The Dutchie juggernaut rolled on Thursday with a $350 million funding round that the Bend cannabis tech startup said values it at $3.75 billion.

D1 Capital Partners, a New York City hedge fund, led the Series D, which pushed Dutchie’s total funding to more than $600 million.

“We seek to back companies with big visions that create significant value for their stakeholders,” Emily Corning at D1 Capital Partners said in a statement. “Dutchie is the tech backbone helping propel one of the fastest-growing industries in the world, and we’re all in to advance their mission.”

Dutchie CEO Ross Lipson told the Business Journal the company now employs about 500 people with roughly 100 in Oregon, most in Bend but some also in Portland.

Raising massive amounts of capital has enabled the hiring, and it’s allowed Dutchie to make key acquisitions that further its ambition of being an across-the-board technology provider to cannabis dispensaries.

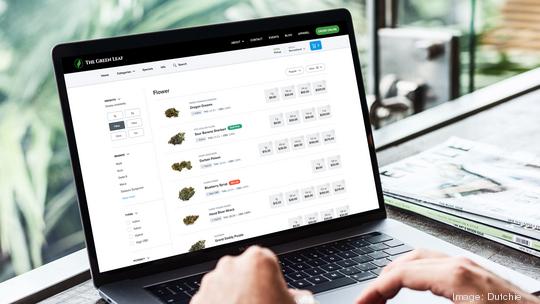

“We are the technology platform that powers cannabis commerce and streamlines dispensary operations while providing consumers safe and easy access to cannabis,” Lipson said.

With its previous funding round, worth $200 million, the company announced it was buying point-of-sale companies Greenbits and LeafLogix.

“That allowed us to offer another product to the dispensary and bring ecommerce and point of sale under one roof,” Lipson said. “Previously, dispensaries were forced to use a fragmented platform — they would have a separate ecommerce company, Dutchie, and a separate point of sale company.”

Dutchie — formally Courier Plus Inc. — makes money by charging a monthly subscription fee based on the products that dispensaries use. The company declined to say if it had reached profitability. However, Lipson said Dutchie was used by 5,000 stores across North America and has “processed over $14 billion in annualized transactions,” a measure of consumer purchases in a shorter time frame projected over a year.

Cannabis legalization continues to spread, and already-legal markets have seen big growth in the past couple of years. That seemingly gives Dutchie an ever-growing array of potential customers.

The new round will finance hiring, a push into new markets, including overseas, technology R&D and new products. Staff expansion to provide quick-response customer support is a priority, Lipson said.

Dutchie has stuck with raising capital privately at a time when IPOs are booming — up 87% globally in number and 99% in proceeds year-over-year through Q3, according to a recent Ernst & Young report.

Since it doesn’t touch the plant, Dutchie can consider other routes.

It’s keeping its eyes open to the possibilities.

“We want to be in a position to take advantage of any opportunity when it comes,” Lipson said. “So we are running public readiness work streams here at Dutchie, and always will, whether we go public or not, just to be in a position to take advantage of any opportunity that will push our business forward.”

Several previous investors participated in the new funding round, including Tiger Global, Dragoneer, DFJ Growth, Thrive Capital, Gron Ventures and Casa Verde Capital. New investors included Willoughby Capital, Glynn Capital and Park West Asset Management.