For a lot of people, simply getting spaghetti on the plate is financial power, and that was the case for Michael Broughton's family. As an adult, he learned that his father juggled three jobs to make sure the family was supported.

"Now I'm like, man, I was being so picky over that spaghetti, you know? I'm like, you all worked so hard to get that spaghetti on the plate," Broughton says in an audio clip on Altro's website.

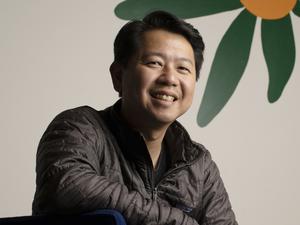

That's the San Francisco fintech startup that Broughton, 23, co-founded with CTO Ayush Jain, 22, in 2019 to help people build credit without a traditional credit card.

"I think everyone has some level of financial power. You have people who, like my family, are living paycheck to paycheck. Spaghetti on the plate, we're winning. That was financial power," Broughton, who's CEO of Altro, continues in the clip.

Now he wants to empower the underbanked, and eventually folks without any bank account at all, to have more financial power.

On Thursday, Altro announced an $18 million Series A round that was led by Pendulum and also included Jay-Z's firm Marcy Ventures, Citi Ventures, Black Capital Fund and Concrete Rose Fund, as well as former Citigroup and Time Warner chairman Dick Parsons.

Shortly after founding the company, Broughton dropped out of the University of Southern California where he had been studying political science before switching to entrepreneurial studies with a focus on blockchain and finance. He had a tough time securing enough funding, though, and was denied a $10,000 student loan due to his own lack of credit history.

It's a frustrating situation that millions of people experience: You need credit to get credit.

"People in my community and other communities have built credit" from predatory lenders like payday loan companies, Broughton told me, and the goal is to create a better way for people to get credit.

To help solve this problem, the Altro app lets users connect their checking accounts so the company can scan their purchase history to establish creditworthiness. After an initial screening to make sure users are real people, the company also issues users a virtual credit card that they can use to make subscription payments at 32 approved vendors including Netflix, Nintendo Online, Apple Music, Spotify, Hulu, Amazon Prime and Hello Fresh.

Eventually, the company also wants to add rent payments as an additional option.

Altro then reports users' new payments to credit agencies so that they can start building up a credit score, which is needed for things like taking out loans and applying for credit cards with better rates. Credit reports are also used by employers when vetting job candidates.

Not having any credit history can be incredibly limiting. About a decade ago, close to 20% of American adults didn't have a credit score, according to a 2015 report from the Consumer Financial Protection Bureau. That figure jumps to 45% for people living in low-income neighborhoods, with Black and Hispanic people disproportionately impacted.

A substantial number of adults also don't have access to traditional banking services. Nearly one-fifth of Americans had no bank account or insufficient access to regular banking services in 2020, according to a Federal Reserve report in 2021. That report also looked at credit card approval rates and found that Black and Hispanic applicants were denied credit more often than white or Asian applicants across all income levels.

In just a couple of months, Broughton wants to launch online banking services specifically for the unbanked so they can start tapping into the rest of Altro's credit reporting services.

The company has hundreds of thousands of users, Broughton told me, and makes money by taking a portion of the fees that credit card companies charge vendors for processing payments. Altro's products are completely free for its users.

The company employs 30 full-time workers plus around a dozen contractors, and Broughton wants to get their headcount up to 50 to 70 people within twelve months, with a particular focus on hiring in data, engineering and marketing.

The company also provides users with educational material about all aspects of finances, including crypto. Though Altro doesn't offer any crypto products and services as of yet, Broughton said he wants to meet users where they are, which means eventually including crypto options.

"There's a spectrum of financial power that exists from zero to 100 and we want to bring people from where they are to later down that stream because it's a win for everybody," Broughton said. "The farther people are on that spectrum, the more monetizable they are from a mortgage to home loans, personal loans, whatever it may be. And people want to get down that spectrum, too. They want financial freedom."

Altro was also in Y Combinator's summer 2020 cohort, and Broughton was accepted into a Thiel Fellowship that same year.