San Antonio has made great strides in growing its tech industry, but when compared to its northern neighbor Austin, as it often is, the Alamo City can sometimes appear as if it’s still in the minor leagues.

But the comparison is unfair as the ecospheres of the two cities differ greatly, said Tom Tunstall, senior director of research at the University of Texas at San Antonio’s Institute for Economic Development.

Tunstall said San Antonio’s tech industry’s top focus should be advancing its own strengths rather than imitating Austin — or any other city — and leaning into its identity.

“The first rule of any strategy is it has to be your own,” he said. “If you try to glom off someone else’s strategy, it will typically end badly.”

To provide better insight into how San Antonio stacks up, the Business Journal asked local economic development officials and tech experts which cities are most similar to San Antonio when it comes to their tech ecospheres and other core metrics.

Our sources identified the cities of Jacksonville, Florida; Cincinnati, Ohio; and Tulsa, Oklahoma, as three of the most comparable technology scenes to San Antonio’s. Read on to see how San Antonio measures up.

But first, a little perspective: A March report by the Brookings Institution found 36 of the country’s metro areas that aren’t typically considered “superstar” or “rising star” cities for tech saw a significant uptick in tech growth during the pandemic — including San Antonio. By contrast, many tech superstar cities like San Francisco and Austin saw slowed tech job growth during the same period.

America’s major tech cities — which, on average, boasted a 4.9% growth rate before the pandemic — saw that rate drop to 2.9% between 2019 and 2020. During that same time in San Antonio, which between 2015 and 2019 experienced a tech growth rate of about half a percent a year, the city’s tech growth rate more than doubled — hitting 1.2%

SAN ANTONIO MSA

- POPULATION: 2,558,143

- MEDIAN HOUSEHOLD INCOME: $62,355

- MEDIAN HOME PRICE: $197,600

- EDUCATIONAL ATTAINMENT: 28.8% (B.A. or higher)

The Alamo City is forging its own tech identity distinct from Austin’s, with its cultural richness and relative low cost of living, making it attractive to young white-collar entrepreneurs and tech workers, said Tunstall, with UTSA’s Institute for Economic Development.

A 2021 Coldwell Banker Richard Ellis Group report found that the city had a 9.4% growth in its tech workforce in the past three years and boasts approximately 33,000 tech workers — but that number does not include many in top-secret government cybersecurity positions. In a 2020 Dice Q3 Tech Job report, San Antonio maintained a 21% growth rate in the industry for the quarter — the highest in the nation. And a 2020 Zillow analysis ranked San Antonio No. 6 among the top 10 American cities primed for future tech growth.

The growing startup and biotech scene was launched largely by the founding of Rackspace Technology in San Antonio in 1998. As the city’s economy developed, it was always able to draw information technology and financial-sector jobs, Tunstall said, but many of these positions were previously at call centers. That dynamic is changing through efforts of economic development organizations like greater:SATX and other city and county entities that are helping identify and recruit higher-paying tech jobs.

Tunstall noted that although San Antonio is making strides in growing its own talent, it’s not something that can be accomplished overnight. But a stronger emphasis on STEM education in both the city’s K-12 sphere and at local universities like University of Texas at San Antonio — which graduates about 250 engineers a year — is vital in establishing a skilled workforce, which in turn attracts tech companies to the city.

Tech talent is also drawn to local resources like the Southwest Research Institute, a nonprofit applied research and development organization, as well as government contract cybersecurity opportunities. (A 2021 Cybersecurity Guide job report found 6,485 cybsersecurity openings in the San Antonio metro area.) And of course educated, white-collar millennials also consider quality of life when deciding where to move, and recent developments like San Antonio’s River Walk extension, San Antonio Creek extension and the Hemisfair Park redevelopment help make the city more appealing.

Realistically, San Antonio is not poised to become the next Silicon Valley, Tunstall said. But that doesn’t mean that it can’t become an innovation hub with universities and public-private ventures enhancing its talent profile, tailoring its own strengths and shoring up its weaknesses.

The city should identify realistic areas of focus and play to its strengths, he said: information technology, cybersecurity and industrial technology like aerospace and biotechnology.

Charles Woodin, CEO of Geekdom, also applauded the city’s cybersecurity strengths with its close connection to the military, adding that the pipeline of cybersecurity talent departing the military is a rich opportunity for tech companies.

