Pure Wafer, a San Jose-based semiconductor supplier with a production site in Prescott, has acquired Noel Technologies, another Bay Area company that offers foundry services. Terms of the deal were not disclosed.

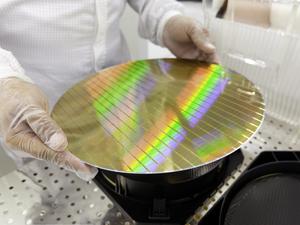

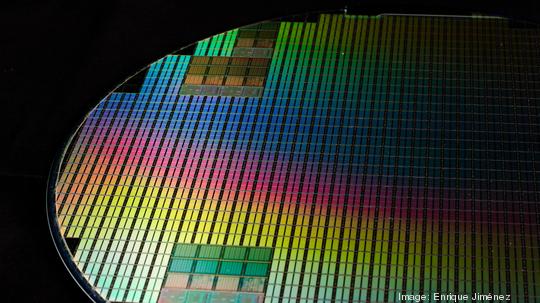

Pure Wafer is the largest U.S. maker of silicon wafer reclaim products, which are used for testing and maintenance of the machinery in computer chip factories. While Pure Wafer is based in California, its highest quality manufacturing happens at its Prescott facility, which employs about 100 people.

By purchasing Noel Technologies, Pure Wafer is able to offer new services to its customers, namely the ability to fabricate semiconductors, which is called foundry services in the industry.

Some of the largest semiconductor companies, like Taiwan Semiconductor Manufacturing Co. or GlobalFoundries, exist solely as foundries that build chips designed by other companies.

Intel Corp., which has its largest U.S. manufacturing site in Chandler, designs and builds its own chips, but earlier this year it announced plans to get into foundry services as well. Intel's first foundry capacity will come online by 2024, when the company’s two new factories in Chandler start production.

These international corporations primarily serve large customers, leaving smaller customers with fewer foundry options. Pure Wafer CEO Mark Borowicz said that many startups need small batches of specialized chips, but that production capability is lacking in the states.

“There’s no one really in the U.S. to fulfill that for them so they can show their investors that they’re on the right track,” he said. “You can’t go to TSMC or GlobalFoundries and say I need 100 wafers, they want it in thousands and thousands in regular, monthly orders.”

These smaller and startup companies play a vital role in American semiconductor innovation, but as it stands now, small-batch orders are generally outsourced to companies in Asia, where the majority of the world’s chips are now built.

Borowicz said the Noel acquisition allows Pure Wafer to offer a “complete silicon solution” to its customers, from the reclaimed wafers used to calibrate machines, to the specialized wafers layered with materials like tungsten, copper and more.

Pure Wafer’s acquisition of Noel Technologies was backed by Edgewater Capital, the Cleveland-based private equity firm that holds a majority stake in Pure Wafer. The combined company will employ about 300 people, but will not have any impact on the company's Prescott operations.

Regaining chip status

The Covid-19 pandemic boosted demand for semiconductors, which power everything from the lights in kids’ shoes to supercomputers, and as a result the world is in a global shortage of computer chips.

The shortage has inspired the Senate to pass a bill that includes $52 billion to increase domestic chip production, noting that it is vital to national security concerns. The funding is part of the U.S. Innovation and Competition Act, which passed the Senate in June.

On Tuesday, Arizona Sen. Mark Kelly joined Senate leadership in proposing that the U.S. Innovation and Competition Act be rolled into the National Defense Authorization Act, which is being considered in the Senate this week.

“This will strengthen our supply chain and create high paying jobs in Arizona and in other states that already are leaders in microchip development and production,” Kelly said at a Tuesday press conference. “This plan has sat idle in the House of Representatives since we passed it in June. Folks, there is no more time to waste on this. We need to get this passed.”

Borowicz said that in order for the U.S. to regain its lost share of the global chip market, there must be investment in both increasing production capacity and in bolstering chip research.

Spending on R&D will inform how to retool existing factories and how to build newer ones, so the U.S. can again, ideally, be the country creating the most advanced computer chips in the world.

“As you fall off that technology curve, that's the hard part to get back on,” he said. “That's why we're seeing these spending bills from the U.S. government in the tens of billions of dollars, is because we've fallen off that curve.”

Even if Congress greenlights billions for domestic chip makers, the industry moves slowly. It will take years to bring factories from the drawing board to full-scale production, and the demand for chips is sure to grow in that time.