If you had asked Matthew Iommi a few weeks ago, he would have said, “First Citizens who?”

Iommi, the Austin-based co-founder and CEO of Fetii, an on-demand rideshare app, still doesn’t know much about the Raleigh bank that just acquired the assets of his longtime partner, Silicon Valley Bank. As of late Monday, he had received zero communication from the new parent company, he said.

Triangle Business Journal, a sister publication of the NBJ, spoke with several founders, many of whom declined to be quoted. Multiple entrepreneurs said that until recently they had never heard of First Citizens Bank (Nasdaq: FCNCA). Others said they're still shocked from the $42 billion bank run that pushed SVB into the hands of regulators less than three weeks ago and are unlikely to return, regardless of who the new parent company is.

“A lot of us have lingering trauma over the situation,” said David Johnson, who had closed on a seed round for San Francisco-based biotech GigaMune just four days before the collapse. “I mean look, we’re startup founders, right? We work our tails off to raise capital … the last thing you want to do is study the balance sheet of some regional bank to see if they’re underwater.”

Now that First Citizens Bank has completed its buy of $110 billion in new Silicon Valley Bank assets, the bank has to deliver. That means stemming the spread of deposit outflows from jittery founders like Iommi.

At the end of the 2022, SVB had about $175.4 billion in total deposits. On March 10 when the bank was seized, it was $119 billion. When First Citizens acquired it Sunday, just $56 billion in deposits made it into the transaction. The rest? It boils down to deposit outflows from nervous customers, analysts said.

The question is: Will First Citizens be able to hold on to what it did get?

Analyst optimism

“The idea now is that these $56 billion deposits that remained are real customers who are willing to stay and now have a new bank who cares a great deal about retaining and growing their business,” said Chris Marinac, director of research for Janney Montgomery Scott.

Brady Gailey, managing director at Keefe, Bruyette & Woods, called it a “phenomenal deal."

Closer look: These are the failed banks First Citizens bought before SVB

Analysts predict that now that First Citizens is at the helm, deposits outflows will slow down.

“I think with Silicon Valley now having a new home at First Citizens, a very safe and sound company, that should really settle any sort of deposit jitters that legacy Silicon Valley customers have,” Gailey said. “If anything, you could even see deposits start to flow back into Silicon Valley’s businesses.”

The comment echoes sentiment First Citizens executives shared during an investor call Monday, as CEO Frank Holding Jr. and CFO Craig Nix told investors they expect to keep the deposits that remain.

But startup founders remain uncertain.

Even after the collapse, Fetii kept its main operational account with SVB, unwilling to lose startup-friendly features such as no account fees and no limits on wire transfers, Iommi said.

“Big banks like Chase and Bank of America and Wells Fargo, they charge these account fees,” he said. If the newly combined bank opts for a more traditional model like the big guys, “then we’re going to have to see if we should look other places," Iommi said.

Justin Barad, co-founder of Osso VR, a San Francisco startup developing virtual reality training solutions for surgeons, is also keeping an open mind. “I’m grateful that SVB has found a home,” he said. “I think we’ll continue to assess the situation very closely.”

Barad said the communication lines with his former partners at SVB are open – but that “given that they’re recently acquired and it’s a rapidly moving situation, I think we’re still watching it closely.”

“There’s some argument that it’s safer now that they’ve been through all this,” he said.

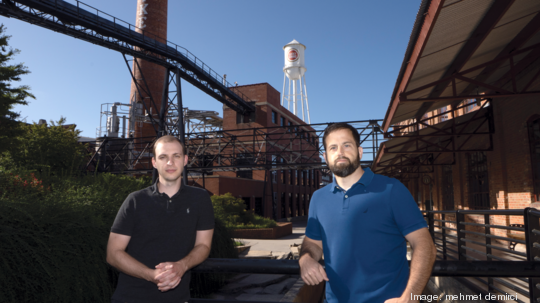

Adam Smith, co-founder of Wrangle, a process automation startup in Durham, didn’t bank with SVB before the collapse but got caught up in the turmoil the weekend it fell. His friends had millions with the bank. He said he’d consider First Citizens depending on how the deal shakes out.

Smith is among those hoping it will be good for the Triangle – having spent much of his career justifying why the region is an “amazing” spot for startups.

“To see SVB, the center of the finance tech world now owned by a Raleigh bank, which I guess makes them pseudo headquartered here, is just crazy to me,” said Smith, who was also a former employee of Durham’s venture-focused Square 1 Bank. He’ll be watching for any potential culture clash – something he saw former colleagues experience when PacWest acquired Square 1.

In a LinkedIn post, Smith said it will be “interesting to see if First Citizens ends venture banking (or erodes it) overtime the way PacWest did with Square 1."