Venture capital has slowed down this year, but Bay Area startups are still pulling in a majority of the capital deployed, and it's not just companies building in the artificial intelligence space.

The number of deals closed across the country was down by about one-third from March to April, compared to the same period last year, according to new data from PitchBook. The overall value of those deals was down by nearly half and reached just shy of $40 billion.

Investors have poured less capital into startups nationwide for almost six consecutive quarters since the fourth quarter of 2021 when firms deployed a record $97 billion. The first quarter of 2023 increased slightly to nearly $46 billion, up from around $41 billion in the fourth quarter of 2022.

Companies based on the West Coast took half of the capital deployed in the second quarter this year, netting them over $20 billion. More than 80% of that went to Bay Area startups.

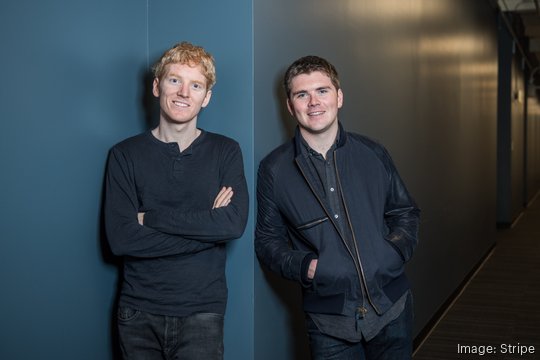

The largest single deal was closed by financial services provider Stripe which raised nearly $7 billion in a Series I round. Stripe is one of at least 13 Bay Area companies that are expected to launch initial public offerings when the market eventually thaws.

Inflection AI closed the region's second largest deal of the quarter with a $1.3 billion round that included a mix of capital and cloud computing credits.

Drone delivery startup Zipline also had one of the Bay Area's largest rounds, along with several biotechs, consumer fitness company Tonal and an electric car manufacturer.

Here are the Bay Area's top 20 startup investments of the second quarter by total value and round, if disclosed.

- Stripe (South San Francisco) — $6.9 billion, Series I

- Inflection AI (Palo Alto) — $1.3 billion

- Anthropic (San Francisco) — $450 million, Series C

- Zipline (San Francisco) — $330 million, Series F

- OpenAI (San Francisco) — $300 million

- Typeface (Los Altos) — $165 million, Series B

- Tipalti (Foster City) — $150 million

- Carmot Therapeutics (Berkeley) — $150 million, Series E

- Bitterroot Bio (Palo Alto) — $145 million, Series A

- Eikon Therapeutics (Hayward) — $141 million, Series C

- Tonal (San Francisco) — $130 million, Series F

- WorldCoin (San Francisco) — $115 million, Series C

- Acepodia (Alameda) — $100 million, Series D

- Lyten (San Jose) — $100 million, Series B

- Drako Motors (San Jose/Austin) — $100 million

- Celestial AI (Santa Clara) — $100 million, Series B

- Auradine (Santa Clara) — $81 million, Series A

- SafeAI (Santa Clara) — $68 million, Series B

- Ethernovia (San Jose) — $64 million, Series A

- Reka AI (Sunnyvale) — $58 million, Series A