If a startup is tackling a big problem with a big market, investors are often going to get excited to invest in it, or so the argument goes made by Graham Rihn, CEO and founder of RoadRunner Recycling Inc., a Pittsburgh-based commercial waste recycling provider.

It’s advice he’s offering to anyone looking to raise capital for their startup amid the backdrop of a national market downturn that’s heavily impacting the tech sector as well as the organizations and people who fund it.

“If you’re working on something more niche and not as big, try to expand the vision to be broader, and it gives a way to be attractive,” Rihn advised.

In November, RoadRunner closed on a $20 million Series D extension round following its massive $70 million Series D raise last January. But RoadRunner’s raise is more the exception than the norm as the time between these two funding deals shows two opposing realities in the startup investment world: A period of frequent capital raise announcements from startups to a dearth in enterprises landing new deal flows.

Venture capital investment nationwide slowed in the third quarter, according to the PitchBook-NVCA Venture Monitor, tracking at just $43 billion, a nine-quarter low for deal value, as 4,074 companies received funding. In Pittsburgh, for the third quarter of 2022, deals, at 19, are below last year’s 29, while dollars rose 24% to $171.96 million.

“The VC slowdown narrative that has been pervasive in the market this year has finally materialized in the data, with nearly every metric aside from fundraising falling sharply in Q3,” John Gabbert, PitchBook founder and CEO, said in a prepared statement. “The VC ecosystem, however, has shown remarkable resiliency in the face of continued economic headwinds, raising record levels of capital and closing an unexpectedly high number of deals.”

But that’s just part of the picture. The IPO market dried up as the stock market turned tumultuous in 2022, so going public, which in turn enables investors to exit, is pretty much off the table. And big public companies that staked tech companies as strategic investors are now laying off staff to cut costs and slashing units, which Pittsburgh knows all too well. Look no further than Ford Motor Co. and Volkswagen pulling the plug on Strip District-based autonomous vehicle startup Argo AI LLC in late October, translating to cutting 679 employees in four phases that began last month.

Uncharted territory

In short, times are tough for tech firms, especially those who need to raise capital or are coping with rising expenses in the midst of supply chain issues, raging inflation and higher salaries.

“We are seeing companies that were very well-funded six to 12 months ago that didn’t pivot and reduce staff or shore up their revenue and capital stacks face tough decisions today,” said Timothy Haluszczak, co-founder and partner at Strip District-based fintech incubator/investor SteelBridge Labs, and partner/head of capital advisory at SteelBridge Consulting.

Justine Kasznica, a shareholder at law firm Babst Calland whose practice includes emerging technologies, said investors are still making investments in tech, but they are increasingly cautious and more likely to make re-upped investments in existing portfolio companies with demonstrated progress. Or, they’ll invest in new tech with a promising growth path with seasoned entrepreneurs — and that have reasonably thought through derisking the business in a downturn.

“On the other hand, investments in new startups in markets suffering significant headwinds — autonomous vehicles and AV-related tech, industrial automation — have clearly stalled, and the investors I speak with are expecting this slowdown to last 18-24 months,” she said.

Ven Raju, the new president and CEO of Innovation Works Inc., one of the region’s largest seed-stage investors in local startup companies, believes that because Pittsburgh’s tech scene is one that leans to the early growth side, the region’s ecosystem overall might not see as much of an impact as others.

“Valuation profiles tend to be more attractive here than on the coasts, and there is an argument to be made that any kind of calibration that happens on the coasts will likely be of a greater fall or steeper than that here in Pittsburgh,” Raju said.

Another argument to be made: Declining valuations can make more enticing deals for investors, though there are some intricacies at play with that theory, too, Raju said.

“Venture firms, places like IW, we have portfolio companies that are likely going to need cash in light of the macro environment, in light of the fact that they may not be able to raise from other sources,” Raju said. “We have to reserve pools of money so that we can support our portfolio companies while balancing the interest that there may be opportunities today from a valuation perspective that are much more attractive than opportunities that may have existed six months or 12 months prior.”

But, in many ways, the sector — actually, the economy — is entering uncharted territory.

“It’s different,” said Jay Katarincic, a partner and founder of Magarac Venture Partners (MVP) and, before that, of Draper Triangle Ventures. “We’ve never dealt with the geopolitical issues we’re dealing with now. We could always control things with policies. This one’s different, when you think of what’s going on in eastern Europe or China. We’ve not dealt with those variables before. You’ve got so many things that, for a large part, are outside of our control.”

Funds abound, but …

That’s not to say deals can’t be made. But, Rihn stressed, startups are going to need to pursue outside investment differently amid these market conditions, and having revenue is likely to be even more significant than before.

“I think in a market like this, there are a lot of ways to raise capital, and one of the ways to raise capital is to have paying customers. You really need to drill down to what are the unit economics or what are the economics of the company as-is right now, and how do I get closer to controlling the destiny of the company by way of seeking profit,” Rihn said. “There are not many investors out there anymore — certainly in the later stages — investing in growth. Everyone is indexed toward profitability. If you’re starting out early on, it’s important to have a big vision and a roadmap that can tackle it.”

