Grid-scale battery maker ESS has abandoned a plan to sell more stock.

The Wilsonville company on Monday withdrew a registration statement it had filed in late December and told regulators that it “no longer wishes to conduct a public offering of securities at this time.”

The proposed offering was for up to 6.5 million shares.

“Given how well the company is funded, it was not important to proceed at this time,” an ESS spokesperson said via email. “We continue to expand our business and execute our strategy.”

ESS stock (NYSE: GWH) was trading around $14 when it made the Dec. 27 filing, which required review and an “effective” declaration from the Securities and Exchange Commission. That declaration never came. Meanwhile, the company’s stock began a slide that took it to a nadir of $4.97 on Feb. 3. It closed at $5.82 on Wednesday, up $0.36 on the day.

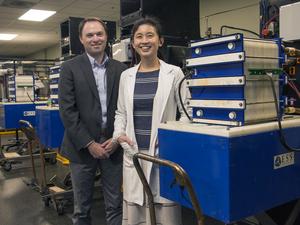

ESS makes a unique iron-based flow battery that it bills as a better alternative to lithium-ion batteries for long-duration grid energy storage, which experts see as vital to greening the grid. The company is spending heavily to build out production capacity in a rapid move to commercialize after a decade of research and development.

The company went public in early October through a SPAC merger that in a best-case scenario would have raised $465 million before expenses. Its haul shrunk to $246 million after expenses after most of its SPAC-partner shareholders redeemed their shares before the merger closed. ESS said then that the IPO would still leave it sufficient funds to pursue major objectives, which it listed as manufacturing expansion, expanded sales footprint, launching its Energy Center product and R&D.