Vancouver wearable computer maker RealWear Inc. plans to go public this year as part of a SPAC merger with Seattle-based Cascadia Acquisition Corp. (Nasdaq: CCAI).

The deal will value the resulting company at $375.5 million, if current SPAC shareholders don’t redeem their shares before the transaction closes, according to a joint release from both companies.

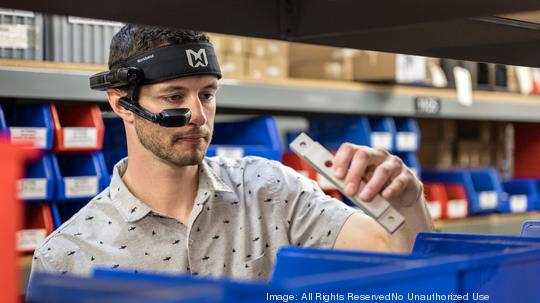

RealWear makes a head-mounted, wearable computer designed for industrial workers. Its products are in an area it calls “assisted reality.”

Unlike with virtual reality, RealWear users' field of vision remains completely open. That is important because workers are in environments and around equipment that require full attention for safety. The products are hands-free. The company has also developed cloud-based software to manage device fleets, and the platform can integrate existing software tools like video conferencing or custom tools.

The company has raised a total of $126.8 million from investors, according to Crunchbase. This includes a Series C round that was completed last year.

“RealWear’s mission is to engage, empower, and elevate frontline professionals around the world and across industries to increase productivity and enhance safety,” said Andrew Chrostowski, chairman and CEO of RealWear, in a written statement. “This combination with CCAI will accelerate our ability to deliver new assisted reality products, services, and solutions at scale that transform the way people work today, tomorrow and into our sustainable future.”

The company reported $20.5 million in revenue last year, up from $13.9 million in 2019, according to regulatory filings. During that time sales have gone from hardware only to hardware plus its cloud software. Last year, the company had gross margins of 63%, according to the filing.

The company has around 100 employees. Proceeds from the merger will go toward hiring for product development and cloud engineering as well as expanding contract manufacturing. The company also intends to expand its sales channels and move into more industry verticals, according to its filings.

RealWear has more than 5,000 customers and more than 70,000 units deployed. It has global customers with names such as TotalEnergies, AirBus, Ford, Duke Energy, Mondelez International, Maersk and Global Foundries. Additionally, 41 of the Fortune 100 companies are customers, according to an investor presentation.

Its largest deployment of units at a single customer is 3,500. The company sees significant runway among customers to continue to expand its reach, according to the investor presentation.

The transaction is expected to close in the second half of this year. CCAI was created to source a deal in the robotics, automation and artificial intelligence space with a February 2023 deadline to find and complete a deal. The CCAI board is meeting Feb. 15 to vote on extending the deadline to Aug. 31.

“CCAI was established with the intention of identifying and partnering with businesses that are utilizing technology and innovation to disrupt industry in sizable and expanding markets,” said Jamie Boyd CEO of CCAI, in a written statement. “RealWear perfectly fits these criteria, and we are thrilled to partner with them and add value by strengthening their financial position in pursuit of growth initiatives across product, customer, geography and industry initiatives.”

CCAI is a special purpose acquisition vehicle, sometimes called blank check companies. These companies raise money from investors and go public as a shell company. The SPAC then looks for a private company to merge with and the result is the private company becomes a public company.

If the transaction closes the combined company will be called RealWear and it will trade on the Nasdaq.

SPAC mergers were a hugely popular way for companies to go public in 2020 and 2021 when there were 248 and 613 such deals, respectively. However, the strategy has lost much of its luster. Activity slowed in 2022 when just 86 SPAC IPOs occurred, according to the research site SPAC analytics.

Locally, there were three SPAC mergers in that timeframe: nuclear power company NuScale Power LLC (NYSE: SMR); grid-scale battery maker ESS Inc. (NYSE: GWH); and vacation rental property manager Vacasa (Nasdaq: VCSA).

Shares of Vacasa and ESS have been battered by the market. Vacasa's share price is down 83% since its debut, and ESS is down 72%. NuScale shares are off their debut by just 0.4%.

This story has been updated to correct the number of customers. RealWear has more than 5,000 customers.