Despite its steady legalization at the state level, the cannabis industry remains in a state of uncertainty nationwide.

On Tuesday, voters in Maryland and Missouri approved legalizing recreational use, bringing the number of states and U.S. territories that have done so to 24. Similar measures failed in Arkansas, North Dakota and South Dakota, according to Vox.

President Joe Biden has directed his administration to expeditiously "review" the plant's classification as a Schedule 1 drug which puts it alongside heroin, LSD, ecstasy and peyote — but the president has not advocated for legalization. Legislation to deschedule the drug is pending in the U.S. Senate, but it's unlikely to pass.

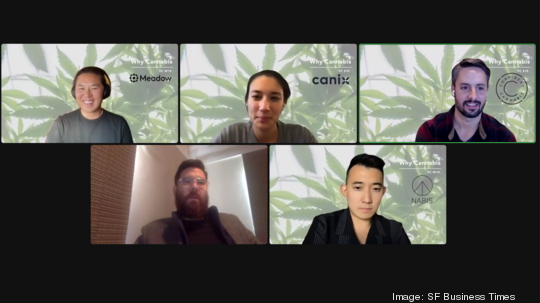

On Wednesday, a group of Bay Area cannabis startup founders discussed the state of the industry and its challenges during a virtual forum hosted by San Francisco-based Meadow, a point-of-sale and compliance software provider for cannabis retailers.

During the virtual forum, founders addressed the patchy regulatory landscape as well as other issues like mergers, consumer demand and profitability. Another theme that also stood out: cannabis is a good industry to invest in right now, they claimed.

Here's who participated in the panel discussion and what they had to say:

- Stacey Hronowski, CEO of Canix, a compliance software developer (San Francisco)

- Steve Albarran, CEO co-founder of Confident Cannabis, a B2B wholesale marketplace (Palo Alto)

- Bertrand Vick, CEO of Rev Genomics, a biotech developing cloned strains (Oakland)

- Vincent Ning, CEO of Nabis, a wholesale distributor (San Francisco)

- David Hua, CEO and co-founder of Meadow, a point of sale and compliance software developer (San Francisco)

On capital markets:

- Vick: “We are raising some more money now. … That's been part of our strategy recently is to raise as much money as we can now, as I think capital markets for cannabis, and in general, are going to continue to be pretty constrained. And given a lot of things that are happening geopolitically, who knows what's going to happen? So even though cannabis worldwide is growing, and it's one of the few things that is, what else are you gonna put your money into? Crypto? No. Meta/Facebook? No. It's a good time to invest in cannabis and help the winners become even bigger winners for the future.”

On the impact of the regulatory environment:

- Hronowski: “The rug can be pulled out from under you with no warning whatsoever. So that ethos really ties into everything that we do. … We don't have a five-year vision. We have an 18-month roadmap and there's always the caveat, depending on what happens in the industry, this could change. … There's a natural tendency to want to know that what you're building will really stand the test of time, but unfortunately, sometimes, the right thing to do for your customer is just to be like, ‘OK, scrapping that, we're going in a completely different direction now.’”

On responding to consumer demand:

- Ning: “People are still experimenting. … Consumer (demand) and what's being produced oftentimes doesn't match. … You end up with a ton of oversupply and it ends up leaking into the illicit market. So it's not a good thing. And there's ideally more data to help everyone produce the exact right amounts and exactly what to produce. But I think there's a ton of siloed technology systems out there across the supply chain that don't permit that feedback to flow back to the producer quickly to be able to actually make day-to-day business decisions around it. The quarterly data doesn't come out till two months after the quarter. And so is it really actionable? The market would probably have changed by the time you actually saw the data from before.”

- Hua: “More people smoke weed this year than last year. … (But) as we expand to other states, the headwind that we're seeing is really on the customer side. The dispensaries are feeling a price hit as consumers are really trying to figure out their spending in an inflationary environment.”

On growth and profitability:

- Albarran: “We started off with a very Silicon Valley kind of mentality. You know, grow at all costs and try to go after the big hairy goal. And if you miss, doesn't matter, just close the company and start a new one. That's not a good idea if you're a really important part of the industry, and I think all of our companies here are pretty important to this industry. We're not huge companies. I'm not saying we're too big to fail, but we're big enough to have a material impact on the industry. … We focus on profitability now that capital markets are pretty closed and have been for a while.”