Unicorn companies with massive valuations during the pandemic-era frenzy may be in for a reckoning as they turn to the market for additional investments in 2024.

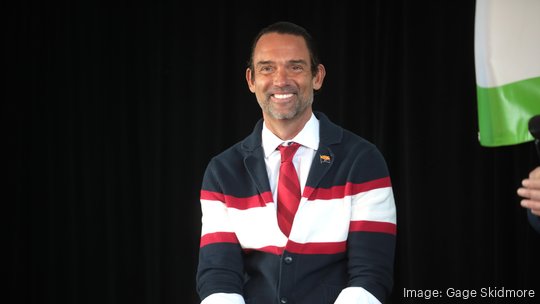

That's according to Jack Selby, managing partner of AZ-VC, Arizona's largest venture capital firm.

Selby added that cash-strapped startups — once worth billions during the height of the market — are facing a different fundraising landscape this year and will likely be raising money at a fraction of their previous valuations, potentially dampening sentiment in the technology sector nationwide.

“There's just going be a huge wave of these companies coming to market because they have to and they've been trying to figure out their Hail Mary strategy to stay in business and semi justify their previous valuation,” Selby said. “But it's a really tricky spot for so many folks. That's going on behind the scenes.”

Economic uncertainty and rising interest rates caused a slowdown in venture capital activity in 2023. Experts predict that will continue this year, as a fundraising rebound is unlikely given the returns of the past couple of years.

Just eight companies completed an IPO in the fourth quarter of 2023. Meanwhile, some 723 "unicorn" companies hold the vast majority of returns for the market and they have balked at listing in the current environment, according to Pitchbook.

Selby echoes that the window for IPOs will likely remain shut, but acquisitions remain an option in 2024.

“But I think if the overall sentiment of the market is more negative than not, acquirers know they essentially have all the leverage, or most of the leverage, and so they get to dictate terms," Selby said. "So they're basically just sitting back and being very selective in terms of who they want to potentially acquire or partner up with.”

However, companies with strong financials are likely to continue receiving investments in 2024, Pitchbook said.

Arizona was somewhat insulated from the VC slowdown as local investors continued to back companies, which raised a total of $1.26 billion across 139 deals last year.

Selby told the Business Journal last year that AZ-VC is in an advantageous position in 2024 because its not triaging a portfolio of distressed or massively overvalued companies. AZ-VC also raised its fund after the pandemic frenzy.

In 2022, AZ-VC closed a $110 million fund with money raised primarily from in-state investors to meet a growing need for startup financing beyond seed-stage capital.

“We have the benefit because we're such a relatively fresh fund and we didn't make any investments during that period. We get to play purely offense, so our due diligence is not going to change,” Selby said. “I think we have the huge benefit of not having this legacy portfolio exposed to arguably the most overvalued period in private tech investment history.”

AZ-VC has eight portfolio companies and invested more than $30 million of its fund into startups, including Nuclearn and Bluetail Inc., which is among AZ Inno's Startups to Watch in 2024.

“We've deployed roughly about a quarter of our fund so far and we've made 12 investments total,” Selby said. “The deployment cadence is about one investment per month, which I'm very happy about.”

Selby acquires rights to PayPal movie

Selby, who has lived in Arizona for more than two decades, is a member of the so-called “PayPal Mafia" as one of the early employees of the fintech company.

Selby sold his stake in PayPal after eBay acquired it in 2002 and later became the managing director of Thiel Capital, in addition to leading AZ-VC's fund.

Now, he’s embarking on another endeavor by acquiring the rights to a movie about Elon Musk, Peter Thiel and Reid Hoffman, all of whom were part of the "PayPal Mafia" prior to becoming billionaires and establishing successful companies of their own, Bloomberg reported.

Selby, along with PayPal’s former chief operating officer, David Sacks, own the rights to “The Founders: The Story of PayPal and the Entrepreneurs Who Shaped Silicon Valley." The film will be an adaptation of a book with the same title by Jimmy Soni, a former managing editor of the Huffington Post.

Selby co-founded independent production firm High Frequency Entertainment in 2011 with a focus on making movies with budgets up to $10 million, according to Bloomberg.

Selby and Sacks are partnering with DreamCrew, a studio co-founded by rapper Drake, to make the film. Selby told the Business Journal Jan. 30 that the project could take many forms, including a serial firm, scripted feature or unscripted documentary.

"Our last conversation with DreamCrew occurred the previous Friday, so we are full steam ahead," he said. "But exact timing with these projects is somewhat elusive."