2020 was a record-setting year for venture capital deals across the country, which saw over 12,000 deals worth more than $150 billion nationwide.

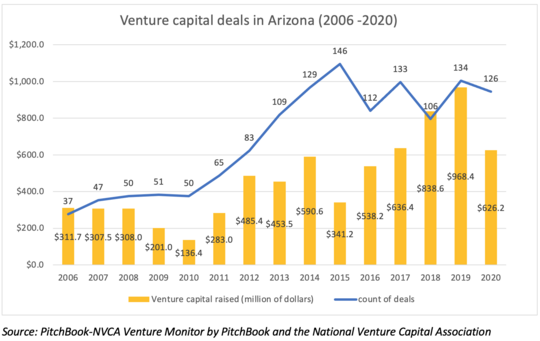

In Arizona, it was a different story. According to figures from PitchBook-NVCA Venture Monitor by PitchBook and the National Venture Capital Association, 126 deals worth $626.2 million were finalized across the state last year. This is down from the $968 million secured by Arizona companies in 2019.

The statewide drop in deal values is due to a concentration of early-stage companies that are generally seeking smaller amounts of money, according to Todd Belfer, managing partner of Canal Partners in Scottsdale.

This trend played out nationally with seed-stage and first-time funding flat in 2020 as investors turned to more established companies during the pandemic. There were fewer deals in the beginning of the year, but activity picked up as the industry adapted to Covid-19.

Despite the local dip, Belfer used just two words to describe the year past in venture capital: “On fire.”

“Absolutely on fire. Valuations are going up, liquidity is going up, the amount of startups is going up, and it seems like the herd mentality is in full play here,” he said.

Belfer described how investors followed the success of others, specifically pouring into electric and autonomous vehicles, e-commerce and collaborative software products that simplify remote work.

The fourth quarter of 2020 was Arizona’s most productive of the year with 39 deals worth $108.7 million. The largest of those went to GT Medical Technologies, which raised $16 million last November, followed by $15 and $14 million boosts for Local Motors and eVisit, respectively, in October.

In 2020, the largest Arizona deal, by far, went to CampusLogic, which raised $120 million in July.

Arizona tallied 126 VC deals worth just over $626 million for the year. This is down from last year’s 134 deals worth a state record $968.4 million.

Belfer expects the national momentum from 2020 to carry into this year, with Arizona following the national upward trend.

“I see a lot of companies that are getting started here that will raise their first seed round of capital,” he said. “As they get traction and velocity they'll start going out for bigger amounts of capital.”

Here are the companies that received the Valley’s 10 largest investments during the fourth quarter of 2020:

GT Medical Technologies, $16 million, Early Stage VC

Local Motors, $15 million, Later Stage VC

eVisit, $14 million, Later Stage VC

NeoLight, $7 million, Later Stage VC

Fasetto, $5 million, Later Stage VC

Calviri, $5 million, Seed Round

Yrefy, $3 million, Early Stage VC

Evercast (communication software), $3 million, Angel (individual)

Dirty Labs, $3 million, Seed Round

ClickIPO, $3 million, Later Stage VC

Here are the companies that received the Valley’s 10 largest investments during 2020:

CampusLogic, $120 million, Later Stage VC

SmartRent, $60 million, Later Stage VC

SOURCE Global, $50 million, Later Stage VC

Paradox (Human Capital Services), $40 million, Early Stage VC

Brightside, $35 million, Early Stage VC

EmergeTech, $20 million, Early Stage VC

Trusona, $19 million, Later Stage VC

GT Medical Technologies, $16 million, Early Stage VC

Local Motors, $15 million, Later Stage VC

Mosaic, $14 million, Later Stage VC