What began as a way for entrepreneur David Weiss to make some extra cash after college has turned into a fintech startup that allows users to automatically trade stocks.

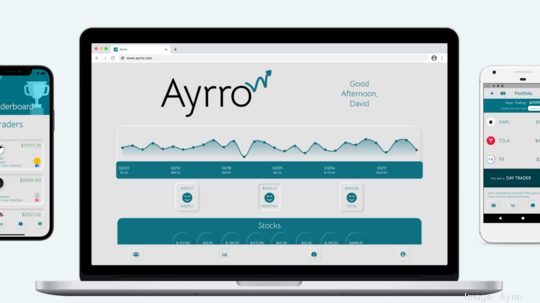

Ayrro — pronounced "arrow" — was founded in 2019 by Weiss and launched to the public in May. Weiss said he originally created the startup to use algorithms to execute trades automatically.

"At first, I was just doing it for myself, but it evolved into a company where users can create their own algorithms without code then deploy their stock trading bots so their bots will trade stocks for them on their behalf, automatically," he said.

Weiss said the platform now also acts as a social hub, where users can share their results and compete in leaderboard-type competitions.

"As we went through our beta periods, we started realizing people liked seeing the competition aspect," he said. "They liked to brag about their profits and how well their auto-trading did."

When Weiss began creating the platform in 2019, he did it because he was looking for a way to make some extra money after graduating college.

"I started dabbling in stock trading. But for a lot of people day trading isn’t an option, so they have to resort to long-term trading because they don’t have the time during the day," he said. "When I built this app out, I wanted to do something based on mathematical systems, and I wanted to do it automatically, so I could go to my job and work there and have this running in the background."

Ayrro offers three tiers of memberships: Analyst, Trade Desk and Hedge Fund.

The Analyst tier, Weiss said, is the free membership that every user is enrolled in when they sign up for the service. In this tier, users are trading in real-time with real data but are using fake dollars to simulate a trade.

Upgrading to a Trade Desk account requires a user to connect their account to Robinhood, which is what Ayrro uses to execute trades. The Trade Desk allows for real money trading, as well as perks like unlimited portfolio stocks and backtesting.

The last, and most exclusive, tier is the Hedge Fund. Weiss said Hedge Fund users are invited to participate based mostly on their profit margins over a period of time as Trade Desk users.

"As a Hedge Fund trader, your algorithm is published to the rest of the traders on Ayrro, so users can then follow you for a daily fee of $10, and half of that fee goes to the Hedge Fund user on a daily basis."

The app is available for download in the Apple store or Google Play store.