Portland software maker Ride Report is being acquired by Kirkland, Washington-based Inrix, a data and analytics provider in the transportation sector.

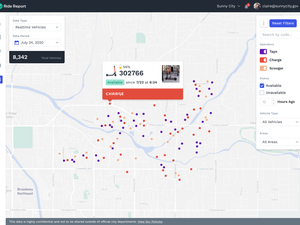

Ride Report, founded in 2014, makes software for municipal governments to manage and monitor shared bikes, scooters and other mobility options. The company has raised $13.4 million from investors over the years.

Terms of the deal were not disclosed, but the Ride Report team will move over to the new owner. This includes CEO Michael Schwartz, who took over the top role from co-founder William Henderson last year.

Schwartz declined to say how many employees this would include. He has been with the company for more than seven years and was the first employee other than Henderson and co-founder Evan Heidtmann.

“About a year ago we took stock of where we were when I took over,” said Schwartz. “We needed to scale the company to meet the challenges and opportunities of the industry. We knew continuing at this size would be hard.”

At the same time, the funding landscape was dramatically different as it has become harder for companies to raise money while interest rates have risen and venture capital investors have pulled back. The Portland metro has seen a stark cooling of investment activity since the highs of 2021 and 2022.

“Between that and the unique challenges of the size we were, we thought the best way to scale would be to look for potential acquisition,” he said.

Ride Report’s most recent round was $10 million, announced in March 2020, right before the start of the Covid-19 pandemic. Even at that time, then-CEO Henderson said the team was preparing for lean times with signs of consolidation within the micromobility market.

Who is Inrix?

Inrix generates traffic and parking data for clients, according to the Puget Sound Business Journal. Businesses use the data to make decisions on new store locations and local governments can use it for urban planning decisions, and the auto industry uses data for services like finding parking or monitoring unsafe driving conditions.

As it became clear that acquisition would be the path forward, Schwartz said Inrix was at the top of the list for potential buyers, based on shared alignment around data.

Ride Report has 75 customers. The majority of those are municipalities across the country, including Portland, which has been a customer from the startup's beginning. Many of these clients will be new to Inrix, said Schwartz. The deal also brings the ability to track transportation options like bikes and scooters to Inrix’s platform.

“For nearly two decades Inrix has been focused on analyzing and facilitating the movement of people and goods around the world. We’re excited to now include shared mobility in Inrix IQ, which has become an important area for many cities” said Bryan Mistele, president and CEO of Inrix in a written statement.

Inrix is itself a venture-backed company. Earlier this summer the company raised $70 million from investment bank Morgan Stanley. Mistele told the Puget Sound Business Journal that he is aiming for his own exit by 2025.

The process of pitching a company for sale versus funding is different, and Schwartz said he received a key piece of advice from one of his investors: Be direct.

“It’s startups. There is a lot of posturing. A lot of people talk about strategic partnerships,” he said. Instead, “talk about what you want and what you want to achieve. Don’t pretend you want a partnership when you want an acquisition.”

With that in mind, Schwartz said he went in to meetings emphasizing what Ride Report built and what it had in its platform. Inrix also ingests data, so Schwartz focused on how both data sets will be more useful together.

“We are part of a broader story. The market doesn’t go away. It’s consolidating,” he said.

When venture capital was more readily available, there was more experimentation and there were micromobility companies — shared scooters, bikes and cars — of different sizes, but now, the best companies are surviving, Schwartz said. As those micromobility companies consolidate it has forced the same in the related markets like Ride Report.

“It makes sense for us to be part of a larger team and make the business go farther,” he said. “We are seeing that micromobility ridership is back up above where it was in 2019. Now, there are fewer companies providing it.”

Investors in Ride Report include Unusual Ventures, Homebrew, Better Ventures and Urban Innovation Fund. The company will continue to have a Portland office and has local projects in the works, Schwartz said.