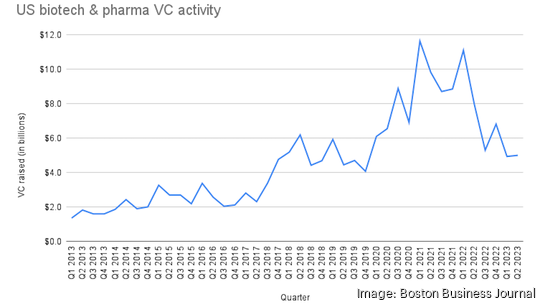

Biotech and pharma companies saw their worst quarter for venture capital since 2019 in Q2 this year, according to a new report from Pitchbook and the National Venture Capital Association.

All told, biotechs brought in $5 billion in the second quarter, on par with the $4.9 billion they collectively raised in the first. The life sciences sector has not seen such low VC activity since the last quarter of 2019, which topped out at $4.1 billion.

Taking the long view, however, 2023 is still shaping up to be one of the top years on record for life sciences investing. The years during the height of the pandemic — 2020, 2021 and 2022 — were a bit of a bubble for biotech, when the need for Covid-19 vaccines and treatments shone a spotlight on the industry, fueling new investment in both the private and public markets.

"In 2020 and 2021, really a tsunami of financing flowed into the biotech space, dwarfing where we were earlier in the decade," Atlas Ventures' Bruce Booth said in a year-in-review presentation in December. "The third quarter [of 2022]... would be a top-five quarter ever, prior to 2020. So there is still lots of capital available to build and grow successful biotech companies today."

The 2023 market reset has long been expected by industry watchers. It's already playing out in the public markets, where fewer companies are choosing to price IPOs, and is now trickling down into the private sphere.

In 2023 so far, U.S. pharma and biotech companies have raised a total of $9.9 billion across 448 deals.

As two points of comparison, they raised $31.2 billion across 1,116 deals in all of 2022, but $19.2 billion across 1,036 deals in all of 2019.

"People came down off that high. Global market conditions changes, which obviously trickles down to all industries," Michael O'Hara, Deloitte's New England life sciences and healthcare audit and assurance practice leader and a board member at MassBio, recently told the Business Journal. "Biotech probably suffered more than most industries."