Compliance isn’t an option in the mortgage industry.

That’s according to Rob Nunziata, co-CEO of Orlando-based lender FBC Mortgage LLC. Like other firms in the industry, FBC routinely gets audited by state and federal agencies, and the consequences can be severe, he told Orlando Inno. “If you’re not compliant, you’re out of business.”

Making sure loan officers and other employees are compliant with industry regulations when using social media often is an intensive task undertaken by lenders and banks. However, Nunziata and Mike Prince, a programmer and entrepreneur, set out to change that when they founded Orlando-based ActiveComply LLC in 2019.

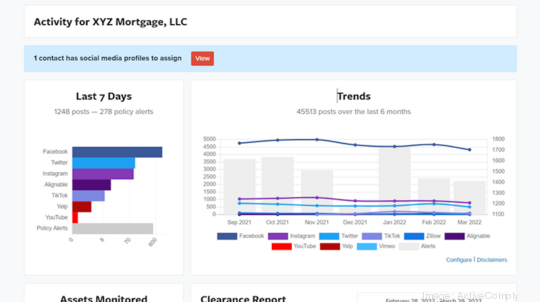

ActiveComply is a social media monitoring software that lets lenders, banks and credit unions make sure their employees are using social media in a way that’s compliant with industry regulations. The software uses machine learning to scan and analyze every post, alerting the company to anything that may be a violation.

Three years after its launch, ActiveComply monitors more than 40,000 licensed loan officers at 90-plus customers including FBC, Zillow Home Loans and PNC Financial Services Group Inc., the sixth biggest U.S. bank. Meanwhile, the company’s average year-over-year revenue growth is 207%, and Nunziata said ActiveComply is on pace to match that growth this year.

The mortgage industry was on fire the last two years as demand for houses hit a fever pitch. The industry has slowed considerably this year as mortgage rates have climbed from historic lows. Still, the slow-down isn’t bad news for ActiveComply, Nunziata said. “Lenders across the U.S. are trying to reach homebuyers because the refinance market has dried up. Loan officers are using social media to find homebuyers.”

Common violations include loan officers not displaying their Nationwide Multistate Licensing System ID on their social media profiles or referencing down payment information without making certain disclosures, according to housing industry news site HousingWire.

These are requirements all lenders must take into consideration. For example, loan originator Caleb Corsair said any social media posts relating to the company where he works, Lake Mary-based Home1st Lending LLC, first goes through the firm’s compliance team. “There is quite a bit of red tape with that now.”

In addition to social media compliance, ActiveComply is beta testing a tool that would let remote employees prove their home offices are compliant, Prince said. For example, they could use their smartphone camera to prove they have a paper shredder in their house, something that’s required in the industry.

While ActiveComply has made inroads with mortgage lenders, Nunziata said the company aims to snag more bank and credit union customers. Securing PNC Bank (NYSE: PNC) as a client this year certainly helps, he added. “Landing those big-name banks gives us credibility.”

Sign up here for The Beat, Orlando Inno’s free newsletter. And be sure to follow us on LinkedIn, Facebook and Twitter.