Arizona's bioscience sector is performing at historically high levels — but there are some areas where the industry still needs some improvement.

For the past 20 years, the Flinn Foundation has commissioned an analysis to track the progress of the bioscience sector in a report called Arizona's Bioscience Roadmap.

In the report, TEConomy Partners LLC found record highs in bioscience jobs, wages, venture capital, National Institutes of Health research funding and university research and development.

Since the 2002 launch of Arizona's Bioscience Roadmap the sector has increased the number of bioscience jobs from 73,000 to 133,000 this year, which includes hospital jobs.

Venture capital has increased from $34 million to $240 million, while NIH funding has jumped from $133 million to $297 million during that time.

Lagging behind in funding

Even so, there are areas where Arizona still lags behind the nation, said Mitch Horowitz, co-founder and senior fellow for TEConomy Partners.

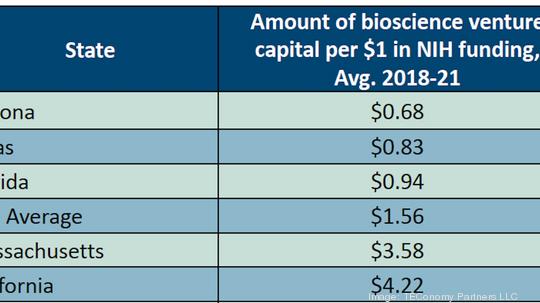

For example, Arizona is only captured 68 cents in bioscience venture capital per $1 in NIH funding between 2018 and 2021 at a time when the U.S. average was $1.56. Texas captured 83 cents, Massachusetts captured $3.58 and California captured $4.22 per $1 in NIH funding during that time, according to the report.

"It's hard to keep up with the national boom," Horowitz said in a Zoom presentation unveiling the research on April 20. "Clearly, even with the great gains Arizona has made overall funding levels, it's hard to keep pace with that national trend."

While Arizona is receiving funding in angel and seed funding, getting that venture capital funding has proven more difficult for Arizona's bioscience firms.

"What we see is Arizona has not been able to keep pace with the country in the formal formal stages by venture capital firms," he said.

Horowitz said that may because Arizona doesn't have much of a biopharma presence, an area that needs huge amounts of capital to scale up a business.

"That may be another reason why Arizona may be lagging a bit in the funding," he said.

While Arizona has seen growth in average wages and university bioscience research and development expenditures, those numbers are down relative to the national average.

"But there's still room for improvement," he said. "These are areas we hope will continue over the next decade to see Arizona continue its maturation and its rise of its overall bioscience space."

For a deeper dive into the report, click here.