The first incarnation of the state’s Commercialization Gap Fund almost didn’t happen.

The program, under Business Oregon, is designed to invest in early-stage, science-based startups many of which are coming out of the state’s research universities. The fund is designed to help get those Oregon-based startups to a point where they are attractive to other private capital for further investment.

The first fund was managed by Elevate Capital. Initially it was slated to be a $5 million, two-year fund. However, it launched in 2020 and half of the capital was reallocated by the state for other Covid-19 business relief programs. Getting the money it did get wasn't a guarantee and was a challenge.

In the end, the fund backed 15 startups in 12 months, according to Elevate. It wrote checks that varied in size from as small as $50,000 to up to $250,000, said Ben Nahir, venture principal with Elevate.

Want more Portland startup news? Sign-up for The Beat delivered to your inbox twice weekly

Those smaller checks went to groups just spinning out of universities and were designed to help those founders reach specific milestones with the technology.

“This funding, it doesn’t exist in the general angel capital world,” said Nitin Rai, managing partner at elevate. “It’s supporting very high risk and very early stage.”

At the other end of the fund’s spectrum, it wrote bigger checks that could augment other angel funding for more mature companies. These funds, usually between $150,000 and $250,000 were used by companies for customer discovery work, product testing or as a bridge for pilot programs waiting on Phase 2 Small Business Innovation Research grants from the federal government.

“For the very early stage, angels aren’t going to look at them, at least not without validation. Several companies got additional investment after we invested,” said Nahir. “Investors felt confident that these companies would have support. For the later stage, we can co-invest but typically we are an anchor investor.”

Through this fund, $1.5 million had been deployed so far. Companies that received investment include:

- Veana Therapeutics, which uses compounds naturally derived from vitamin E to improve cancer chemotherapy.

- Stonestable, uses silica-coating technology to make vaccines stable at room temperature.

- LeapFrog Design, designs and develops residential rainwater, graywater and wastewater recycling systems using natural water filtration properties of marsh and wetlands.

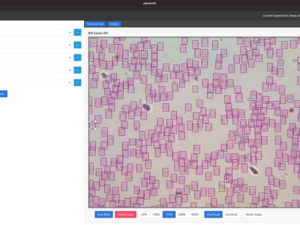

- Rewire Neuroscience, is developing artificial intelligence software aimed at biomedical image analysis.

These Gap Fund portfolio companies have secured more than $3 million in additional outside funding and $4.3 million in non-dilutive grant funding. Elevate noted that one-third of the Gap Fund companies are led by women and 27% have a minority of immigrant founder.

As Elevate has worked on this program, Nahir and Rai have looked closely at the tech transfer and innovation pipeline used at the University of Washington as something Oregon could be modeling on.

“What we discovered in this process is how much stuff is being left on the table,” said Rai. “These companies are starved for capital.”

He added that to start, the fund needs to be bigger and make this a long-term commitment. It’s a good start but more capital is needed to keep these early stage companies in Oregon and help them grow.

Nahir added that Oregon has top-tier institutions “and I don’t feel like we are making enough use of the resources.”

The two pointed to UW’s CoMotion program as an innovative and unifying program for resources and support that goes beyond tech transfer.

“Our institutions have aspects of that, but it’s not coordinated and the approach is academic,” said Nahir, adding that it can be hard to get away from the academic mindset.

Business Oregon is taking applications for a fund manager for the 2021-2023 biennium. Rai and Nahir said Elevate would apply again to be fund manager.