A group of University of Virginia alumni, staff and faculty recently crossed the $20 million mark in startup investments across its lifetime.

CAV Angels was founded in 2015 and started as a traditional investors club for members with UVa. connections. Over the last four years, it has grown into a powerful force for early-stage startups.

“Who would have thought when we were this little group and having lunch and making a couple hundred-thousand-dollar investments here and there that it would turn into something of substance?” CAV Angels co-chair Rich Diemer said.

Last week, CAV Angels was involved in a $6 million funding round for Charlottesville medical device startup Luminoah. That investment put the organization over that $20 million mark. Overall, CAV Angels has made 26 investments in 45 different companies. All the companies have a connection to the university.

“Some people ask if that is restrictive, and we have found is that it is not,” Diemer said. “Charlottesville, Virginia, like Richmond, is an undiscovered place. People don’t look to invest money in startups [located there].”

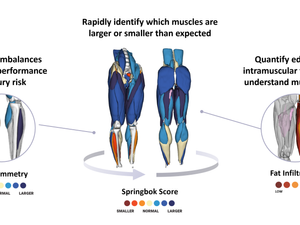

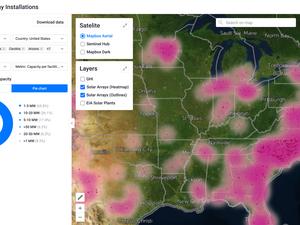

Diemer said Albemarle County startups cumulatively received $8 million in early-stage funding last year and 80% of that was associated with CAV Angels. Besides Luminoah, CAV Angels has invested in farming tech startup Babylon Micro-Farms, personal care product comparison site Brandefy, augmented reality company ARtGlass — all based in Richmond — and Charlottesville satellite data company Astraea. The largest investment was $1.4 million in Charlottesville’s TearSolutions over several funding rounds.

“That came out of the UVa. lab, and it’s a natural solution for dry eye,” Diemer said.

The group has 141 accredited investors and around 80 noninvestor members.

CAV Angels is organized as a nonprofit because it also has an educational component. Students from UVa. are actively involved in the due diligence process. Currently, the students are helping to analyze a potential investment in Richmond on-demand warehouse platform Warehowz, Diemer said.

This component to the organization also fills a gap in university education, Diemer said. UVa. did not have expertise in venture-backed startups, and CAV Angels gives the students hands-on experience.

So far, CAV Angels has had two exits. The first was Dive Technologies, a Boston-based underwater drone company. The organization invested $400,000 in an early-stage funding round, and Dive Technologies was purchased two years later by Anduril Industries, a Peter Thiel-backed company. As well, CAV Angels invested in Durham, North Carolina, medical device company Phitonex, which was later purchased by Thermo Fisher Scientific.

Unlike other investment organizations, CAV Angels does not take a large management fee. The organization has no paid staff and only takes a small percentage for administrative and legal fees, Diemer said.

Diemer said the organization’s next focus is creating a separate fund. Right now, CAV Angels presents individual investors in the organization with potential opportunities. Each investor makes their own decision. Diemer said that creates challenges because CAV Angels cannot lead a funding round. The goal is to create a pooled fund where the organization can take on lead status in investment rounds.

CAV Angels is also advancing the educational component through an entrepreneur-in-residence program. Elizabeth Blankenship, a UVa. grad and founder of sustainable fashion company By Eilly, was recently named the inaugural appointee of the program. For the residency, she will focus on founder support, due diligence and operational support.

Moving forward, Diemer said he sees the network becoming more organized and might begin to outsource some administrative functions.

“We are hoping to build on the credibility that we have built over the last five, six, seven years,” Diemer said.