Portland-based NuScale Power has endured a volatile stock market and a couple of negative news reports since it went public a month ago.

But in a business update on Friday, executives emphasized the advanced nuclear power company’s financial position and pointed to progress on several fronts.

NuScale is something of an anomaly among recent SPAC-merger listings. As its deal moved toward closure, it gathered additional backing in the form of private investment in public equity, or PIPE. And it hung onto most of the funds provided by its SPAC partner, Spring Valley Acquisition Corp.

“In a period in which many high-quality deals were seeing redemption rates well over 90%, Spring Valley redemptions were only 37.5%,” NuScale CEO John Hopkins said Friday. “The assets in trust plus our upsized PIPE yielded significant capital to fund our growth plan over long term.”

NuScale netted $341 million in proceeds going public

That netted the company $341 million, about 9% less than the $373 million cited when the deal with Spring Valley was announced in December. That compares well to the experiences of two other local companies that went public through SPAC mergers: Vacasa fell 30% short of its initially announced potential proceeds and ESS was off by about 45%.

A story in the online trade publication Utility Dive this week emphasized NuScale's need for a “solid balance sheet.” On Friday, the company reported it had $383.7 million in available capital, $140 million more than it had projected needing through 2024 as it pursues its first sales and deployments later this decade.

NuScale’s stock has seemingly reflected investor comfort with where it stands: After opening at $10, it has traded in a narrow range of $8.87 and $11.23. The stock closed Friday at $9.44, off less than 0.5% on a day when the wider market took bigger losses.

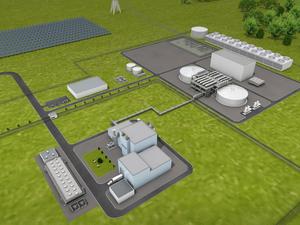

UAMPS-NuScale project in Idaho on course

In the update, NuScale also touted incremental progress on its “anchor relationship” with Utah Associated Municipal Power Systems (UAMPS) — the public utility consortium aims to site a project at the Idaho National Laboratory with a first NuScale small modular reactor online in 2029. Executives noted, too, the announcements of exploratory agreements with a Wisconsin-based cooperative and entities in Romania and Poland.

Analysts didn’t ask about two recent news stories NuScale had to deal with, one that broke just before the company went public and the other that came out this week.

In late April, Reuters reported that based on safety concerns raised by an agency engineer, the U.S. Nuclear Regulatory Commission had ordered staff to document its 2020 approval of NuScale’s reactor design.

Regulator staff say NuScale SMR design is safe

But Reuters last week followed up with news that staff had determined the agency’s “evaluations were acceptable and updates to design approval were unnecessary.”

The second NuScale story involved a study published in the Proceedings of the National Academy of Sciences. The study found the company's small modular reactors could produce more radioactive waste than large reactors and lead to more complicated waste management scenarios.

NuScale disputed the findings, saying that the analysis used incorrect characteristics for the its reactor thermal core. The company demanded a correction from PNAS. PNAS on Friday did not immediately respond to a request for comment on NuScale’s assertions.