Portland fintech startup Bumped launched its first bank partnership with Ogden, Utah-based online bank TAB Bank. It’s the first of what is expected to be several partnerships this year as the startup pushes into the market.

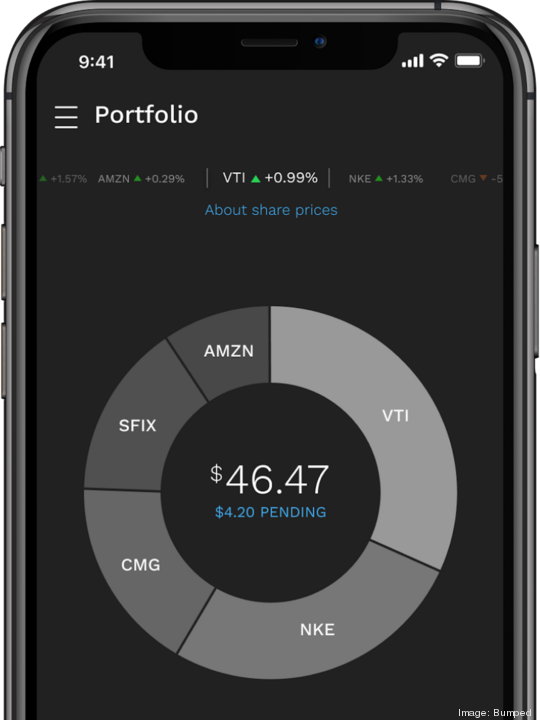

The Bumped platform allows consumers to receive fractional shares of public company stock. TAB is using the platform to offer stock ownership as a benefit to its checking account and debit card customers using its TAB Flow and TAB Flow+ accounts.

The bank's accounts reward customers for qualified purchases with small investments in brands including Walmart, McDonald's, Amazon, Starbucks and more.

Bumped founder and CEO David Nelsen likens the bank partnerships to an evolution in the existing points, miles and cash back incentives bank customers have become accustomed to.

“(We are) creating new products for true loyalty. We’re launching products that do something different and give the consumer a new emotion and new experience,” said Nelsen.

From the start Nelsen has talked about Bumped being an onramp for people into stock investing. The company has its own consumer app that people can use directly, but its broader go-to-market strategy is working with financial institutions and brands to build the Bumped platform into their apps and experiences.

“We want to empower our partners to launch stock rewards and build an ownership economy,” he said. “That is the theme of who we are. We look at the Bumped app as one iteration of what will be hundreds of fractional share apps.”

These partnerships generate revenue through a base fee and then fees per active user or by percentage of stock rewards issued.

“Rewarding your customers in stock is a way to literally invest back into the relationship. Banks like TAB that are willing to help their customers go from simply spending to ‘spend-vesting’ (as they have named it) are showing commitment to a lifelong partnership,” said Nelsen in a blog post about the TAB launch.

Nelsen expects more bank partnerships will launch this year as well as some brand partnerships. He said the Covid-19 pandemic affected consumer brands in significant ways and many discussions were put on hold. When that happened, the startup shifted to pushing bank and financial institution deals forward.

The launch with TAB has been in the works for about a year. The two companies first met in 2019 at he fintech conference Finovate, said Amy Dunn, senior vice president of marketing and communications. That was the first time Bumped had demoed the product and it won Best in Show. They had another meeting at a conference in 2020 and talks really began.

Bumped has a team of 30 and Nelsen expects that number to stay consistent for the next four to six months. He does expect to hire in operations side and customer support as more users come online. But, for the most part, he is waiting to hit milestones to trigger hiring.

On the capital side, he has raised a little money in the background but may package that with an eventual B round. The company has raised a total of $30 million in debt and equity.

In October, Bumped launched with Canadian financial services company The Moves Collective, which is building financial products aimed at gig workers. As Moves customers earn and manage their money using Moves, they gain fractional shares in Uber, Lyft, DoorDash and Grubhub.

Between its own app and these early customers the company is generating revenue.