The Arizona startup community has been clawing toward national prominence for years, but the state is still far behind coastal hubs in terms of venture capital funds. One Valley group is doing its best to break that mold.

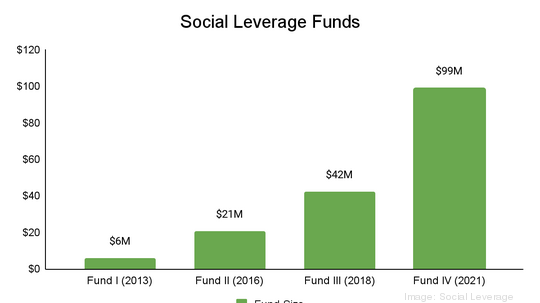

Social Leverage Group, a venture capital firm in Scottsdale, has raised its fourth venture fund, pooling more than $99 million to make seed-stage investments. This fund is more than double the $42 million the group gathered in its third fund in 2018.

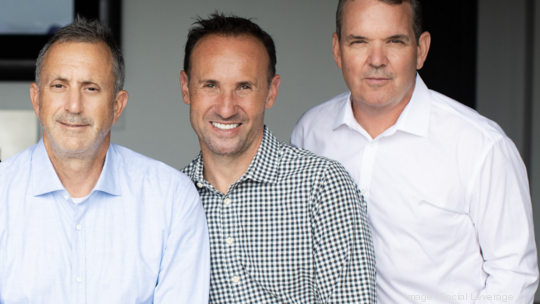

Social Leverage was co-founded by Tom Peterson and Howard Lindzon, who did angel investing together before raising their first venture fund in 2013. The pair, both from Canada, met at Arizona State University while getting their MBAs. Gary Benitt joined the team in 2015 for the second fund.

The fund will focus on software companies in the financial sector, enterprise SAAS (software as a service) and the consumer market. Peterson said, in general, they look for companies on the cusp of revenue, with a strong team and a handful of customers identified.

Previous funds put money into Kustomer (a customer service software that was acquired by Facebook last year), Robinhood (the high-profile stock trading app popular with retail traders), eToro (a cryptocurrency trading app) and more than 150 other startups.

Peterson said the fund is typically willing to write a check for $1 million in exchange for at least 10% of a company, though it varies depending on the specific deal. He said they’ve already one deal in this latest fund with two or three more in process.

Growing network

Social Leverage raised its first fund in 2013, and Peterson said a lot has changed since then.

“Part of the challenge in fundraising was, frankly, being located in Arizona,” he said of the group’s earlier funds. “When we would go to institutions to raise money, they would say you guys don't live in the ecosystem, how can you find good companies from Scottsdale, Arizona?”

That skepticism from institutional investors made the team turn to high net worth individuals, family offices and their extended networks to raise money, a playbook they still use today.

“It is highly irregular to see $100 million venture fund come from 169 limited partners,” Peterson said. “Most people with a fund that size would have far less (limited partners), and would primarily come from fund of funds and pension funds, endowments, universities, things along those lines. So our network's grown considerably.”

Peterson said part of that growing network is here as limited partners based in Arizona contributed more money to this latest fund than they had in the past.

Desert blooms

Arizona is home to other venture capital and angel groups — incuding Grayhawk Capital, Arizona Tech Investors and Sonoran Founders Fund — some of which focus more intently, or exclusively, on funding startups in the Grand Canyon state.

Peterson said that in general, Social Leverage’s split of investments has been about 40% in the northeast, 40% in California and the remaining 20% spread across the rest of the country.

The software ecosystem has developed in recent years, according to Peterson, thanks in part to the Arizona Commerce Authority, the Greater Phoenix Economic Council and the StartupAZ Foundation.

“It's changed a lot in the last five years, and it's been exciting to see. And so the time is really right, I think for us to be more involved and we hope to be more involved,” he said.

Specifically, he said Social Leverage will look to expand its team in the Valley later this year.

Not only does Social Leverage has the distinction of being one of the biggest VC funds in the region, but it is also one of the only groups in Arizona to sponsor a special purpose acquisition company, or SPAC.

The Social Leverage Acquisition Corp. has Howard Lindzon as its CEO, but the blank-check company is run by a different operating team than the VC fund. The SPAC, which was announced in early February, is still searching for the right merger target to take public.