MVP, which reached first close on its $150 million new fund in May — meaning it could begin investing — finally did so on Nov. 29. It co-led a $5 million seed round for Silicon Valley artificial intelligence startup Netail, which is moving its headquarters to Pittsburgh. A startup with 13 employees, Netail has begun producing revenue and is ready for the next stage of growth.

MVP’s fund is the largest of a quartet of new Pittsburgh-based funds announced last year. Granted, none is devoted solely to the region. So far, only the $20 million 412 Venture Fund has invested in tech firms based here. It currently has $4.7 million deployed in 13 companies, seven of which are in the Pittsburgh region. Black Tech Nation Ventures and BlueTree Venture Fund are each raising a $50 million fund, and both have made investments outside the Pittsburgh metro.

In addition, a regulatory filing revealed last month that Pittsburgh-based billionaire Thomas Tull is raising a $5 billion U.S. Innovative Technology Fund and already has $1.347 billion in hand. Bloomberg had reported in September that the fund is focusing on growth- and early-stage companies in industries such as artificial intelligence, cyber, satellites, biotech and space. It’s not clear how the Pittsburgh region will be impacted, but Tull is a player in the tech scene here, having invested in at least two local startups, and is a major donor to higher education, notably Carnegie Mellon University where he is a trustee, and the health care sector.

Locally-based capital is important because not only are the VCs able to easily visit companies, but they also can leverage connections and introduce startups to potential customers and larger investors.

“There is a significant amount of private capital on the sidelines,” said Sreekar Gadde, co-managing partner at BTVC. “Much of this capital is looking for capital-efficient companies. And the Rust Belt generally, and Pittsburgh specifically, is positioned well to address this need with our capital-strapped founders and fiscally sensible ethos.”

Still, while funds abound, access to capital may be hard to come by.

Ilana Diamond, managing partner at 412 Venture Fund, noted that while her own fund is active, in general, VC funding may be tougher to get during a downturn.

“Many VC funds have taken a pause — especially those that are having to take significant markdowns in valuations of their portfolio companies,” she explained. “During a recession, economic development and other mission-motivated funding can be important sources of early stage capital.”

Companies jump in

Dick’s Sporting Goods Inc., a Findlay-based retailer, announced in early November the launch of its own $50 million in-house investment fund, DSG Ventures. The mission-motivated goal is to fund startups that are innovative and “hold the core belief that sports make people better,” the announcement said. It’s not specific to tech or Pittsburgh, but one of DSG Ventures’ first investments was in SidelineSwap, a global online marketplace for sporting goods.

Dick’s decision to create a fund is unusual for retailers, but not unheard of in Pittsburgh. Health care giants UPMC and Highmark Health have both invested in and nurtured life sciences and medical device startups. Giant Eagle Inc. started staking Seegrid Corp. in 2011, even serving as a beta tester for its autonomous vehicles in warehouses. And Belgian chemical and pharmaceutical giant Solvay had been a big investor in Plextronics Inc. before it bought the Pittsburgh company for $32.6 million after Plextronics filed Chapter 11 in 2014.

Corporate investors, also called strategic investors, have been a force for decades, but truly emerged with the Great Recession. Huge companies, including publicly held corporations nationwide, cut their internal research and development budgets in order to save costs and increasingly plugged money into innovative companies. It gave them access to products, technologies and even the nimble reflexes of startups.

