A Philadelphia health insurance technology startup has raised $1.6 million and will launch next week in four states, with plans to expand to three more by the end of the year.

Precursor Ventures, Elefund, V1.VC, Kindergarten Ventures, and Westerly Ventures participated in the pre-seed round.

StretchDollar's platform seeks to make it easier for small businesses to set up health insurance plans for their employees. Its platform is set to launch in Pennsylvania, Delaware, Illinois and Colorado on Oct. 1. The startup, which has a second headquarters in San Francisco, is tracking to cover California, North Carolina and Texas by the end of 2023 with plans to be in all 50 states in 2024.

Co-founder and CEO Marshall Darr's interest in the health insurance industry began about a decade ago after he cut a tendon in his finger. He was 25 at the time and had just secured a job after his first startup didn't pan out. If the accident had happened two weeks earlier when Darr didn't have health insurance, his medical expenses would have cost him $44,000, he said.

In the decade since, Darr's career has focused on affordable health care and helping small companies provide health insurance. Along with Kaiza Molina, he co-founded StretchDollar in March. The duo previously worked at and helped grow fintech firms focused on small businesses like San Francisco-based Gusto and Austin-based Decent.

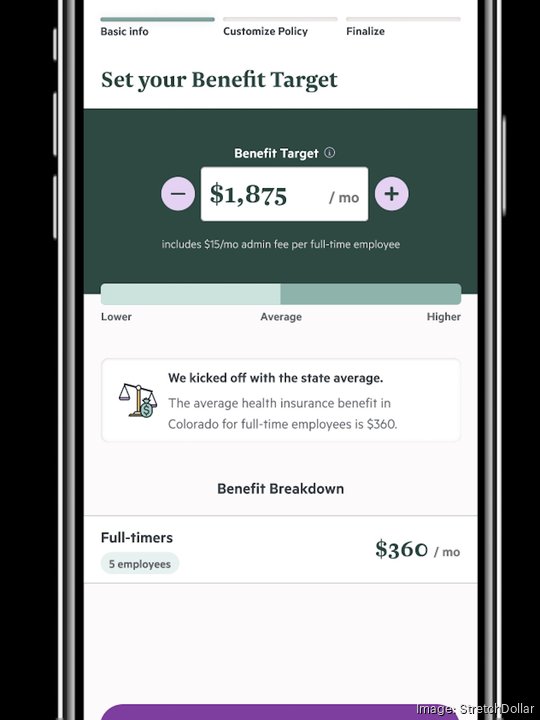

Darr described StretchDollar as "a funding vehicle" and a "new way for small businesses to approach health care benefits." Instead of small businesses having to set up group insurance plans that can be expensive and time-intensive, they are able to directly give employees a pre-tax stipend to go toward their health insurance premiums. StretchDollar employs licensed brokers to help connect small business employees with suitable health care plans and the health care policies process takes small business owners "under five minutes" to set up, Darr said.

StretchDollars charges a flat fee of $15 for each employee on the platform. It also earns commission from health care companies when health plans are sold.

That's a vast decrease from the two to eight weeks it can take small businesses to set up group plans for their employees and which can cost about $1,000 per employee, Darr said.

Following its platform launch with a handful of companies, Darr said the startup is "looking to expand rather quickly through the end of the year." There has been a lot of initial interest from small businesses in the Philadelphia area, he said.

"Our goal is to get to a couple hundred companies on the platform by the end of the year. That should take us to somewhere between $500,000 and $1 million in annual recurring revenue," Darr said. "From there, we're going to look into raising our seed round sometime early next year. Hopefully from there, I think we're going to have a real shot at reaching profitability."

StretchDollar currently has five employees. Following the forthcoming seed round in early 2024, Darr is looking to expand headcount to about 20 to 30. Though Darr didn't disclose a specific target number for the next round, he has ambitious goals.

"I have a number in my head, it's quite large, but I need to justify it with the work we actually do first," Darr said.