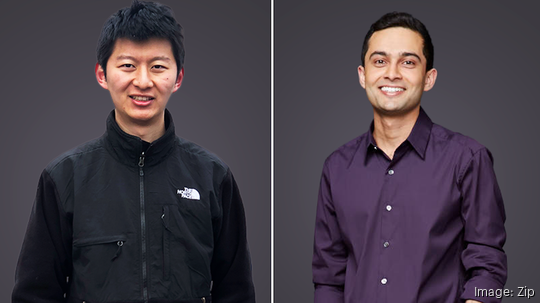

Zip was founded in 2020 by CEO Rujul Zaparde and CTO Lu Cheng. They met while working at Airbnb, decided to start a business together, and went through some other "embarrassing" ideas before eventually developing Zip, Zaparde told Forbes, which first reported the news on Monday.

In 2012, Zaparde also previously co-founded FlightCar, a car sharing platform geared at airport travelers which was acquired by Mercedez-Benz in 2016 for an undisclosed amount.

I spoke with Zaparde about how Zip differentiates itself, the impacts of hybrid and remote work on corporate software spend, why investors doubled down on the company and whether Zip is raising too much capital, too quickly. Our conversation has been edited for clarity and length.

What are some of the biggest lessons that you took from your previous startup, FlightCar? How important it is to have the fundamentals and the business be healthy. Gross margins, customer acquisition costs. Not only because that means you have a healthier business, but so you can operate it and make the right long-term decisions. Otherwise, you're beholden to being compelled to decide things and run things in a short-term view — compelled to fundraise or have just more constraints on your business and how you operate. And it's so important to have the right tailwind. With our car sharing company, we started during the same timeframe that Uber and Lyft were just becoming real things back then. Those were headwinds, because there were fewer people driving.

With Zip, there's certainly a tailwind here because if I close my eyes and pretend it's 2033, 10 years from now companies are only going to care more about auditability in their approvals when it comes to data security, risk. Buying is going to only become more and more distributed across the organization, and there's only going to be more and more software and other things that people can buy 10 years from now. So, we have a real tailwind.

What were those earlier “embarrassing” ideas that you and Lu were workshopping before settling on Zip? We looked at accountants and other roles that are skills-based. Was there a way that we could use software to help map open contract positions with qualified accountants and CPAs? Fulfill those contractor positions? We realized that it was ultimately still much more of a service problem, and something that you still need humans for. It's not fully a software solution that would work.

What were the pain points in procurement that you saw and wanted to fix? We both experienced the problem previously in our careers, and it was just obvious to us that if we need to buy something, it's so confusing to figure out. And the end user had been forgotten. It’s such a complicated workflow issue between all these different teams, and it's a controls issue for the company because you have to make sure that if you're buying a piece of software, you're bringing onboard a contractor who's going to show up and that they have been properly vetted. Lou and I realized that this was just so convoluted, and a manual process across the board.

How is Zip different from other incumbent procurement management software? Zip is built with user experience in mind. One customer said he would get six to seven questions every working day about how to put in a request with their previous setup, and after Zip, it’s like one question a month. The intuitiveness in the user experience really matters. That starts with creation of the request, but it extends to a visual workflow. Both pieces are very unique to Zip.

To what extent is Zip is benefiting from the shift to remote and hybrid work? The hybrid world makes it even harder for an employee to figure out what the process is. Four years ago, you could go walk up to someone and ask for help. Today, you can't really do that. And it puts more burden on the software to be intuitive and usable without requiring training or explanation. So, I think it's definitely helped us in that sense. And then from the sales cycle perspective, it's probably helped. But I would not say that we're very sensitive to a hybrid or nonhybrid model for our customers and prospects. And we're very agnostic. We have customers from technology companies, of course, but also financial services, manufacturing, retail, healthcare. It’s very diverse.

You raised a very sizable round for not really being in the market for new capital. Was Y Combinator the first investor to approach you about a Series C? Yep, it was. We've had just a phenomenal relationship with them. And it was truly an opportunistic fundraise because we really love working with them as partners.

What do you think YC, CRV and Tiger Global Management all saw in Zip that made them want to give you $100 million, when you weren't even asking for it? The customer feedback. I think that that really has resonated more than metrics and growth rates, and other numbers. It’s the customer love for the product and the feedback that I know they've heard.

Your valuation just ticked up a little bit, too. Does that come with a little more pressure to perform or reach certain metrics? I think raising money always does, in a sense, but we felt very comfortable with the valuation terms. If we hadn't, we wouldn't have completed the round. We felt very comfortable given the company's growth rate and felt that it would be the right decision for us, so that we can continue to invest in product and other core components of Zip.

Do you worry about raising too much, too quickly? I think that really applies to companies that are pre-product. But for a company that has market fit, which I think we've had for quite some time now, it makes sense to raise if you have a good use for the funds. And for us, that's R&D, product, engineering and design investments. And so that's why we chose to proceed with the financing.

What does the next couple of years looks like for Zip? First and foremost, it is product, engineering and design. That is where we'll invest the most over the next three years, but we'll also continue to invest in what we call our solutions and customer success teams. Our solutions team runs the end-to-end implementation of the product, and the customer success team supports the thereafter. And we'll grow the sales team. The capital will be used for growing headcount across the different functions.

You told Forbes that your Series B “could have been the last round that we ever raised” before an exit. Will your Series C now be the last time you need to raise funding? It doesn't mean it is the last time we will ever raise, but it's certainly the last time that we ever need to raise. We'll always make the right decision at the right point in time for the company. And seek the right path in the future, which might be going public in some number of years, but it also might be raising another round of financing in the future.