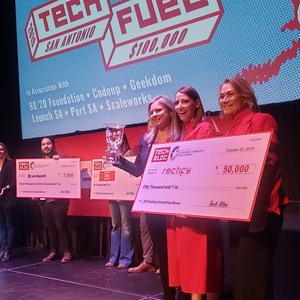

He noted that the city’s accessibility in terms of tech, finance and military contracts is one reason tech workers are attracted to San Antonio. Large companies like H-E-B, USAA and Whataburger have beefed up their presence by adopting new technologies and opening up more tech jobs in traditional sectors. And startups are emerging at a fast pace in San Antonio — since Geekdom’s inception 10 years ago, more than 2,400 new jobs have been formed, primarily in the tech sector.

Other tech development wins in San Antonio, Woodin said, are in the area of education technology, with about half the businesses in Geekdom’s most recent preaccelerator programs specializing in edtech. Health care tech startups and fintech startups are also succeeding in the city, with FloatMe, a Latinx-led company founded at Geekdom in 2017, raising $16 million in the last year in a series-A run.

JACKSONVILLE MSA

- POPULATION: 1,613,250

- MEDIAN HOUSEHOLD INCOME: $64,489

- MEDIAN HOME PRICE: $339,000

- EDUCATIONAL ATTAINMENT: 33% (B.A. or higher)

The coastal city of Jacksonville, Florida, offers white-collar job opportunities, tourist attractions and lifestyle activities to tech professionals, said Aundra Wallace, president of economic development agency JAXUSA Partnership. Its cost of living is 6% lower than the national average — San Antonio’s is about 12% lower— and Florida, much like Texas, has no state income tax. Florida also has no sales and use tax on goods manufactured or produced in the state for export; and no sales or use tax on co-generation of energy.

San Antonio and Jacksonville both ranked among the top five American cities for monthly tech-job growth rate in a 2020 Dice Q3 Tech Job Report — San Antonio with a 21% growth rate for the quarter and Jacksonville with a 17% growth rate. Both cities were also named in the top 10 American cities for future tech growth in 2020’s Zillow analysis — Jacksonville at No. 3 and San Antonio at No. 6.

Like San Antonio, Jacksonville offers a host of STEM educational, business and tech certification opportunities to students and young professionals. The city’s job market has seen a 9% increase in tech workers during the pandemic and it’s experienced the third-largest monthly tech job growth in the nation, according to the Dice report.

A crop of Fortune 500 companies, startups, financial technology and health technology companies have moved to Jacksonville in recent years including Synergy Technologies, Newfold Digital, financial technology companies FIS and Black Knight, and health care information technology companies Availity and Forcura. And in June, Jacksonville will launch a 3,900-square-foot Open Innovation Center to house preaccelerator activities. Like San Antonio’s Geekdom, the innovation center serves as an entrepreneurial education program for small to medium-sized businesses and helps support corporations and startups in areas that include financial and health technology.

Jacksonville has also seen explosive workforce growth recently, particularly in its fintech industry. The city's financial services industry supports more than 62,000 workers. Last year, Dun & Bradstreet, a global provider of business decisioning data, analytics and banking technology, relocated offices to Jacksonville, creating 500 local fintech jobs. And in June, a new 12-story corporate headquarters will be completed for Fortune 500 fintech company FIS.

CINCINNATI MSA

- POPULATION: 2,232,907

- MEDIAN HOUSEHOLD INCOME: $66,825

- MEDIAN HOME PRICE: $224,090

- EDUCATIONAL ATTAINMENT: 34.4% (B.A. or higher)

Like San Antonio, Cincinnati draws millennial, white-collar workers with its low cost of living. In 2019, it was ranked No. 1 for lowest cost of living in a major metropolitan area by the Bureau of Economic Analysis, though neither city made business forecaster Kiplinger’s 2021 list of cities with lowest living costs.

Cincinnati is also a hotspot for tech and innovation: According to Regional Economic Development Initiative Cincinnati, it’s home to more than 17,000 jobs in the tech industry, 17,000 jobs in the aerospace industry and almost 14,000 jobs in biohealth. In 2021, LinkedIn ranked Cincinnati ninth out of 10 cities where “tech strength defies the pandemic” (Austin clocked in at No. 6, while San Antonio didn’t make the list). And Zillow in a 2020 analysis ranked Cincinnati the No. 5 market “ripe for tech growth” (San Antonio followed at No. 6, with Austin at No. 8).

Pete Blackshaw, CEO of Cincinnati startup catalyst Cintrifuse, said some of the metro area’s most common tech jobs are in biomedical research, health information technology and medical device manufacturing. And the regional pipeline of startups continues to grow, with companies like Cloverleaf and Cerkl focusing on new human resource practices and Donovan Energy on green energy. Cincinnati startups PayTheory and Coterie explore financial technology innovation and local startup Hearty just launched the first professional NFTs for innovators. Another local startup, Physna, known as the “Google of 3D Objects,” has employees in both Cincinnati and Columbus.

