Oregon's Congressional delegation is continuing its push to get cannabis banking regulations through Congress.

Democratic Oregon Sen. Jeff Merkley along with Republican Montana Sen. Steve Daines have introduced the SAFE Banking Act in the Senate with 38 co-sponsors, including Oregon Sen. Ron Wyden.

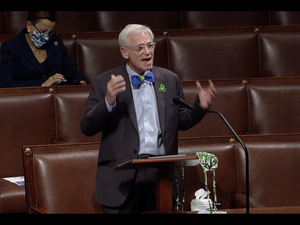

In the House, the legislation is being led by Oregon Democrat Earl Blumenauer and Ohio Republican Dave Joyce. There are eight co-sponsors in the house including Oregon’s newest representative, Republican Lori Chavez-DeRemer.

The bill would give state-legal cannabis businesses access to banking and other financial services. As it stands now financial institutions steer clear of cannabis businesses, even in states where the drug is legal, due to the product's federal legal status. That leaves the industry largely operating in cash, increasing the risk of illegal and dangerous activity, reform advocates argue.

Want more Portland business news? Sign up for the PBJ’s daily email newsletters.

“For the first time, we have a path for SAFE Banking to move through the Senate Banking Committee and get a vote on the floor of the Senate,” said Merkley in a written statement. “Let’s make 2023 the year that we get this bill signed into law so we can ensure that all legal cannabis businesses have access to the financial services they need to help keep their employees, their businesses, and their communities safe.”

A version of the SAFE Banking act has passed the House seven times but has always stalled in the Senate. Just last week, Blumenauer, a long-time cannabis reform advocate, said he was hopeful cannabis banking and tax reform would be addressed during this Congressional session.

What will the Safe Banking Bill do?

The lawmakers noted this bill will:

- Prevent banking regulators from prohibiting, penalizing or discouraging banks from working with state-legal cannabis businesses or related businesses

- Prevent banking regulators from terminating or limiting a bank's Federal Deposit Insurance because the bank is providing services to state-legal cannabis businesses or related businesses

- Prevent banking regulators from recommending or incentivizing banks to stop or downgrade services to state-legal cannabis businesses

- Prevent banking regulators from taking action on a loan to an owner or operator of a cannabis-related business

- Create safe harbor from criminal prosecution and liability and asset forfeiture for banks and their officers and employees who provide services to state-legal business. But banks still have the right to choose not to offer such services.

- Provides protections for hemp and hemp-derived cannabidiol (CBD) related businesses.

The bill would also cover the work of Community Development Financial Institutions (CFDI) and Minority Depository Institutions (MDI).

The American Bankers Association released a statement praising the reintroduction of the legislation.

“This commonsense, bipartisan bill, which has already cleared the House multiple times, would resolve the ongoing conflict between state and federal law so that banks can serve state-authorized cannabis and cannabis-related businesses,” said ABA President and CEO Rob Nichols in a written statement. “The SAFE Banking Act would also enhance public safety, tax collection and financial transparency, and national surveys show a strong majority of Americans support this bill. We urge Congress to consider this legislation without delay.”