The percentage of startup funding concentrated in Silicon Valley has been steadily declining for years. And a new report shows the West Coast's overall share of venture-capital dollars is also on the decline as other regions of the country prove to be more than capable hubs for startup growth.

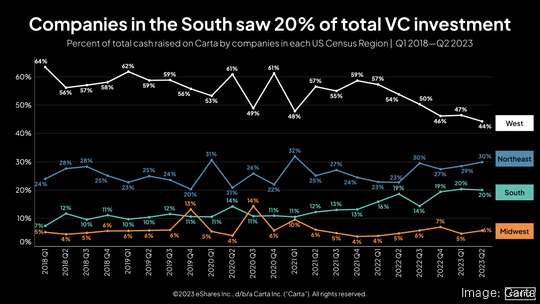

Four years ago, the share of startup capital in the South was just 10%. Last quarter, that number shot up to 20%, according to Carta, an equity-management platform. That's the highest percentage of funding that companies from the South have raised on Carta since 2018, when Carta's data begins.

The South's growth comes as the share of VC dollars in the West has shrunk. Four years ago, in the second quarter of 2019, companies in the West saw 59% of all U.S. VC investment. Last quarter, that number was just 44%. That's the lowest figure for the West since Carta began tracking data in 2018. The West's highest percentage of venture funding was 64% in early 2018.

In the past four years, the Northeast has also seen its share of venture funding rise, growing from 25% in Q2 2019 to 30% last quarter. In the Midwest, its VC funding percentage has held steady at 6%.

The shifting landscape of where venture funding is allocated comes as capital becomes harder to come by everywhere. Venture funding is down across the board from the highs of 2021, even as venture capital firms sit on $271 billion in dry powder. Investors have slowed their pace of deals as the tech market recalibrates from its pandemic-era highs.

Here in the Portland metro venture activity is down significantly this year after several record years, excluding 2020 and the onset of the Covid-19 pandemic. In the first half of this year, deal volume was down 21% compared to the first six months of last year while the amount of money invested in startups sank 69%, according to the second quarter Venture Monitor report from Pitchbook and the National Venture Capital Association.

For the second quarter, investors pumped just $163.3 million into startups in the Portland metro. That was across 38 deals. In the same quarter last year, investors pumped $341 million across 38 deals into companies in the Portland metro.

Nationally, investors provided $39.8 billion to U.S. startups last quarter, down from $45.8 billion in the first quarter of 2023 and $76.6 billion in the second quarter of 2022, according to Pitchbook. Deal flow also declined to 3,011 in Q2, from 3,503 the prior quarter and 4,529 a year ago.

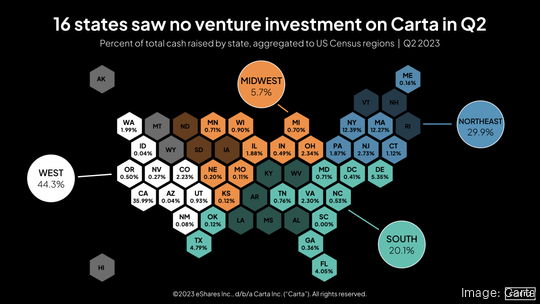

Texas and Florida helped propel the South to its new high in percentage of VC funding, both accounting for more than 4% of all U.S. venture funding raised on Carta last quarter. California still captured the bulk of VC funding at nearly 36%,

Carta, which provides companies with a cap table management and valuation software platform, said 16 U.S. states saw no venture-capital deals on its platform in the second quarter this year.

The venture market remains "a long way off" from its peak in 2021, Carta's report says. One area of concern is down rounds, or a fundraise where a company's valuation decreases compared to its previous capital raise. Carta says 20% of all fundraising rounds on its platform last quarter were down rounds, the second-highest quarterly figure in the past five years.