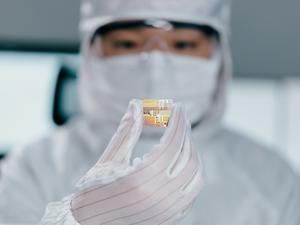

Bridg is working with Osceola County to position the area for federal semiconductor investment.

The nonprofit partnered with the Southeastern Consortium for Assured Leading-Edge Semiconductors (SCALES) and the University of Florida on an April 14 meeting to bring together business and academic leaders for the industry.

Bridge seeks to boost the NeoCity mixed-use development underway in Kissimmee into a tech hub for semiconductor business and get a grant from a $52 billion fund that's available through the CHIPS and Science Act.

Why this matters: Jobs in semiconductor manufacturing often are high-paying and can draw other similar companies to the region.

Besides networking, the meeting also served as an opportunity to prepare a response — due in June — to the first CHIPS Notice of Funding Opportunity, which focuses on commercial fabrication facilities.

"This monumental effort will galvanize a state and funds to stimulate growth in workforce development, R&D and manufacturing in the semiconductor market focused on advanced packaging throughout Florida," Jim Vandevere, Bridg president, said in a prepared statement. "The timing for a unified approach leveraging Osceola County’s vision and investment to grow a much-needed U.S. capability is now."

Any additional funding would come on the heels of $50.8 million the county was awarded from the U.S. Department of Commerce's Economic Development Administration bureau for expansion of the semiconductor operations at NeoCity.

Semiconductor research and manufacturing is an anchor industry of NeoCity, which Osceola County officials hope will create more than 100,000 mostly high-wage jobs in the next 50 years.

The mixed-use hub already includes the 109,000-square-foot Center for Neovation manufacturing facility leased by Bloomington, Minnesota-based SkyWater Technology Inc. (Nasdaq: SKYT). The company in 2021 took over operations of the Center for Neovation, with plans to create 220 jobs there by 2026. SkyWater moved into the facility after the University of Central Florida ended its financial support of the previous operator, Bridg.

Semiconductor work in NeoCity is being undertaken by SkyWater, nanoelectronics company Imec USA and Bridg.

In addition, in 2021 Osceola County commissioners voted to enter negotiations to sell up to 70 acres inside the county’s envisioned NeoCity tech district to DSUS LLC — a Duluth, Georgia-based firm related to South Korean semiconductor firm DS Semicon Co. Ltd. The county since has conveyed 25 acres for the first phase of NeoCity to DSUS. Last July, DSUS principal and Sciame Construction LLC CEO Frank Sciame presented county commissioners with its vision for the first phase, which includes a waterfront plaza, performing arts center, condos and more.

The growth of the industry may create more jobs at those firms and attract more companies, especially as the U.S. faces a semiconductor shortage.

Meanwhile, the activity comes as global semiconductor industry sales are down in the short term, but are expected to grow long-term. Sales hit $39.7 billion in February, down from January's $41.3 billion mark and February 2022's total of $50.0 billion, according to the World Semiconductor Trade Statistics organization.

“Global semiconductor sales continued to slow in February, decreasing year-to-year and month-to-month for the sixth consecutive month,” John Neuffer, Semiconductor Industry Association president and CEO, said in a prepared statement. “Short-term market cyclicality and macroeconomic headwinds have led to cooling sales, but the market’s medium- and long-term prospects remain bright, thanks to growing demand across a range of end markets.”

Worldwide semiconductor sales during 2022 hit a record of $574 billion for the year, up 3.3% from the prior year. The growth comes as computer and communication end-use markets for the chips has remained strong, while emerging markets that need chips like automotive and industrial have grown their share of chip demand compared to the others.

Sign up here for The Beat, Orlando Inno’s free newsletter. And be sure to follow us on LinkedIn, Facebook and Twitter.