GT Medical Technologies has obtained a $35 million venture loan facility to fund expansion of its technology to treat patients with operable brain tumors.

The Tempe-based medical device company secured the loan facility from Horizon Technology Finance Corp., an affiliate of Monroe Capital, which has already funded $15 million of the total amount, according to a company announcement.

A venture loan facility is an option in which startups can a borrow a predetermined amount of capital. It differs from equity financing because startups obtaining loans don’t give investors a stake in the company in return.

“This loan facility is part of an overall capital structure plan that includes an equity raise, which we have underway,” Per Langoe, CEO of GT Medical Technologies, told AZ Inno. “The initial draw allows the company to refinance some existing debt at favorable terms and increases our current cash balance. Over half of the total facility remains available, giving us flexibility in how we fund future opportunities.”

Langoe did not disclose a target amount for the company’s equity raise that's underway.

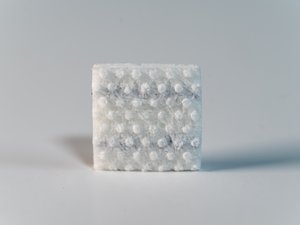

GT Medical plans to use loan proceeds to expand market reach for GammaTile, an FDA-cleared targeted radiation therapy in the form of a small tile that brain surgeons can place in an incision site after removing a brain tumor. The tiles reduce radiation exposure and potential damage to healthy tissue, according to the company.

GammaTile is available to patients at more than 100 cancer treatment institutions in the U.S., including the Mayo Clinic, University of Arizona Cancer Center and University of Texas MD Anderson Cancer Center, according to the company’s website.

The company aims to reach even more cancer patients in need of treatment. Some 300,000 patients a year are diagnosed with a brain tumor in the U.S., but fewer than 2% of patients who could benefit from GammaTile are receiving it today, Langoe said.

"So, we have an opportunity to expand utilization of this life extending therapy within our existing user base and by gaining broader adoption in the marketplace,” Langoe said. “Alongside our commercial efforts, we will continue to invest in clinical studies that build upon the strong foundation of evidence that exists today, demonstrating GammaTile’s safety and efficacy in treating many types of brain tumors.”

Company has VC backing from health care investors

GT Medical, founded in 2017, has garnered venture capital investments from MVM Partners, Glide Healthcare Partners, MedTech Venture Partners and BlueStone Venture Partners.

What’s more, the company closed one of Arizona’s largest funding rounds in 2023, bringing in $45 million to expand its GammaTile technology. The company has raised more than $73 million in venture capital to date, according to data from PitchBook.

Earlier this year, Langoe joined GT Medical as CEO, succeeding Matt Likens who retired from the company. In May, GT Medical acquired the brachytherapy business from Seattle-based Perspective Therapeutics Inc. (NYSE: CATX), the Puget Sound Business Journal reported.

GT Medical's new loan facility comes at a time when the venture debt market is reviving for “performing borrowers,” PitchBook reported in May.

Companies that recently raised an equity round and are performing well are likely to see favorable terms as lenders intensely compete for these deals, Jake Moseley, co-head of venture banking at Stifel, told PitchBook.

In addition, lenders are willing to work with revenue-positive startups that haven’t raised an equity round for a while but are seeking to raise debt to bridge a funding gap.

While there’s been positive signs of venture capital deal activity in Arizona during the first half of the year, the market has not rebounded from pandemic-era highs as venture capital firms are focusing on supporting their most promising companies amid a challenging exit environment.

Arizona companies inked 32 deals totaling $360.5 million in the second quarter, compared to 38 deals and $181.4 million raised in the second quarter of 2023, according to PitchBook’s Venture Monitor report.