Venture capital investment tripled in the region in 2021, according to Blackshaw, with Cincinnati doubling its number of venture capital firms in recent years to include CincyTech, Refinery, Lightship Capital, RC Capital, eGateway Capital and others. Upstart Orange Grove Bio also recently relocated from Boston to work on medical research for University of Cincinnati Medical and Cincinnati Children’s Hospital Medical Center. The region is now home to 24 venture capital funds according to Tracxn, a platform for tracking startups and private companies, while San Antonio has approximately 17.

Donna Zaring, director of development and external relations at Cintrifuse, said Cincinnati attracts tech talent with the University of Cincinnati and Xavier University offering computer science programs. In addition, Fortune 100 corporations like Procter & Gamble, Kroger and Western & Southern and Fifth Third Bank also draw skilled workers.

According to Pitchbook, startups in the greater Cincinnati area raised a record-breaking $671 million in 2021. Public-private seed-stage investor CincyTech, which focuses on life sciences and digital companies, reported 1,630 jobs created by clients in 2021 in the Ohio State of Startups 2022 annual report.

Zaring pointed to several recent economic development wins for the region: 80 Acres Farms, a Hamilton-based vertical farming startup, received a 10-year incentive agreement worth up to $2 million for a $74 million investment to triple its size and create 125 local jobs. And in February startup Cerkl received a nearly 1.8%, eight-year job creation tax credit from the Ohio Tax Credit Authority to create $9.5 million in new annual payroll and add 125 new employees — quadrupling its current workforce.

TULSA MSA

- POPULATION: 1,015,331

- MEDIAN HOUSEHOLD INCOME: $57,859

- MEDIAN HOME PRICE: $205,000

- EDUCATIONAL ATTAINMENT: 31.8% (B.A. or higher)

Tulsa is another rising tech city bearing similarities to San Antonio. CBRE, a commercial real estate services and investment firm, recently ranked Tulsa on its list of up-and-coming North American tech-talent markets. Its tech employment has grown to 12,460 jobs in the past five years — a 19% increase since 2015.

Moreover, Tulsa offers a $10,000 incentive to remote workers to move to the city for the year. In the last three years, that’s helped convince 1,400 workers, many in the tech industry, to move to Tulsa — and around 95% of them stay, according to the Tulsa Authority for Economic Opportunity.

A recent analysis by Tulsa Innovation Labs and McKinsey noted that Tulsa has some regional-specific tech niches due to its unique connections — not unlike San Antonio’s edge in cybersecurity and military jobs. For Tulsa, the niches in which it excels include energy technology, advanced aerial mobility, virtual health, cybersecurity and analytics.

And Tulsa Innovation Labs, an economic development organization, is helping develop more tech-specific university programs and talent pipelines directly to the city — similar to the approach UTSA and other San Antonio universities are taking.

Other Tulsa incentives designed to attract tech workers include no-cost education opportunities to help Tulsans get training to enter the tech industry, like Holberton, a tuition-deferred software development school, and Satellite, a free boot camp for tech sales jobs.

Recently, the city of Tulsa and Tulsa Authority for Economic Opportunity partnered with the Tulsa Economic Development Corporation to fund the creation of a business incubator in Tulsa’s Greenwood district, which will help entrepreneurs launch businesses by housing a business accelerator and providing $1 million in small business capital.

The city also recently provided funding and space to 36 Degrees North to create a 48,000-square-foot incubation space for local high-growth tech startups in the One Technology Center — which, like San Antonio’s Geekdom, will provide flexible office space, access to capital partners, and in-house programming and networking.

A new accelerator program, ACT Tulsa, was launched this year to help nine Tulsa tech startups with Black and brown founders launch and scale businesses with coaching, programming and a $70,000 non-dilutive investment. Tulsa-based startup and “venture studio” 19days announced a close of $5.5 million in February 2021 to build and launch software-as-a-service companies from the heartland. And since 2020, Atento Capital, backed by the George Kaiser Family Foundation, has made nearly 40 investments, almost half of which went to minority founders or partners.

Wyatt Donnelly-Landolt, a spokesperson for the Tulsa Authority for Economic Opportunity, noted that San Antonio is a comparable city to Tulsa in terms of its burgeoning tech scene, and noted that they sometimes compete for the same companies.

For instance, in July 2021, San Antonio-founded company PatchRx, which created a smart prescription pill cap and platform, moved operations to Tulsa after a pre-seed round from Tulsa’s Atento Capital.