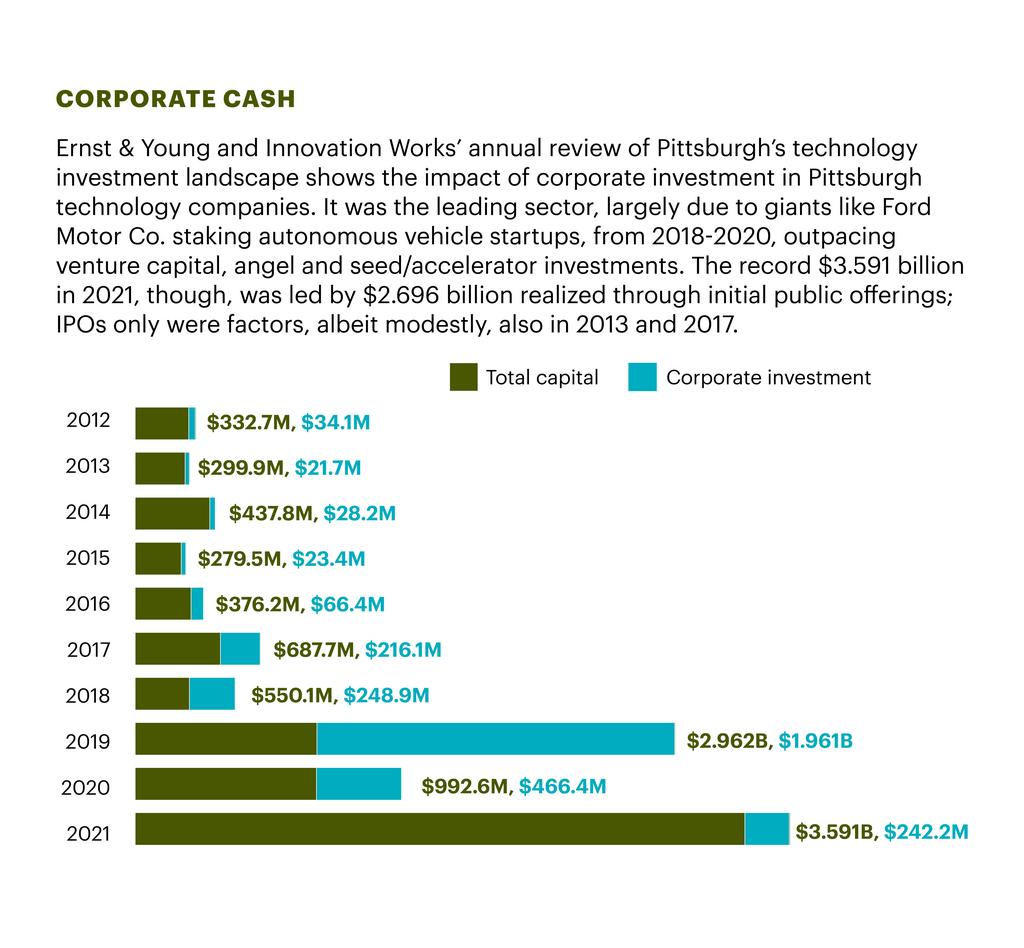

It’s a type of investing that has been on the rise in Pittsburgh. In 2012, corporate investment in local tech companies was $34.1 million, according to data from Ernst & Young and Innovation Works’ annual report on Pittsburgh’s technology investment landscape. The boom years of nine-figure infusions started in 2017, with the emergence of high-profile corporate investors in self-driving vehicle companies Argo AI and Aurora Innovation Inc. Aurora went public in 2021.

But then the economy turned sour. In October, Ford and Volkswagen abruptly pulled the plug on Argo, causing the company to shut down. Public companies like Ford have shareholders to answer to. And its action put a new and unexpected twist to corporate investors. The money flow could stop, just like that. The question remains if there will be more such casualties.

“Well, I think the story arc of Argo serves as a great lesson to smaller companies being funded by larger companies,” said Kim Caughey Forrest, founder and chief investment officer of Pittsburgh-based money management firm Bokeh Capital Partners LLC. “And the lesson is this: Make sure that your businesses are aligned. Ford is a car manufacturer, and they are going to put the core business before all other strategic activities. … Cash is king, and when your sales are dropping and expenses rising, people make decisions based on the core business and protecting that over making investments for the future. You have to look through the lens of time to payoff. In the case of Argo AI, many people thought that self-driving cars would be on the road by now, and it looks like the timeline was too long for investors.”

Andrew Hannah, executive director of the recently launched 1486 Labs, which is partnering with the University of Pittsburgh to launch new businesses based on the intersection of data and analytics, and president of the Othot division of Liaison International, has been an entrepreneur since 1995, including leading Plextronics. He figures both angel and corporate investments are more difficult to obtain during downturns.

“From an angel’s perspective, they look at asset allocation,” Hannah said. “If their other assets are shrinking because of the recession, then this will decrease the amounts they have available for startups. Also, small angels tend to be tighter with their capital in downturns because they are most concerned about companies raising the next round of investment to protect their investment. Corporations can also decrease their commitments to venture investments when they are more concerned about earnings. Down markets can put down pressure on earnings, which could decrease investments.”

Survival of the fittest

One thing that hasn’t changed is the notion of survival of the fittest.

“Companies that need capital for growing rather than surviving will have a much easier time with fundraising,” observed Liam Krut, investment partner at Reinforced Ventures, a Pittsburgh-based syndicate of accredited investors, mostly tech sector veterans, that began investing in early 2020 and now has a portfolio of 52 companies, 12 of which are local.

Krut believes, given the economy, startups should focus on expanding engagements with current customers and cutting costs.

“The market is likely to continue declining, but we expect the companies that arise over the next 18 months to be some of the best performers over the next decade,” he said.

Katarincic has a similar philosophy, backed by a track record through downturns at his prior VC firm.

Despite the pandemic wreaking havoc with the stock market in early 2020, triggering the short-lived viral recession, Draper Triangle Ventures marked the best portfolio history in its more than 20-year history. It made no new investments in 2020, but did follow-through funding to nine portfolio companies, six of them local. Draper invested $75 million in Q4 of 2020, its largest quarter ever.

“I think that the greatest returns have been recognized by investing during downturns,” Katarincic said. “If you look at the investments we made in 2014 and 2015 [as the nation was emerging from the Great Recession though not yet in the boom era for the economy and stock market], those will end up being some of our biggest winners. As companies, they were able to get through those first early hard years with a little less competitive threats and cheaper labor costs. Today, it’s different. You don’t have cheaper labor.“

MVP has a game plan.

“We’re going to continue to invest,” Katarincic said. “But we’re making sure that the investments we do make, the money can last.”