Expensify (Nasdaq: EXFY) founder and CEO David Barrett runs his company a bit differently.

You’ll see what we mean below. But first, the setup. Expensify is a financial technology company that works in expense reporting and offers corporate credit cards business owners give to their employees. Companies can specify spend controls based on types of merchants, how often cards can be used. Every purchase is routed back to the business owner.

It also has expense management and invoicing software.

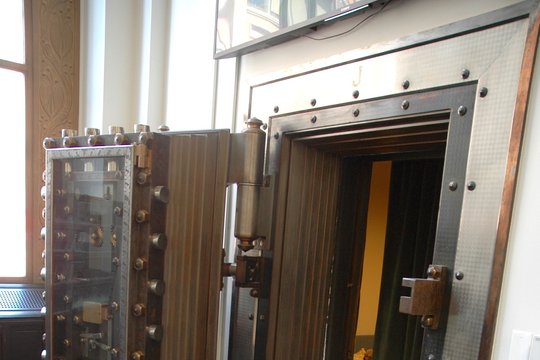

Expensify’s headquarters is in downtown Portland in the old First National Bank Building. It purchased the building in 2019. This year, it renovated the food cart pod that was across the street and reopened it as the Midtown Beer Garden, as part of the company’s effort to help bring people back to the neighborhood.

Barrett was the speaker at the November Power Breakfast. Here’s part of the conversation he had with Portland Business Journal Publisher Candace Beeke. This interview has been edited.

On running a company with no managers:

So everything about the company is super weird, like everything. We started off, it's just me and my co-founder. And we're like, oh, how are we going to decide how much to pay ourselves? Well, we don't have any money. So let's just do equity and kind of figure it out. Then we hire a couple more people. And then we just basically talk it out amongst ourselves. Like, how much should we pay each other? We just kept scaling up this approach that basically really had no managers and no hierarchy to this day. We're a public company, 140 employees, $100 million revenue, scattered all over the world. And there's no management. You don't report to anyone. No one reports to you. You can do anything you want to do, you are pre-authorized and you don’t need permission. You're the one who knows your skills, you have total transparency to all of our problems, just decide what you want to do.

On its unique compensation setting:

However, there's a major catch to that. Because there's no bosses, it's a question of how you decide how you get paid? What we do is we vote on our compensation. We built a tool that picks two random people (and shows metrics like) how many customers did you talk to? How many bugs did you fix? How many customers did you close? Like there's a huge number of metrics side by side, Twitter length bio at the top, no photos. It just shows two people side by side and all of their metrics, and then asks: Who do you think should be paid more, left or right? You do that about 7,000 times, you'll have ranked basically every pairwise combination of 140 people. And then everyone in the company does it and approves of this huge data set of tens of thousands of basic comparisons of who should be paid more based upon the opinions of everyone in the company. And then we normalize this against a power curve and, boom, it spits out your compensation. And what's interesting about it is, it's just impossible to game. Because the only way you game the system is you just, I guess, kick ass in front of everyone.

Reaction to this system:

It's been a really radical concept of empowering the employees to actually take control of this compensation decision. And it's something we all take very, very seriously. It takes forever to do. It's like a 10-hour process to go through this ranking system. But it's a very important 10 hours, because this is 10 hours where it forces you to not only sit down and assess the relative values for of your coworkers, but in doing so it forces you to establish what value is to yourself. And that affects basically how you run your job as well. And so, it's a really introspective process.

On sending an email in 2020 urging customers to vote for Joe Biden:

Everyone in the company can do anything they want, with the caveat that their compensation is determined by their peers. Though we don't have a formal management team, there's a variety of ways through our Growth and Recognition Plan where you can join a group of people called the Top Tier. The Top Tier are people who've either been around for a very long time, they've gone through various sorts of certifications, things like this. They're effectively our quasi-management team. The Top Tier doesn’t make any management decisions other than it’s the only group that has the power to tell someone not to do something. So, I, coming into the last election was like, “Hey, everyone I think that democracy is under threat. I don’t think he’s (Trump’s) gonna leave if it’s (a) close (election). I think not many expense reports get filed in a civil war. It's an adverse business climate, if we see democracy fail. We're obligated to act as leaders of this company. And so I think that we should do everything we can to promote Biden, because he's the only person who could possibly be Trump.” Needless to say, there was some uncertainty about that as being a good course of action. It requires a supermajority of our Top Tier group to let this go forward. That led to a large discussion internally. We went through all these questions, methodically took a vote, wrote a draft, everyone in the company saw the draft of the email, and we all talked about it basically and then the Top Tier voted, “should we send this email to every single user?” And it just barely won. It was interesting, though, no one quit. Even though a lot of people disagreed with it. Everyone stuck around, because there was a process that they went through. And I think people believe in the process.

On whether being public stifles social engagement:

Legally no. We went public in an unusual way. We went public on Nov. 10 (2021), which is within days of the top of the market for fintech. We had a lot of leverage as we were a profitable company and didn’t have to go public. We created not just a super voting class of shares but shares that can only ever be legally owned by employees. We took all the combined voting power into what’s called a voting trust, which is a weird way of saying we have consolidated control of the company into employees' hands according to the charter of the company. We are pretty protected from a lot of the traditional risks of being a public company, like the activist shareholder risk. As long as we’re doing things that the auditors are happy, the SEC is happy, as long as we’re doing things legally, it kind of doesn’t matter what people think about us because shareholders just want us to perform, they just want the financial success.

On creating a lounge experience at their San Francisco office to draw employees back:

We just concluded there is absolutely nothing you can do to get people to voluntarily go to the office consistently. I think you can make cool places to work. But I just don't think that the traditional office environment is something that's going to come back. I think that the office has to be viewed as an option, not as a necessity. It has to be something that attracts people at the right time. And that has to be a bigger value proposition than simply you'll be fired unless you come in.