Seed-stage startups, companies that are raising funding at some of the earliest stages, provide a window into what the venture market will look like in the years to come. And since the onset of the pandemic, the seed-funding market has seen some noticeable shifts in overall volume of deals, as well as the places those deals get done.

As the overall venture market has cooled in the past year and a half, the number of seed deals has plummeted, according to Carta, a cap-table management platform for startups. Startups use Carta when they have an equity transaction, like a fundraise, which gives Carta unique perspective on the health of the venture market.

In the last quarter of 2021, there were 880 seed rounds on Carta's platform. In the second quarter of 2023, that number was cut in half to just 440 seed deals.

It's indicative of the broader pullback in startupland, but seed deals have also mirrored a larger venture-capital trend: a geographic shift in where startups are raising capital.

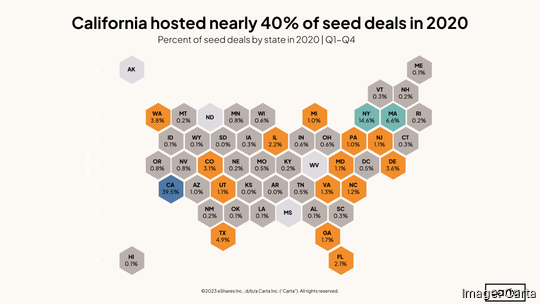

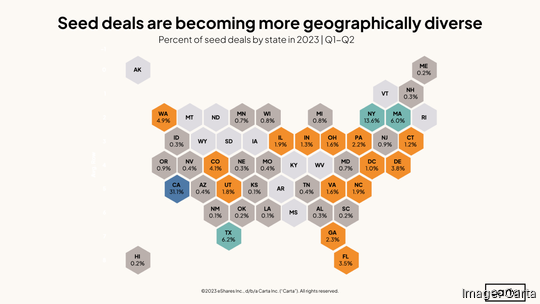

In 2020, 40% of all startup seed-funding rounds took place in California, according to Carta. Through the first two quarters of 2023, California's share of seed deals fell to 31%.

Seeds deals in 2020

Seed deals in 2023

Notably, places like Texas, Florida and Colorado have gained ground in the past three years as cities like Austin, Texas; Miami; Denver and Boulder, Colorado, prove to be more than capable startup hubs.

Texas cracked the top 3 for the first time in 2023, according to Carta, with 6.2% of all seed deals so far in 2023. It overtook Massachusetts, which hauled in 6% of seed investments this year, down from 6.6% in 2020.

Florida's growth — from 2.1% of all U.S. seed rounds in 2020 to 3.5% this year — was the fourth-largest percent increase (1.7X) in the country, behind only Indiana (2.17X), Pennsylvania (2.2X) and Ohio (2.67X), according to Carta.

"Seed is becoming a little bit more disbursed geographically than it used to be," said Peter Walker, head of insights at Carta. "That, I think, is a good story for venture capital overall."

Some 38,000 startups use Carta for cap-table management, Walker said, and the company estimates about 50% of all capital invested in U.S. startups went to a company that uses Carta.

Walker noted the changing landscape of seed deals has less to do with Silicon Valley losing its shine, and more to do with the rise of remote work and the strength of emerging startup ecosystems elsewhere.

However, one distinct advantage the Bay Area has over other startup markets, Walker said, is in AI. San Francisco's head start in artificial intelligence has seen it land an outsized portion of AI deals compared to other cities.

"When you look at the burgeoning AI boom across Carta data, that's much more heavily focused on San Francisco," Walker said. "San Francisco takes more share in AI than it does in other places. As it becomes the next big wave of venture investment, I do think San Francisco could capture more share in AI than other cities do."

Carta's data also tracks startup valuations, and Walker said valuations at the seed stage have been more resilient during the VC downturn than later stages. The median seed stage valuation is down 12% from Q1 2022, whereas the median series D valuation is down 65%, Walker said.

Carta's 2023 data also highlights the more challenging aspects of raising startup funding in 2023. Around 40% of series A rounds on Carta were bridge rounds last quarter, Walker said, indicating how focused many VCs are on supporting current portfolio companies rather than new bets.

Startups are also increasingly shutting down. Carta saw the most companies it's ever seen exit its platform last month due to bankruptcy or dissolution, Walker said.