This week Portland tech company OpenSesame announced a fresh $50 million round of funding. It’s a deal that has been six years in the making and an example of careful relationship building.

It’s a deal that means the growing Portland company can capitalize on increasing customer demand for online learning and training tools and potentially make its first acquisition, said CEO Don Spear.

The round was led by JMI Equity. It’s a group that Spear has known for years and has kept in contact with. The two sides first started talking well before OpenSesame was even close to being the target size of a JMI investment.

Even two years ago when OpenSesame raised $28 million the company was just out of JMI’s target.

“They reviewed the business significantly two years ago,” said Spear. “Now we are 3.5 times bigger than when we did the Series C in 2019. We fit for them.”

Even so, Spear and the management team had multiple term sheets to evaluate, he said. But the relationship built and the partnership opportunity with JMI won out. Spear said the initial contact was from JMI years ago when the firm was flagging companies that fit its investment thesis.

OpenSesame has been around for a decade and over the course of its growth, Spear has always looked at building relationships before they are needed. Spear goes to about two investor conferences a year — lately they have been virtual — where he can update groups of investors on the progress of OpenSesame.

“In many cases companies are so heads-down, building the business they don’t realize they need to spend time reaching out and courting investors of the right size and types,” he said. “There are different investors and investors for different phases.”

For OpenSesame, the company wasn’t in need of funding. It still had capital from its 2019 round. But, the shift to remote work during the pandemic, plus a focus by many companies on diversity, equity and inclusion training saw the business grow in 2020.

With venture investing and private equity at record levels Spear said the time was right to raise a round while “the world is awash with cash.”

The company has already started hiring knowing that this round would close. The management team expects the company will have 200 employees by the end of the year. It currently has 175. The company also has a robust program for both college and high school interns to expose students to the breadth of jobs available within technology.

Spear noted that many students have a misunderstanding that employees are all software developers, when in fact the majority of OpenSesame employees are not software developers.

This new capital will also help the company build out its content curation tools either through its own development or from acquisitions. Last year, the company evaluated possible acquisition targets, but opted to pass, Spear said.

“We continue to explore technology in the space that would be additive to what we have created,” he said.

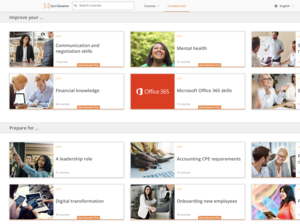

OpenSesame has an online catalogue of more than 20,000 training courses from hundreds of publishers. Customers use OpenSesame to find curated courses that integrate with a company's corporate learning management systems and learning and development programs. Recently the company has added the capability to create custom courses and develop courses in multiple languages.

The company has 140 Global 2000 companies that use the platform. Customers have been asking for content delivered in multiple languages, he said.

OpenSesame’s overall goal is to be “the world’s leading platform for the delivery of business training,” said Spear. To get there, the company has evaluated the investors it chooses just as much as those investors evaluate the company.

The team has passed on deals that would be too dilutive or seek majority ownership.

“We aren’t interested in that,” he said about those deals. “It’s so much fun, and the value we are creating and we are just scratching the surface.”

With this latest round, the leadership team has calculated a path to being five times bigger than the company is today. The company is to a point where it can make its own choices on growth trajectory and how to get there.

“We’ve been doing this for 10 years, I feel like we are just getting started,” Spear said.