Bend-based Cascade Seed Fund has fully raised its second fund and hit its intended $10 million.

Fund II is expected to back roughly 25 early stage companies — this can mean either seed stage or earlier — with checks between $100,000 and $250,000 over the next three years, said Managing Directors Julie Harrelson and Robert Pease.

At $10 million, the duo said the fund is the right size for the stage they focus on. The fund targets software startups and direct-to-consumer companies.

“A $10 million fund is more flexible in what you have to believe to write a check,” said Pease. “If it’s $100 million we have to believe what we invest in is a $500 million exit and those happen, but they are few. You limit the open funnel of what you can be on. The average M&A deal is $50 million. That is life-changing money (for an entrepreneur) and our fund can make money for investors.”

Cascade reserves funds for follow-on investment into companies. As an early-stage investor the fund is typically a bridge between angel rounds and a full institutional round.

Last fall, after raising the first close of Fund II, Cascade could start investing. It has so far made six investments:

- Roost, a deposit automation platform for landlords and financial wellness app for renters.

- Hest, an outdoor camping brand.

- SyncFloor, a music discovery and licensing platform.

- Field Day, a platform to connect nonprofits and corporate volunteer groups.

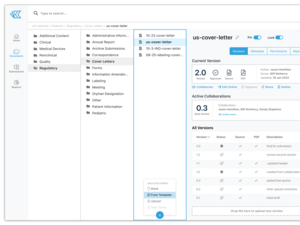

- Kivo, document management platform for life science companies.

- Fizz and Bubble, makes natural bath and body care products.

Harrelson and Pease are closely watching the broader economic shift with public market volatility and larger venture capital funds warning of slowdowns. As was the case in 2020 during the onset of the Covid-19 pandemic, the duo are leaning into their process to continue to find founders that fit their thesis.

Harrelson and Pease have built a process that doesn’t require warm introductions and is meant to be transparent for the founders pitching. They work with an investment committee that consists of fund investors to provide insight for investment decisions.

Pease said that as the market got frothy in 2021 and valuations went up, the fund was less active but still found high quality investments.

“If you were burning $500,000 a month as a seed stage company and you have two months runway, that is a tough position to be in (fundraising now),” Pease said. “Maybe it’s the region, but there is more pragmatism here. People want to build things but there is a business they are building.”

Cascade Seed Fund grew out of a smaller annual fund that Harrelson started in 2014. Since she started investing there have been several exits including Vancouver-based Hubb, Bend-based Cairn, and Beaverton-based Topbox, which were all acquired in 2021.