Economic uncertainty put pressure on venture capital deals and initial public offerings in the past year, prompting investors to "focus capital deployments on high-growth companies," while startup founders "optimized for stability and cash flow," according to Pitchbook.

Despite the sluggish year for venture capital deals, Phoenix-area startups and investors remained bullish on the local tech ecosystem.

In the first three quarters of 2023, Arizona startups raised a total of $461.9 million in funding including $451.9 million obtained by Valley-based companies, according to Pitchbook data. Pitchbook has not yet released fourth quarter data.

Scottsdale-based Lessen brought in the largest fundraising haul in 2023 with a $500 million debt and equity financing round in the first quarter. Earlier this year, the property technology company that connects institutional landlords to service providers acquired SMS Assist, a facilities maintenance technology firm headquartered in the Chicago metro, in a deal valued at $950 million.

Here are the largest venture capital funding deals in Arizona of 2023, based on Business Journal reporting and data from Pitchbook.

Lessen — $500 million

Scottsdale-based Lessen raised $500 million in combined new debt and equity financing as part of its acquisition of SMS Assist. The deal boosted the company’s total valuation to more than $2 billion. Debt and equity investors who backed Lessen’s transaction include Monroe Capital, Värde Partners and Koch Real Estate Investments.

Lessen reached unicorn status — meaning it has a valuation more than $1 billion — in 2021. In September of this year, the company completed renovations to its headquarters within the Portales Corporate Center I at 4800 N. Scottsdale Road.

Persefoni — $50 million

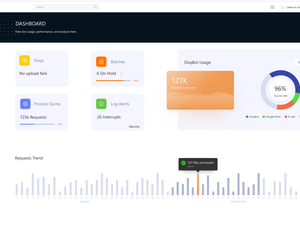

Persefoni, a Tempe-based software startup that helps companies track their carbon footprint, closed a $50 million series C round in August to boost its artificial intelligence technology.

The company launched PersefoniGPT, a carbon accounting AI product that provides clients with insights and guidance to adhere to regulatory requirements. The AI product has natural language processing capabilities, meaning clients can ask questions and give commands for a conversational and intuitive user experience.

Since 2021, Persefoni's workforce has grown from 34 employees to more than 300 worldwide.

GT Medical Technologies — $45 million

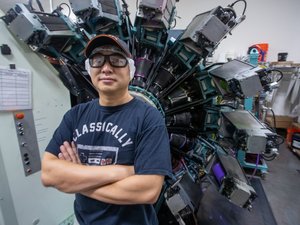

Tempe-based GT Medical Technologies Inc. raised $45 million in March to expand its technology to treat patients with operable brain tumors.

The company told the Business Journal it planned to use the fresh infusion of capital to fuel commercialization of its GammaTile Therapy, a targeted radiation therapy cleared by the U.S. Food and Drug Administration in 2018. Funding also will support clinical studies for patients with brain metasteses, glioblastomas and meningiomas.

The company has more than 60 employees and has raised $74 million to date.

ZayZoon — $34.5 million

ZayZoon, a Canadian financial technology firm with an office in Scottsdale, landed $34.5 million in series B equity and debt financing in September to continue expansion of its earned wage access platform and support recruiting efforts.

ZayZoon provides workers with early access to wages they’ve already earned at the push of a button through integrating with payroll partners. The platform also offers educational resources and tools to help workers break the paycheck-to-paycheck cycle, according to the company.

Erthos — $24 million

Tempe-based solar panel startup Erthos raised $24 million in equity financing led by Capricorn Investment Group, a sustainability-focused venture capital firm that was an early backer of Tesla, SpaceX and Helion.

Erthos builds earth-mounted solar panels directly on the ground – a technique the company says saves customer money via an automated cleaning system.

This year, Erthos inked an agreement for a 180-megawatt solar plant in Mississippi, bringing its total projects under contract to 18 nationwide.

MyLand — $23 million

Phoenix-based soil health startup MyLand Company Inc. closed a $23 million series B funding round in September. The round was led by Climate Innovation Capital and The Borden Family Trust, underscoring the company's mission of sustainable agriculture.

MyLand is using the funding to extend its operations in the Pacific Northwest and Texas, hire more employees and forge strategic partnerships to facilitate adoption of its products in the agricultural sector.

Oats Overnight — $20 million

Tempe-based startup Oats Overnight obtained a $20 million series A round in March, allowing the company to expand retail sales and build out a new, 85,000-square-foot fulfillment center in the Valley.

Oats Overnight, founded by former professional poker player Brian Tate in 2016, manufactures more than 35 flavors of packaged, high-protein oatmeal that are sold in Whole Foods, Meijer, Walmart, and HEB.

ZEVx — $20 million

Gilbert-based ZEVx Inc. in February raised $20 million in the first tranche of a funding round led by Reyolds Capital, the investment arm of The Reynolds and Reynolds Company, a provider of automobile dealership software and services.

ZEVx, founded in 2020, operates a 103,000-square-foot facility in Gilbert that houses the company's production of EV conversion kits for gasoline-powered light and medium-duty fleet vehicles.

The company is planning to build an EV chassis and electric car of its own in the future, the Business Journal previously reported.

PayGround — $19.7 million

In November, Gilbert-based financial technology startup PayGround raised $19.7 million in a series A round to fuel rapid expansion into healthcare systems and hospitals, and boost its sales and marketing team.

PayGround’s platform streamlines health care payments for providers and patients via its mobile app that manages, tracks and pays medical bills all in one place.