Supply chain issues crimped ESS in the third quarter, putting it off pace to ship the 40 to 50 Energy Warehouse units the Wilsonville grid energy storage company was forecasting in 2022.

“We continue to build Energy Warehouses, but the nearly finished units are sitting in our production bay awaiting the parts that are delayed,” CEO Eric Dresselhuys told analysts in a quarterly earnings call after markets closed on Thursday.

ESS (NYSE: GWH) fell 8.5% in Friday trading, closing at $3.70.

Through the third quarter the company had shipped 10 Energy Warehouses, though it doesn’t recognize revenue until the units are accepted by customers. For the year it has recognized revenue for four units, including one in the third quarter worth $192,000.

“We feel we can ship 20 or more EWs in the fourth quarter,” Dresselhuys said. “I believe it’s below our original target for 2022, but importantly, we’re still confident in our ability to get to our exit run rate at the end of the year.”

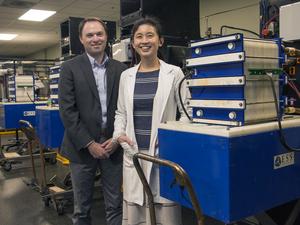

Founded in 2011, ESS went public last year, netting nearly $250 million. It’s using the money to staff up, scale production and boost marketing of its unique iron-based flow battery. It went from 160 employees as of the end of 2021 to 247 recently according to a Business Journal manufacturing survey.

Dresselhuys said the parts challenges “obscure the progress we are making with our production process.” With two semi-automated lines for battery modules and a fully automated line expected before the end of the year, ESS expects to go into 2023 “with a capacity greater than our original target of 750 megawatt-hours per year.”

The CEO also cited the Inflation Reduction Act as a significant long-term tailwind for the company. The legislation’s sweeping energy-related provisions could provide customer savings “approaching 70%” on ESS products, he said. A production tax credit is also available for ESS as a domestic manufacturer.

“The combination of incentives represents an unprecedented catalyst to our market, both customers and suppliers,” Dresselhuys said.

ESS bills its technology as a better alternative to widely deployed lithium-ion batteries, especially for longer-duration output — from six to 12 hours instead of the one to 4 hours conventional batteries provide.

With its quarterly report ESS also announced that Amir Moftakhar had resigned as chief financial officer, effective on Friday. The company appointed Anthony Rabb, previously CFO at Total Safety, a Houston company that provides worker safety supplies and services.

On Friday, ESS announced a deal with Burbank Water and Power to deploy a 75-kilowatt/500-kilowatt-hour Energy Warehouse at the California utility's campus, connected to a solar array.